# 32 | DAO Treasury Management: Cut the Chase

If You Are the Smartest Stablecoin in the Room, You Are Just in the Wrong Room

We are like dogs chasing cars.

We keep aiming at wealth, aiming at success, aiming at fame, without a clear idea of what we’d do if we ever got there. It has been a useful mental construct for a long time, when money was patient enough to come knocking at the door, eventually, accompanied by age, some sort of wisdom, and a useful degree of fatigue. The kids born rich never played heroes in the movies. During those days, the chase was the way.

Not anymore. Today companies get rich as fast as rappers from the ‘90s. Whether they die as rapidly is yet to be seen. And although I would pay to drive around town with Biggie and five kg of gold around my neck, I wouldn’t give him the keys of the Federal Reserve. You are free to differ. Thirty years ago a well-designed mouse trap would have gained you a profitable shoe brand, fifteen a lot of personal data to sell to the best offeror, today it could deliver control on a generation worth of savings. We should acknowledge that great power hasn’t yet been followed by a great sense of responsibility.

Loud promises have gained some DeFi protocols (this is ultimately a newsletter about money flows) huge amounts of liquid assets to play with, but the speed of their success hasn’t allowed them to mature a sound treasury management strategy along the way. It is interesting to reflect how some of the most successful projects have attracted funds with the promise of delivering x,000% annual returns exactly through their fund management strategy - the bar they set themselves wasn’t low. With liquidity retrenching, the flaws of this model are now emerging, impacting market valuations across the board.

Good news? We are still on time to transform an existential threat into a powerful opportunity.

Acid Test: Good Treasurers Don’t Get Excited

We need a new mental model to manage the treasury assets of crypto projects - h/t Hasu.

But do we? My guess is that we should actually be more humble and realise that we already have a sound mental model to manage treasury assets, and that we should apply it to crypto projects. It could help us all to design better products, increase economic value - or at least how we measure it, and make better investment decisions.

The Old World of Equity Investors

Historically, the value of a company’s equity referred to the fair value of what remains when everybody else (commercial creditors, employees, debt holders, the state, etc.) gets paid. There are two important elements in this definition: equity value is (1) residual value, and equity value is (2) fair value. Those characteristics have several implications.

Residual → Equity, being the value of all assets minus that of all liabilities, is a fictional amount. That is why the words equity and net assets are mutually intercheangable. There isn’t a bank account in a company’s name with the word equity written on it. This means that the nature of equity differs from company to company, depending on the quality of the assets backing it. In the old construct, the term treasury used to refer to the combination of cash and liquid financial investments that weren’t used in the ongoing operations - in this sense, equity and treasury had some overlap.

Fair → The residual amount should be valued fairly and not only based on its accounting, or book, value. Such fair valuation will depend on several things, but mainly on the nature and volatility of all assets and liabilities, growth expectations, and other aspects that are market-dependent and not company-related. In the real world, given the fixed nature of all liabilities, a fair valuation of the equity is mainly related to the characteristics of its assets.

The assets of a company are a collection of many different things: fixed assets, intangible endowments, amassed financial resources, etc. Equity investors, typically, tend to spend much more time in evaluating assets that are core for the revenue generation potential of a company, and instead mark non-core assets through external benchmarks. This means, pragmatically, that businesses with a different nature but holding the same assets would be valued in different ways. A wise investor should not allocate any meaningful premium to assets that are non-core to the business, so even if Apple and Google have among the largest balance sheets in the world, a good equity investor would just treat their cash and liquid instruments for what they are. The situation would be different when valuing the assets of a company like Blackstone or Pershing Square, that do of fund management their core business, where investors might allocate a premium on the financial assets based on the alleged ability of those companies to purchase assets that actually have a higher fair valuation - that the market will recognise at some point in time.

Such realisation has a flip side, and one that we are interested in. Good owners-operators, knowing how smart investors are looking at their companies, should focus on creating value by managing their core assets, while limiting as much as possible the impact of the non-core ones. Although we all believe we can extend our sphere of influence and add value in several areas of business, smart investors (who have seen it all) tend to prefer specialisation: it allows managers to focus on delivering superior quality in what they do best, and it allows investors to bet on different themes by investing in separate companies they can more easily monitor. Conglomerates, in the old world of equity investments, tend to trade at a discount.

The New World of DeFi protocols

There is nothing that forbids us to apply the same framework to the world of DeFi protocols. Through their operations (of different nature) some of those protocols have amassed hundreds of millions, and in some cases billions, of assets that they can discretionarily manage. Interestingly, in most cases the active management of those assets is not part of their core business, and yet there is nothing the protocols are doing in order to mitigate their volatility and its impact on core valuation. Why is that? I believe it is due to a lack of sophistication on both the protocol managers’ and the investors’ side: crypto investors are risk seekers and prefer asset appreciation at all costs, and protocol managers haven’t yet developed the mindset required to protect their business rather than growing it factorially.

We can look at two alternative projects as an example: Fei Protocol and Olympus.

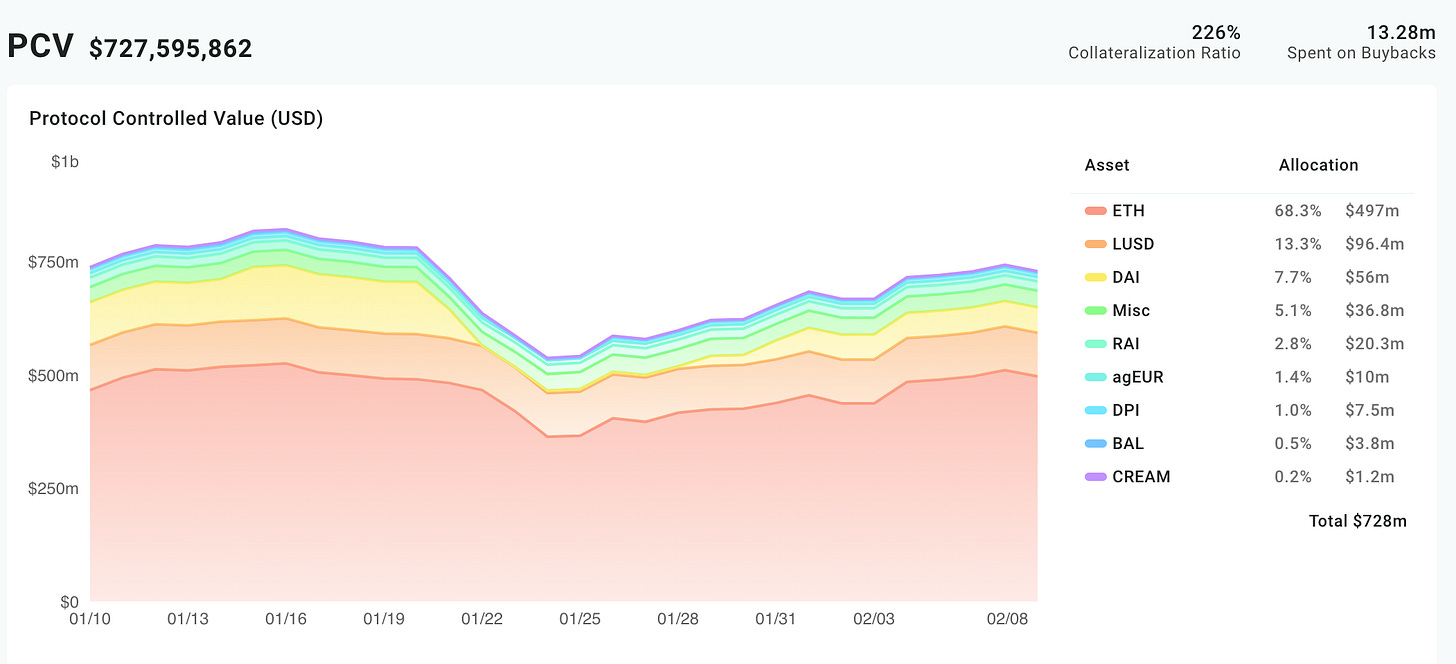

Fei → Fei is a currency minting protocol (we have talked about $FEI in the context of the recent merger with Rari - here and here) that controls today c. $730m worth of assets. Core activity of the protocol? Producing and protecting the stability of a currency. In this context, some assets can be considered core and others non-core. Is the protocol approaching treasury management in a way that is consistent with this vision? Fei’s asset base is in vast majority composed by $ETH - c. 68%, $LUSD - c. 13%, and $DAI - c. 8%. The protocol, in other words, doesn’t seem to care too much about the volatility of their asset base and aims at managing volatility through prudent over-collateralisation - Collateralisation Ratio is currently > 200%. It is a missed opportunity: by improving the volatility profile of its assets, the Fei Protocol could reduce the levels of collateralisation and help expanding the monetary base.

But Fei is in all shape or form some sort of bank, and as all banks its business is to manage both assets and liabilities - a commercial bank is actively managing its loan book but also ensuring that its funding is sound and efficient. The protocol controls c. $235m of the c. $550m of circulating $FEI: some of it is used to provide liquidity to the currency - through Uniswap v2, Curve and Sushi, some to generate yield - through Rari and Aave. The rest is sitting in reserves. It seems that the protocol owners are more sophisticated in managing their liabilities (i.e. currency) rather than their assets - i.e. proprietary treasury.

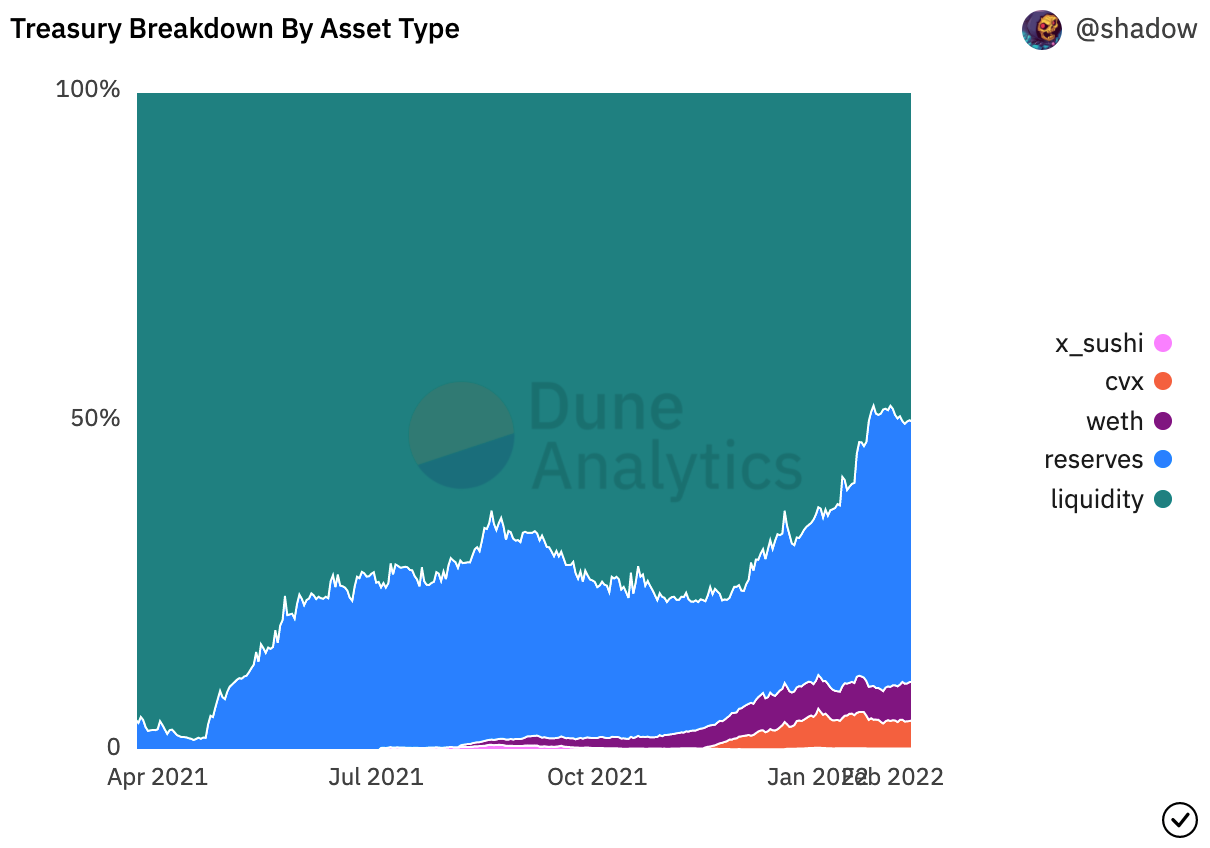

Olympus → Olympus’ story is a different one, and one I will not indulge in today - having written about it here, here, and here. It is enough to say that Olympus is radically different from Fei. Core activity of the protocol? Internalising market making, providing outsourced liquidity mining services - tiny business, and most importantly managing its own treasury. Olympus has generated c. $37m of fees by internalising market making and currently c. 50% of its asset base (or c. $275m) is employed in facilitating liquidity. This number is close to the average liquidity owned across the life of the protocol so the return on assets isn’t bad (c. 10%) but definitely not enough to justify 1,000% APY. Most of the remaining asset base (c. 40%) is invested in what the protocol calls risk-free treasury, i.e. stablecoins like $DAI, $FRAX, $UST, and $LUSD. Only a tiny portion of the asset base is in high-vol tokens like $wETH and $CVX.

It actually appears that the Olympus team is managing their treasury in a diligent way, reducing asset volatility to the minimum while it provides market making services (for its own $OHM token) to the community. But there is a flip side: if the quasi totality of the liquidity is parked in zero-yielding assets such as stablecoins, how can Olympus justify any relevant premium vs. market? For a long time, $OHM has traded at 20-30x over its treasury, meaning that the market was pricing the superior ability of the team to generate huge returns from its asset base. There is a contradiction in terms, however, as you can rarely have both low volatility and superior returns. Olympus’ bonding mechanism can only be considered a fund raising strategy, and not a value creation one. Again, I will not indulge here, I guess we will need an update on Olympus at some point.

What is the market telling us today? With a market capitalisation of c. $718m, $OHM is trading at c. 50% premium over its assets, which is still a lot. My guess is that with 10% return on asset, and a cost of capital in DeFi definitely higher than that, the premium should rather be negative. In a nutshell, if Olympus wants to keep a similar valuation they should step up their treasury management game. And they could, since their investors seem to have the appetite for it.

Enters RAI <> WTF Is RAI

In May 2020, Stefan Ionescu and Ameen Soleimani wrote a whitepaper with the aim of introducing a low-volatility, trust-minimised, collateral to be used in the DeFi ecosystem, or in other words a well-functioning new-generation currency for DeFi. Their intentions came from the frustrations around the development of the grand-daddy of decentralised and collateralised stablecoins: the $DAI. In order to bootstrap the adoption of its stablecoin, the Maker Foundation → MakerDAO had decided to peg the currency to an external benchmark, the USD also known as The Devil in many DeFi circles. Although effective, the authors (my personal take) felt that the peg had de facto bonded a lot of $DAI’s dynamics to a centralised source of risk: the USD and its crypto-world proxies. Fast-forward almost two years, and c. 63% of the collateral backing $DAI is in the form of stablecoins such as $USDC (5b), and $USDP (500m). The authors were right: even when ignoring governance the $DAI is much less centralised than you think.

$RAI was formed from Multi-Collateral $DAI (or MCD) with the realisation that a well-functioning currency, although stable, didn’t necessarily have to be hard-pegged to an external system. We have discussed some of the macroeconomic and monetary concerns of a pegged system (here) and won’t repeat ourselves. A well-functioning currency, was $RAI’s thesis, should have been:

Sound: backed by a solvent economy

Not excessively volatile: employing a volatility-dampening system

Predictable: anchoring expectations on its future behaviour

Fungible: having a well-functioning and liquid market

How did $RAI want to do it in practice? The terminology used by the project isn’t straight-forward, let’s review:

Reflex-Index → central piece, i.e. a collateralised, non-pegged, asset with low-vol compared to its own collateral - in other words a low-vol version of its native collateral

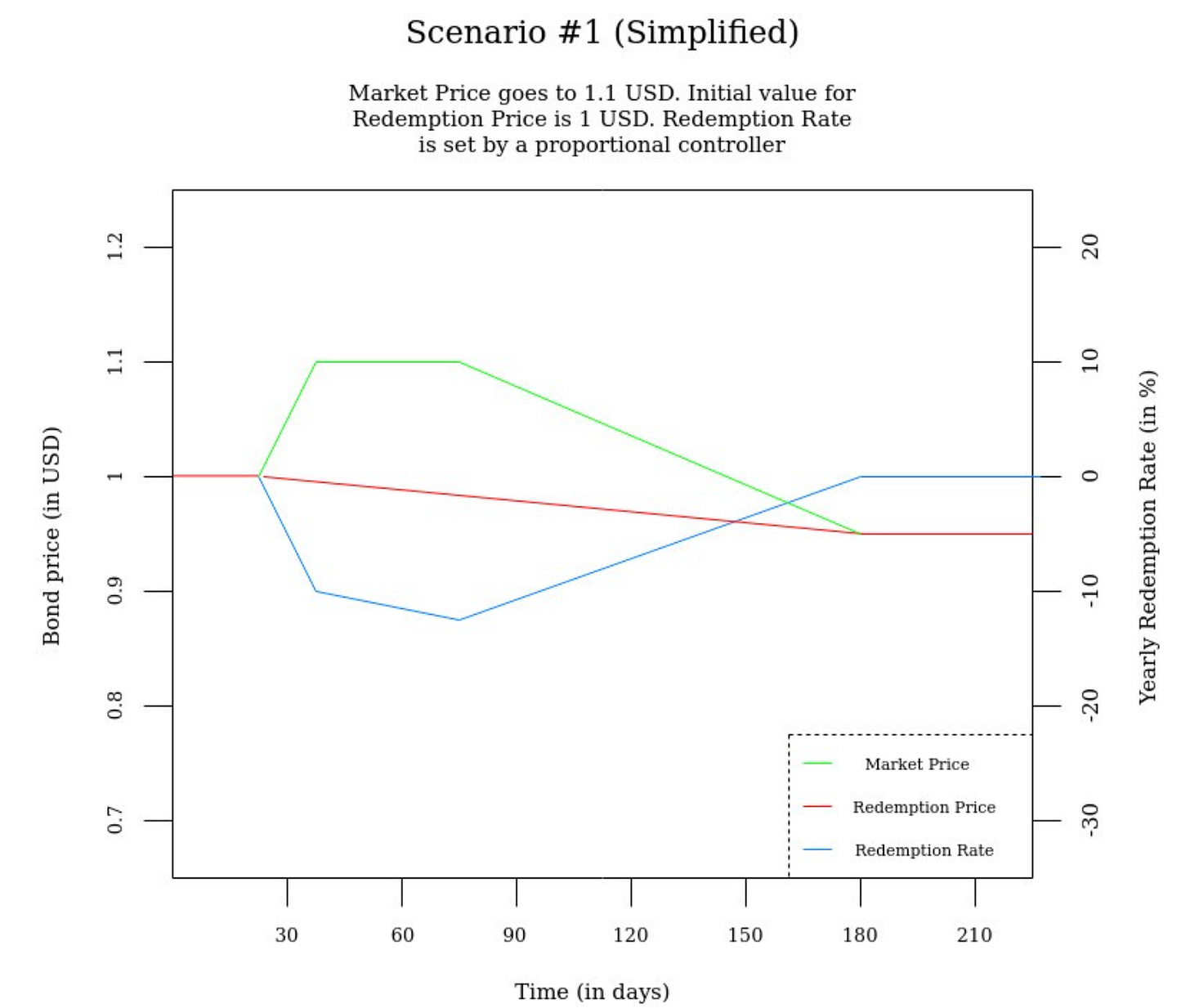

Redemption Price → target price for the Reflex-Index established by the system - this is a variable amount

Market Price → price the market values the Reflex-Index at

Redemption Rate → per-second rate used to incentivise users to generate lever or payback debt - the Redemption Rate impacts the Redemption Price and works similarly (but not exactly) to an interest rate

Borrowing Power → Reflex-Index that can be borrower per collateral unit - e.g. collateral is $ETH and has price $100, liquidation ratio is 150%, current Redemption Price is $1, Borrowing Power would be $100 / $1 / 150% = $66.67

The diagram below tries to explain how the different pieces fit together.

Here’s what (I think) happens. $RAI has a Redemption Price initially fixed at $1. When the Market Price for $RAI diverges, let’s say goes to $1.1, arbitrageurs have the incentive to mint new $RAI at a value of $1 and sell them immediately in the market for $1.1, meaning that more $RAI supply enters the system and consequently reduces price pressure. The Redemption Rate tries to accelerate the price correction by being anti-cyclical and adaptive: the Redemption Rate starts lowering further the Redemption Price and increasing the incentive for the arbitrageurs, until the speed of correction accelerates enough for the Redemption Rate to starts converging back to zero when the Market Price and the Redemption Price are equalised. The adaptation of the Redemption Rate is left to a (programmatic) Controller.

The side effect of this process is that the Collateralisation Ratio changes as well. A decreasing Redemption Price devalues the whole monetary supply, meaning that for a fixed amount of collateral (and constant collateral prices) the level of collateralisation grows. The monetary base, in other words, has suffered from an algorithmic inflation. The effects are intertwined. We can draw at least a couple of scenarios - below.

Scenario A: Demand for $RAI increases (what we just described) → There is an inflow of external currency in the system, potentially due to several factors, and as a consequence the value of $RAI increases. This is not necessarily good, as users of $RAI want clear expectations. In TradFi, those expectations are set by the central banks during the several touch points they have with the investing community about their interest rate policy. In the case of $RAI, it is more programmatic: just look at the Redemption Rate. A negative Redemption Rate signals that the system wants to devalue the currency, this pushes the arbitrageurs to mint $RAI and sell them in the open market until equilibrium is restored.

Scenario B: Value of $ETH is reduced → There is a shock in the economy backing $RAI - we are assuming here $RAI is only backed by $ETH. This means that the economy is now more levered, or that the blended Collateralisation Ratio goes down, pushing vaults closer to liquidation. This should incentivise users to payback loans, by repurchasing $RAI and burning them in the open market. The market value of $RAI keeps fluctuating around the Redemption Price (helped by the Redemption Rate) while the monetary supply shrinks and the Collateralisation Ratio is restored to equilibrium.

We can describe what $RAI wants to do in several spins, but I will try two different ones here: the (1) monetary economist view and the (2) crypto-actor view.

The monetary economist → What $RAI wants to do is to produce a fungible currency backed by a homogeneous economic system. In the case described, that economic system is Ethereum as the future multi-purpose distributed infrastructure of the world. $RAI is a derivative contract backed by $ETH, and its base expands or contracts depending on the behaviour of the underlying economy. By getting rid of the hard peg, the contraction/ expansion cycle happens in a less abrupt way. The problem of hard-pegged currencies is that their hyper-stability blinds many that are keen to build leverage on top of it with very slim margins of safety, recursively. When the peg breaks there ain’t much left keeping the rest of the castle standing. And in DeFi that castle can be arbitrarily high. Ok, but then couldn't we use $ETH directly as a currency and means of exchange? Sure we can, but it would be an inefficient one. First of all, $ETH is still highly volatile - and I think we have lived long enough to realise that highly volatile assets aren’t great currencies. Secondly, it’s immutable/ almost un-forkable - different use cases, in different phases, might require different currency set-ups, while you can fork $RAI (and you are actually incentivised to do so) it’s much more difficult to do it with Ethereum. As a currency or reserve asset $RAI is just a better version of crude $ETH, at least design-wise.

The crypto-actor → For the crypto-actor instead $RAI is first of all a low-vol version of $ETH. Do we like or even need a low-vol version of $ETH? If you are a degen just boarded on a spaceship to the moon, you don’t, you just want the upside. It’s now or never. But if you are a protocol treasurer, aiming at diversifying out volatility and idiosyncratic risk from the (non-core) protocol reserves, you should. Assuming you can digest $RAI’s protocol risk overlay: a reliable oracle system, a battle-tested Redemption Rate controller, well functioning lending and liquidation mechanisms, a sound governance structure. Crypto borrowers should also be interested in $RAI, as its better volatility management mechanism means that users can borrow at more attractive rates. Reflexer ($RAI’s development studio) is itself suggesting several attractive use cases for their product: more stable money markets, stacked funding rates to $RAI-based perps, options, better pegged coins/ synthetic assets, yield aggregators, portfolio management strategies, etc.

How’s $RAI doing today? There are more than 54k $ETH locked as collateral to mint $RAI - equal to c. $165m, across c. 330 active safes. Due to over-collateralisation there are a bit more than 23m $RAI in circulation, with a market price of c. $3 each. Because of the slight premium over market price $RAI’s current annual Redemption Rate is a negative 3.8%, meaning that $RAI is expected to depreciate annually by that amount in the next twelve months. Borrowing $RAI today is very cheap, with the borrow rate at 0.1%. As a comparison, borrowing $ETH on Maker’s ETH A Vault comes with a 2.25% stability fee.

Not exactly a success when you compare it to $USDT - c. $80b, $USDC - c. $50b, $TUSD - c. $11b, $DAI - c. $10b. All definitely less capital efficient, and utterly more centralised than $RAI. So why is that? I have written in the past about Angle, another currency that gets the concepts of volatility and is attempting to provide a more sophisticated solution for its users when compared to the antiquated Tether and Circle models. Angle’s TVL is currently $243m, a bit more than $RAI, but also thanks to aggressive liquidity mining campaigns. So where is the problem? In my opinion the problem is that there’s hardly anything more mass market than the product we call currency. I have a ton of family friends completely ignoring the existence of the Jenners’ Instagram-fuelled empire, but they surely know their way around cash. Managing the stability of a currency is mind-bending difficult, but users completely ignore what happens in the background, and they tend to do it until it’s too late and hidden volatility slaps them on the face. Even currency traders, as Taleb puts it - disclaimer I am definitely not a Taleb fan, tend to keep “eating like a chicken and shitting like an elephant”.

If not even Kylie Jenner can compete against a piece of paper with a face and some numbers written on it, who is $RAI to succeed? Simply put, common currency users care about fungibility and some sort of (perceived) stability, and they are just not $RAI’s target market. Still, exactly because of the fungibility premium that currencies have, wide adoption has huge positive externalities. The RAI+3Crv pool on Curve has currently c. $45m in it, even when yielding an APY up to 8% - definitely not deep enough for institutional users. A lack of recognition for prudence and sophistication is a sad story of the DeFi 2.0 era and although we all hope this will change it hasn’t yet. Some protocols have indeed experimented with $RAI in their treasury. Fei Protocol, for example, has $RAI and $agEUR among its assets, but at 3% and 1.5% respectively for a combined amount of less than $50m. As we mentioned before, the protocol doesn’t seem to care excessively about the volatility profile to its asset base.

Is $RAI perfect? Of course it is not. The algorithmic inflation/ deflation controlling mechanism has yet to be battle-tested, and the volatility that $RAI spits out needs to go somewhere. Within an arbitrarily narrow band users won’t mind to swallow some of it, but the ability of the controller to keep that band in check has yet to be proven. In addition, Reflexer incentivises a rigid governance process that stimulates forking; with liquidity remaining a precious but scarce resource it is unclear how a fragmentation of $RAI across several single-collateral forks would perform. I am not part of the development team, and as an external time-constrained researcher I am sure there are several aspects of the construct I am missing, but I see Reflexer’s intentions and cannot do anything but endorsing them.

The time has come for DAO treasuries to step up their game, and show the community what they can do. This process will necessarily happen alongside a professionalisation and institutionalisation of the dialogue within the projects, a need that has become evident following the recent scandals and tribalism. Trustless-ness should emerge from redundancy rather than worshipping.

Disclaimer. I do not own any of the tokens (being stablecoins or governance tokens) produced by Fei Protocol, Olympus Finance, or Reflexer Labs. I am instead personally involved in the MakerDAO project and as a consequence I use and own significant amounts of both $DAI and $MKR.