# 11 | The Macroeconomics (and Politics) of Axie Infinity

Yield Guilt Games and Blackpool Are Pioneering the Private Sector In the Metaverse, When Will Others Make the Move?

This is another issue of Dirt Roads. Those are not recaps of the most recent news, nor investment advice, just deep reflections on the important stuff happening at the back end of banking. The time we are sharing through DR is precious to me, I won’t make abuse of it.

Goodbye Cruel World

I grew up in a cruel, stateless, gaming world. A world infested by violence, ruled by a totalitarian emperor - the game developer, a world where players had neither property nor other economic rights in exchange for their efforts in making the game great. In Metal Gear Solid 3, or Skyrim, or Donkey Kong, glory was the only exchange currency. But glory, and a sensorial experience getting more phenomenal by the day, was enough to convince me and many others to sacrifice a huge portion of free time for the screen.

Then the day came for me to leave gaming and pursue intellectual and financial growth opportunities in the real world. I wanted an environment with the promise to interact, build, innovate, and get compensated for my efforts and investments. In the mid-2000s I had been told that world was Wall Street. But it was suboptimal: the effort demanded was enormous, the experience unpleasant for long stretches of time, and the space to innovate and earn shrinking by the year under the attacks of competition and regulation.

I was not the only one thinking in that way, and definitely not the most experienced nor accomplished. In March 2015, while at Morgan Stanley, I received the internal memo informing all staff that our CFO, Ruth Porat, was leaving the firm to become Google’s CFO. Ms. Porat, often described as the most powerful woman in finance, had joined Morgan Stanley in 1987. I don’t remember her leaving words by heart, and I couldn’t find a copy of the memo on the internet, but I still remember the memo saying something like the following: I joined Morgan Stanley when Wall Street was at the forefront of innovation, for the same reasons I am now leaving the firm to go to Google.

It was a powerful move but one that, like my own entry in banking few years before, might have been already late for the times. Patience is often the least appreciated of qualities, and in an ironic turn of events gaming, my old good and neglected friend, might now actually be the best place to satisfy the same ambitions that brought me out of it in the first place.

Axie Infinity and the Explosion of P2E

In 2020, right after the end of the crypto winter, a game called Axie Infinity took the gaming world by storm. It combined the potential of CryptoKitties to earn by monetising play, and the cuteness and gameplay of the Pokemon franchise.

A lot has been written on Axie Infinity following its explosive growth during the summer of NFT investing, including Packy McCormick’s spectacular piece Infinity Revenue, Infinity Possibilities. A lot but not everything. In the quintessential crypto-style of building on top of what others have done before, in this week’s issue of Dirt Roads I intend to look at Axie in the same way a macroeconomist would approach a state, or a corporation.

First of All, Is Axie Infinity a State or a Corporation?

This is an impossible question to answer but, in order to leverage the mental models we have in place as investors, we need at least to try, highlighting a few fundamental characteristics of the game.

Centralised governance system with coercion -> state. Using Weber’s definition, a state is a polity under a system of governance with a monopoly on force. Axie has a clear system of governance detailed in its whitepaper, which operates as a kind of constitution. The definition of force might require some extra colour in the metaverse, but arguably there is nothing more constrictive than hardcoding all the rules in the programming language that constitute reality. It is true, you can unplug yourself from the metaverse, but that’s not an exclusive characteristic of the metaverse either.

Citizenship representation -> corporation. Axie has the ambition of becoming a fully decentralised DAO, where all decisions will be taken by AXS token holders – this is not the case today, with Sky Mavis fully controlling decision making and the top 10 addresses owning 96% of governance tokens. The model of one-token-one-vote resembles more a disintermediated corporate shareholder model than a democratic one with universal representation. AXS governance tokens however, and here’s a slight twist, are also needed to breed Axies, creating a connection between monetary policy and citizenship representation that seems purposely designed to reduce the reinforcement loop between wealth generation and political influence. It is also, in a way, a form of taxation.

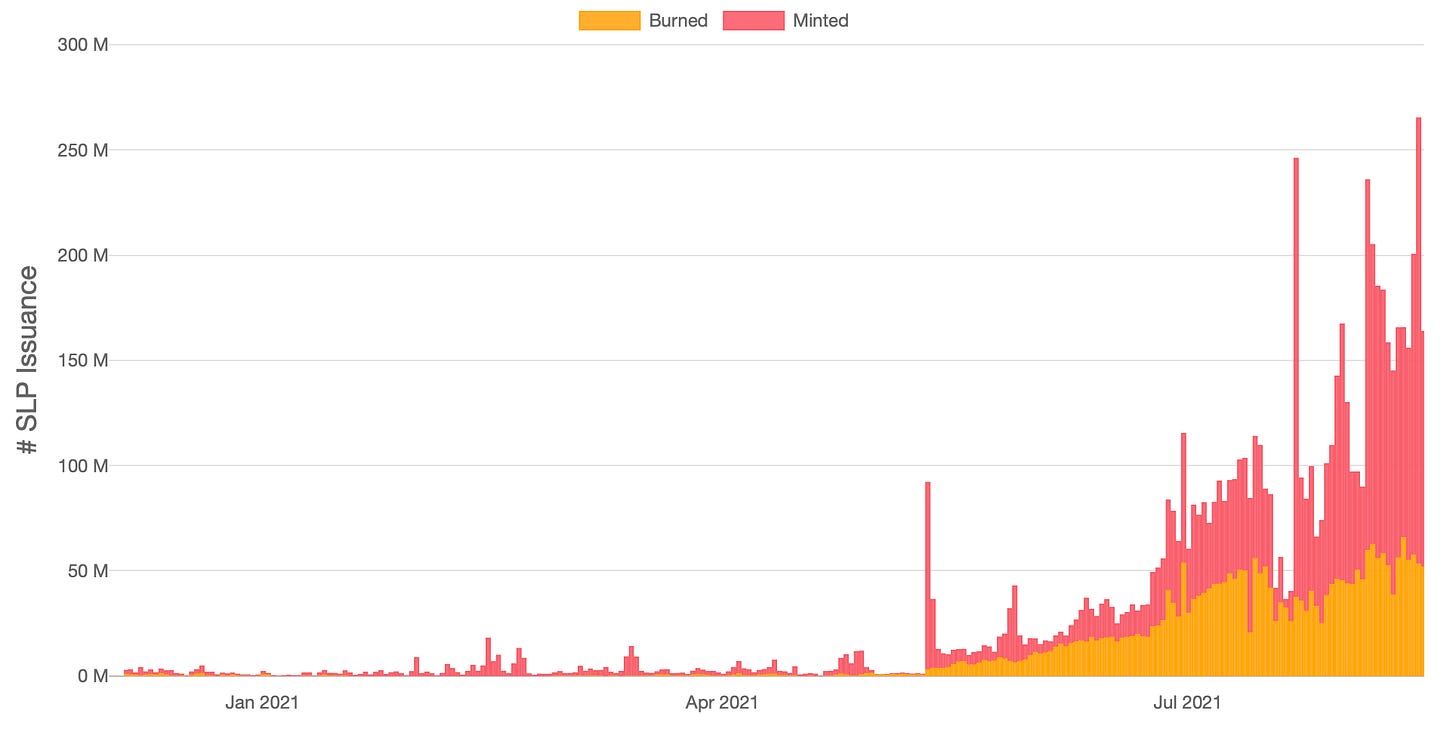

Sovereign monetary policy -> state. Axie has its internal form of currency: Smooth Love Potions, or SLPs. SLP is an uncapped utility token that can be used within the game to breed Axies based on a specific schedule. Once the SLPs have been spent, they are burned. Players can obtain SLPs within the game basically by playing, and those are freely tradable on DEXs outside of the game. Axie Infinity has de facto control over the monetary base by changing the parameters for burning and minting.

Private ownership of assets -> state. Within Axie Infinity, players and external shareholders can own some assets outright - land, Axies, and other items; those NFTs can be traded in the open market and the correspondent value flow enjoyed by their private owners. Ownership of those assets within Axies Infinity resembles more that of a state model (where private property is allowed) than a corporate shareholder model.

Centralised treasury -> state. Axie Infinity produces revenues by charging levies on transactions and production. A 4.25% cut is taken on sales and purchases of Axie NFTs in its marketplace, and fees are charged on breeding. Revenue for Axie Infinity stood at c. USD 350 million in the last 30 days window, > 2x times Ethereum’s, and 12x OpenSea’s. Cumulative inflows to treasury amounted to c. USD 470m, with the vast majority coming from breeding fees. The centralised treasury is controlled by AXS token holders.

International legal sovereignty -> state. When it comes to sovereignty outside of its borders Axie Infinity resembles more a state than a corporation. There is no regulatory body that can limit significantly the activities within its boundaries, although the relationships between Axie and the outside universe (and other metaverses) might be regulated by an evolving set of rules.

Shared sense of purpose -> ?. Scholars believe states were born during the neolithic age out of a shared sense of purpose that emerged from managing the surplus stock of static agricultural activities. Axie has clearly a sense of purpose shared by the players: having fun and making money. We could say that this is also the case of well-functioning corporations, where employees affiliate because of a vision they share with the rest of the organisation, and a promised compensation for their services.

Response: that of state is a good proxy mental model to deal with Axie Infinity as an investor, although Axie resembles a kingdom rather than a modern, democratic, state.

A Macroeconomic View of Axie Infinity, the State

Sky Mavis has the ambition of opening up Axie Infinity to the community and to evolve it into a comprehensive, expanding, vertically integrated ecosystem. As investors, we should assess Axie’s macroeconomic viability before anything else, in the same way rating agencies evaluate sovereign risk before that of corporations.

The Stylised Traditional Framework: a Reminder

Flourishing, export-led, economies are characterised by a significant trade surplus and, on the other side of the equation, a net inflow of domestic currency from foreign markets. The net inflow of capital puts pressure on the currency that, typically, appreciates.

An appreciating currency increases the purchasing power of citizens in foreign goods, with deflationary effects on local prices and distorting ones on the national industrial footprint. Due to the imbalances of its industrial policy, the economy remains exposed to the volatility in foreign demand, often with destructive effects. It is often called the commodities’ curse.

The mission of monetary policy remains that of balancing deflationary and inflationary effects, and that of the treasury directing spending and investments in a productive way for a sustainable and balanced economic growth.

The Axie Infinity Case

As a state, Axie is not different from any other, broadly speaking. Its economy is flourishing, running a huge trade surplus and, we can imagine based on the latest treasury data, a fiscal surplus as well - with treasury revenues far exceeding development and running costs. In other words, due to a strong demand for its native NFTs, Axie is currently a net importer of ETH - and, indirectly, fiat. This puts significant pressure on its currency, SLP.

With NFTs the main good to be produced and exchanged in the economy, the effect of an appreciating SLP (and to a lesser extent AXS) would be deflationary, making (relatively) more convenient for Axie players to swap SLPs for other tokens and purchase NFTs abroad, rather than producing them internally, to satisfy global investors’ demand. This, in the long run, would be detrimental for Axie, as it would reduce engagement, the appeal of its currency and economy, and its future viability.

Axie knows it and has been actively trying to balance those deflationary effects with inflationary measures. We can see from the chart above that increases in the USD/SLP exchange rate were followed by drastic reductions, due to the parametric minting activity of new SLPs - below. Axie’s monetary base - i.e. SLP market cap, that stood below USD 1m at the beginning of 2021, reached USD 230m and continues to expand.

Excessive inflation, however, is not good either for Axie, as it would reduce the participation incentive for those players who earn in SLP and spend in ETH and fiat. It is, in other words, a trial and error game, where Sky Mavis has been experimenting to find a balance.

On the 9th of August, The Lunacian (Axie’s substack) published a few economic adjustments to the way SLP is earned, basically making minting more difficult and favouring expert players - i.e. dampening inflation and promoting skilled labour, using macroeconomic jargon. For as mind-blowing as it might sound, Sky Mavis is doing proper monetary, fiscal, and industrial policy for its metaverse. The tone of the newsletter is unequivocal (emphasis is mine):

While we rarely comment on the scholarship system, we believe that these adjustments will put upward pressure on scholar wages for skilled battlers and reward managers that have put time into educating and training their scholars for the arena. Just like in the real world, higher pay must be a function of variable outcomes. Turning scholars into skilled workers is a step in this direction.

[…]

Long term we need to carefully use many different strategies to balance the economy. Here are some of the additional mechanisms in our policy toolkit:

Short Term

Adjusting the AXS portion of the breeding fee. Lately the AXS portion of the breeding fee has gotten quite high and this is something that we are considering adjusting.

Adjusting the amount of SLP needed to breed Axies. We may increase the amount of SLP required per breed in the future if burning and minting is still skewed towards oversupply of SLP.

We will appraise the need for further action based on the data produced over the coming weeks.

Long Term

Launching our own decentralized exchange to attract greater liquidity for our in-game resources.

An Axie sink that requires releasing Axies for crafting materials. These crafting materials could be used to upgrade land, Axie body parts, and land items. They could also be used to create consumables and buy/roll cosmetics.

Releasing new features and Axie game modes that increase demand for Axies through access to new experiences and utility.

Yes, we are talking about a game. I tried to summarise those competing forces in the diagram below.

Whether Sky Mavis, and later the DAO, will be able to achieve a balanced growth for the Axie economy remains to be seen. For now investors are enjoying the explosive growth part of the story, disregarding the explosive risk that come with it. We should keep looking closely at the rate of growth of the SLP market cap.

The Emergence of the Metaverse Financing Industry

When, on the back of COVID, more than 7 million Filipinos lost their jobs, breeding and battling Axies for a living became one of the key industries of the country. Developed economies, flooded by freshly printed cash, were eagerly demanding digital collectibles in the form of NFTs for diversification purposes; the Philippines, on the other side, were ready to put the effort to transform their labour into those NFTs. Axie was perfectly positioned to benefit from this geographical arbitrage. A mini-documentary (below) on the play-to-earn model was released in May 2021 and became an instant classic.

As soon as the financial opportunity became real, it opened the door for actors who were ready to front the initial investment in exchange of a cut of future earnings.

The rent-to-play-to-earn product is Yield Guilt Games’ (YGG) first product line: guilt members are allowed to use YGG-owned assets in exchange for a profit share. Those profits, and the fresh capital coming from outside investors, would be invested in purchasing additional NFTs within the metaverse the same way a real asset investor would buy land, property, and other assets with the expectation of a yield. Before YGG’s governance token sale was completed on July 27, a16z had already invested USD 4.6m in their latest financing round.

Axie Infinity, as well as The Sandbox, and League of Kingdoms, were only the first games YGG decided to focus on. In its whitepaper, YGG describes itself as game-agnostic, as long as the gaming metaverse has the following characteristics:

Aleksander Larsen, aka Psycheout, Co-Founder and COO fo Sky Mavis, is listed among YGG’s advisors.

Building a Meta Investment Arm

YGG remains agnostic not only in relation to the underlying games, but also regarding the types of activities it could engage in. Basically, YGG’s value could be derived by any investment and management activity into all digital assets native of metaworlds, making the company similar to an old school investment bank ported into the digital space. Given the lack of regulation existing within those metaworlds, the activities available to entrepreneurial minds are numerous, and include sponsorships, raids (!), merchandise sales, as well as land purchases, yield farms, etc.

There is a feeling that, in response to the increasing regulation, economic players have created for themselves secluded pockets of reality where to replicate all the elements they do like of the physical world, but without the aspects they don’t. It will be interesting to see how long it will take for the red tape to catch up.

In addition, YGG is building a metaverse on top of the gaming metaverses it operates in: YGG token holders can use those tokens to vote and get economic benefits, but also to subscribe to a metacommunity with exclusive merchandise, content, and benefits. My mind is exploding.

Like many other crypto projects, YGG too has the ambition of becoming a DAO. Of the 1b tokens treasury is planning to release, 45% will go to the community. Founders, investors, and treasury, however, would still jointly control majority of the voting on a fully diluted basis. As it often happens, decentralisation in theory doesn’t necessarily translate into decentralisation in practice. As of today, YGG’s token capitalisation sits at USD 565m, its fully diluted one at USD 8b.

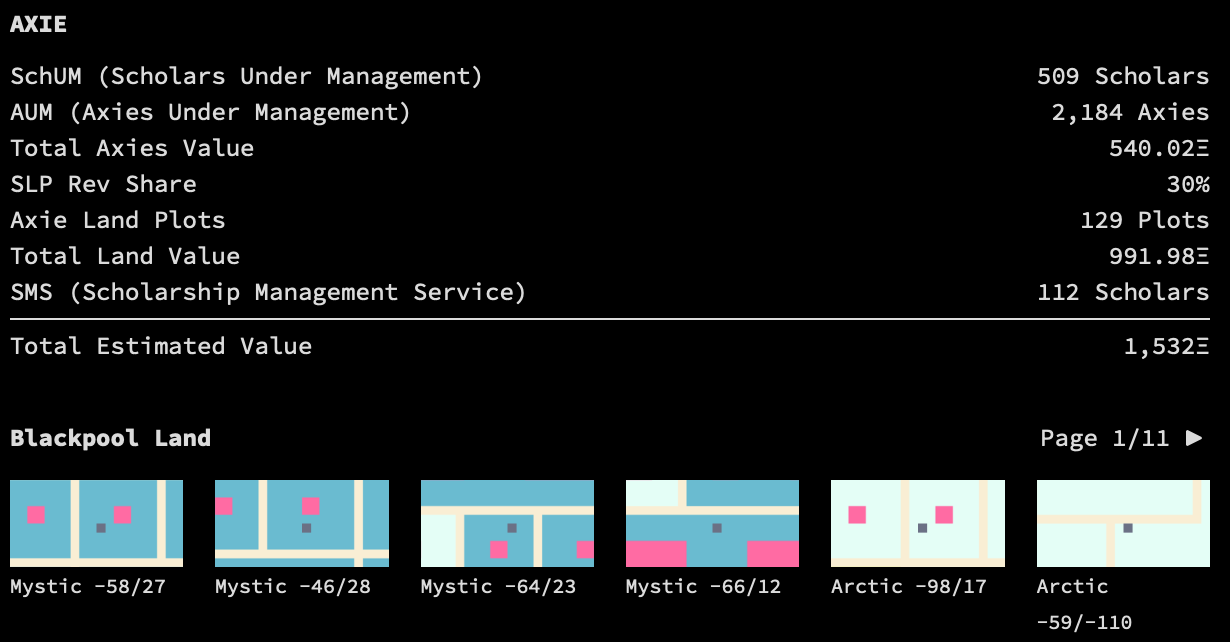

YGG is not alone in the game. Blackpool launched at the end of 2020 with broader ambitions, as a new asset manager fully dedicated to the NFT industry. In the same fashion of more traditional capital allocators, it has business (gaming) lines, digital assets under management and custody, investment services - scholarships, proprietary investments, and a fully transparent balance sheet that looks like the picture below - I wonder what accounting standard they use.

It Is a Game, and It Matters

Axie is not only a game, it is the alpha version of something grander: a digital, trustless, social operating system. It is much easier to remain within a system, developing endogenous solutions to endogenous problems for endogenous agents, than translating and porting mechanisms that already exist outside. Digital institutions and digital services for a natively digital world, this could be the way. The bridge between the blockchain and the outside world is narrow and shaky, ask the TradFi-DeFi facilitators.

Axie and the other emerging metaverses could be the training camp for simple models with a far wider applicability. DeFi should listen in. With time, the old system will shrink, and more substance will natively emerge directly inside the new. Patience, again, is often the least appreciated of qualities.

It always starts as a game.

Innovating is a communal effort. If you have great ideas you want to explore together, great companies that should be on Dirt Roads radar, or topics you would like to co-author on DR, please feel free to reply to this email or contact me on Twitter.

So in theory Axie is a state whose monetary policy (and tax rates) are determined through direct democracy — except of course it’s run like a corporation for the time being, with a single dominant shareholder. If nothing else, will be fascinating to see how the parameters evolve once/if governance does become more distributed