# 18 | Olympus, Devourer of Planets

The Bonding Force of Olympus Is Immense, We Should Master It With Care

This is another issue of Dirt Roads. Those are not recaps of the most recent news, nor investment advice, just deep reflections on the important stuff happening at the back end of banking. The time we are sharing through DR is precious to me, I won’t make abuse of it.

I am a bit nervous while writing this post, I must admit. I spend quite a lot of time studying the field of experimental currencies - on DR here and here, and the first time I was introduced to OlympusDAO’s idea, that of a decentralised reserve currency that remains unbound by a peg, I wasn’t expecting to find myself writing about it a couple of months down the line. My relevance filter was triggered by a series of red flags, and I had simply moved on to more interesting things - I thought.

To start, I hated the pseudo-game-theoretical description that gave birth to the Ohmies’ (3, 3) twitter tag. I found it unnecessary and rather confusing also considering the plethora of strong assumptions over the payoffs and the game structure - but I will leave Von Neumann and Morgenstern alone. I know, I have never been a marketing guru.

The choice of the word currency, that in my mind is so extremely abused in DeFi, was another of those warnings. Confusing the social role of a currency with that of a reserve asset seems one of the favourite sports in the inner circles of crypto-finance, and it is one that, coupled with its sibling - i.e. an extremist aversion to inflation, makes me particularly nervous. The belief that an orderly depreciating currency needs to be fought as the worst scheme against humanity never resonated with me.

The fact is that inflation, when controlled, is a pretty good sign that things are progressing as they should in an economy. It is an indication that the economy itself is expanding and acts as an incentive for owners of liquid resources to consume or use those productively by lending them out to others. Symmetrically, it pushes borrowers to ask for loans, and banks to intermediate them - the spread between rates on loans and those on deposits tends to be correlated with interest rates and inflation. A lot of vicious effects kick in instead when inflation and interest rates are at the floor, or worse case below it. We should remind ourselves that resource allocation is one of the core functionalities of a well-functioning currency, and that the enemy here is not an expansionary monetary policy but rather an inefficient (currently bank-based) allocation system.

We could say that currencies are somehow trying to make the future tangible today. When a bank mints currency to finance the purchase of a home - currency that didn’t exist before, it is materialising today the cash flow that an individual is expected to generate in the future. Things are different for reserve assets, that are owned as some form of safe haven for value preservation. Using a similar analogy we could say that reserve assets are instead trying to teleport ourselves into the future with the minimum impact possible. Structurally scarse resources with some social recognition (gold, diamonds, London Z1 flats, Patek Philippe watches, Bitcoins, Punks) function well as reserve assets since their own scarcity is testament that their value cannot be deflated in time - assuming the absence of a social paradigm shift.

The concept of reserve currency, a crasis of the two described above and maybe a pun on the USD, left me nervous and sceptical. OHM, OlympusDAO’s currency of use, was in my mind:

Not a good currency as the absence of a peg and of a clear target monetary policy weren’t facilitating its use as a unit of account

Not a good currency, again, as its tokenomics weren’t incentivising its use as a mean for exchange

Nor a good reserve asset, as its structure was build around a concept of endless expansion

So I moved on. Then, fast forward two months, this happened.

OlympusDAO has amassed a treasury chest of c. USD 400m, has a market capitalisation of c. USD 3b, and still runs at an APY of 7,764% for stakers - the comma is not an error. As a business person and not an academic, I had to stop for a second and interrogate myself whether it was only a misnomer that had pushed me away from one of the most relevant financial innovations of the recent DeFi landscape. Or maybe not. Let’s dive in.

Ohmies, Bonds, and the Power of (3, 3)

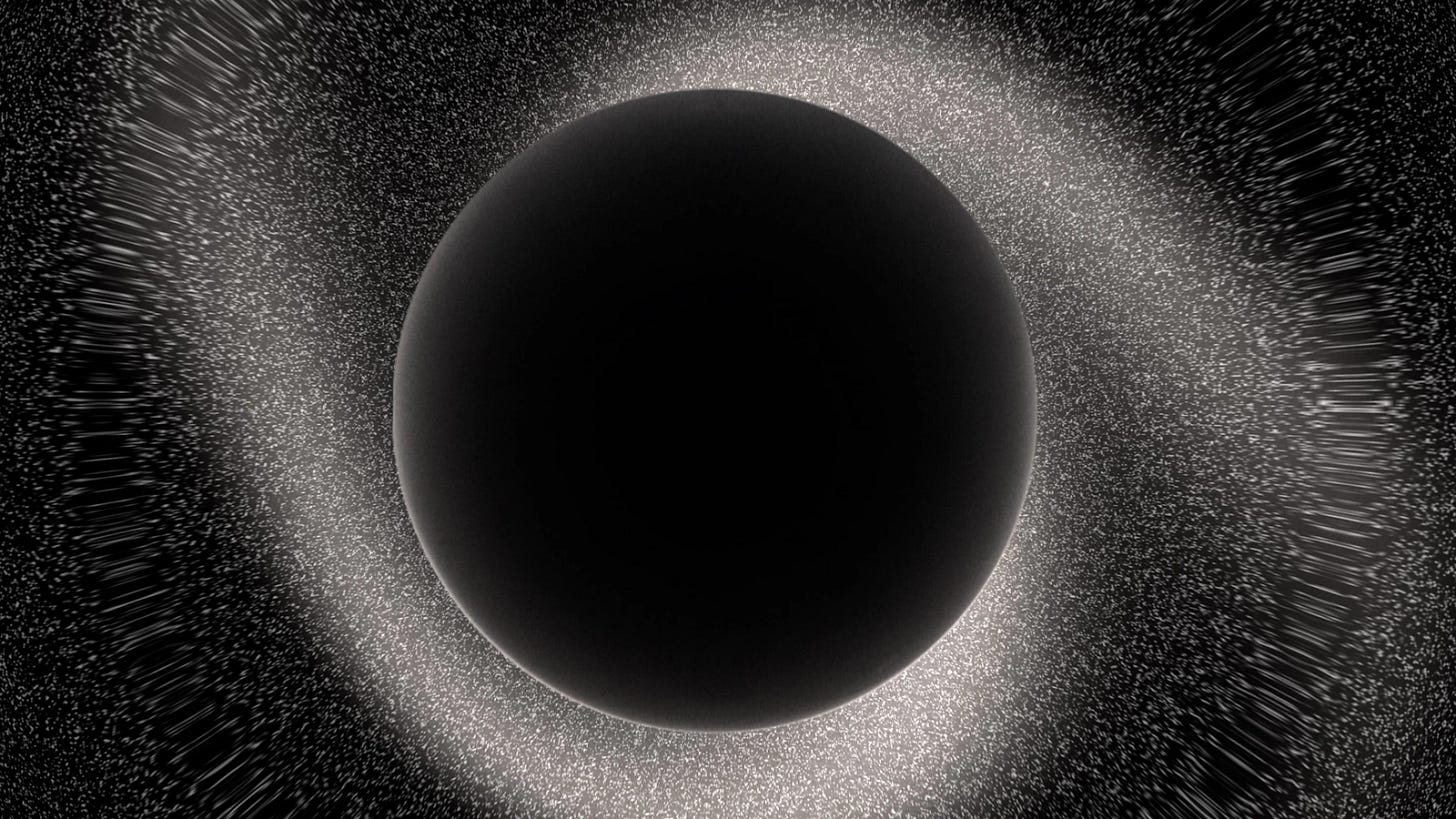

In a nutshell, Olympus is a liquidity black hole, one of the hot ones. It attracts liquidity in various forms, releasing in exchange energy as freshly minted OHM tokens. The world outside is free to trade and value OHM, backing valuations with the belief in Olympus’ endless powers of bonding. Rather than a new primitive in the DeFi ecosystem, Olympus resembles one of those rare combinations of forces that sometimes make the universe ripple.

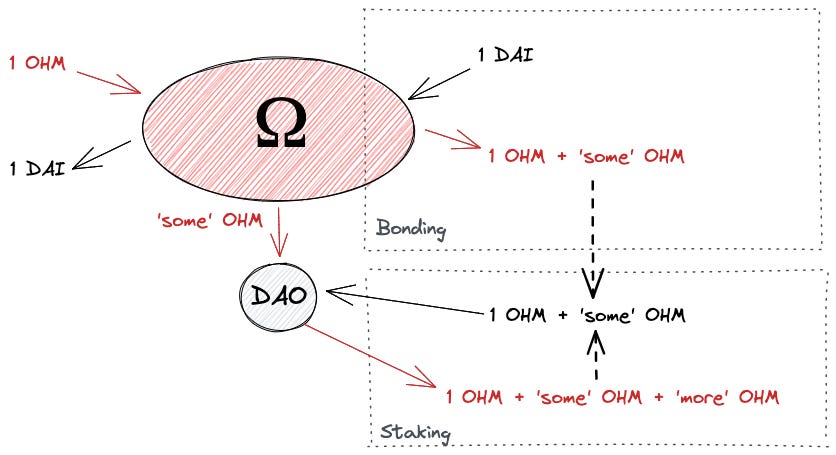

OHM tokens are minted in exchange for the contribution of other coins, mainly stablecoins or LP tokens obtained by parking liquidity in a DEX - Sushi is the one of choice. The minting of new tokens is done via a mechanism called bonding, that attracts new assets by maintaining a discount window vs. OHM market prices. Once this liquidity has been attracted within the radius another force comes into place: staking. Olympus keeps expanding so fast that by not remaining glued to the nucleus holders risk to be spaghettified, as they say in astrophysics, or tore to pieces and thrown into oblivion, as we say in finance.

Attraction Force: Bonding

Bonding is the most important way Treasury attracts a whitelist of assets - mainly stablecoins and liquidity tokens. In order to do so, Treasury offers to sell outright OHM tokens to bond holders at a discount vs. OHM’s current market price, based on a linear vesting schedule. Such a discount is proportional to the amount of bonds that are outstanding, through a set of functions and parameters.

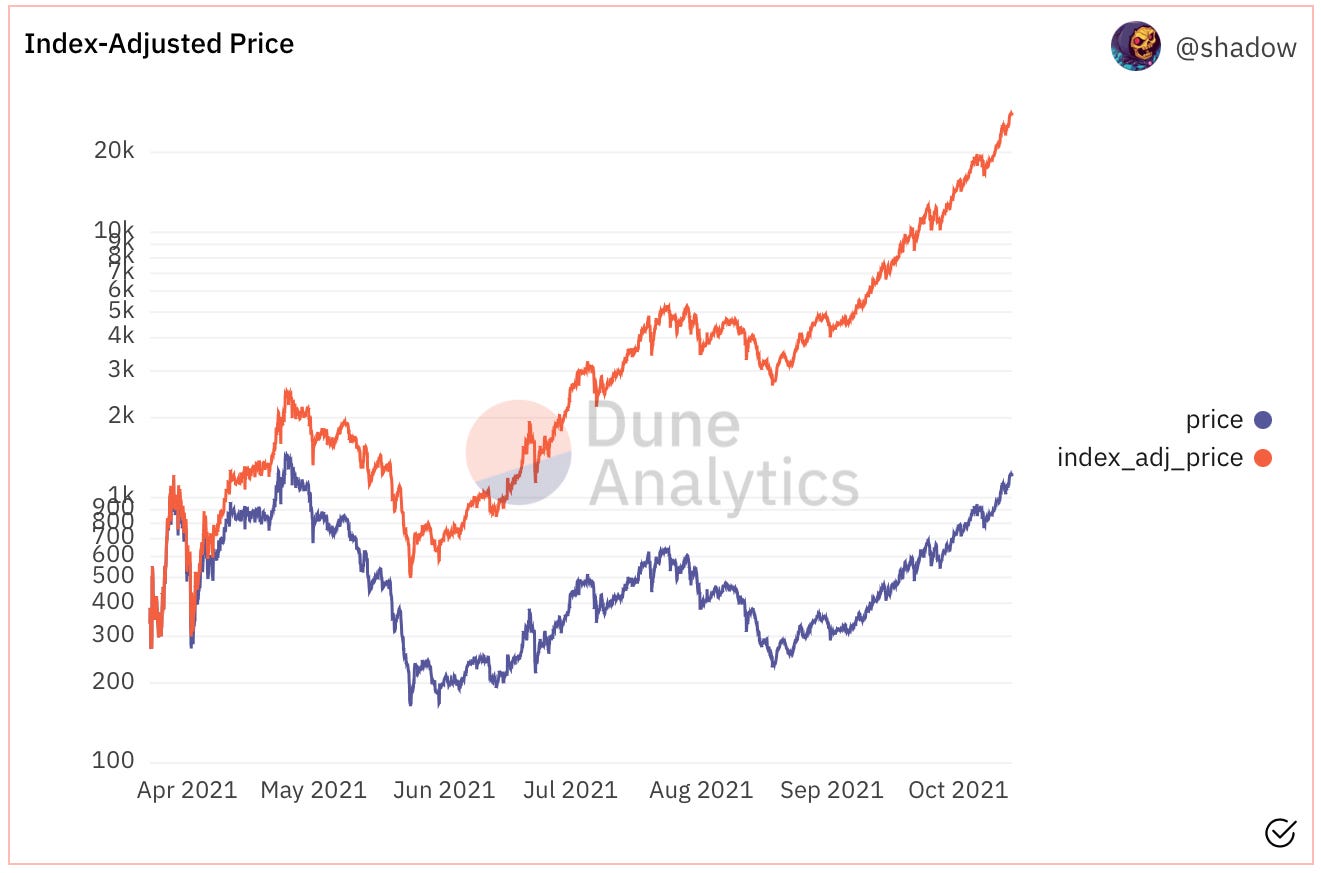

Bonding represents an active strategy for investors, as it requires actors to monitor the market parameters and do their own math before each bond decision. After you bond it might be too late to think about what you’ve just done. During an expansionary phase, when prices surge, things look easy and any discount is good enough, but doing proper math for simulating bonding returns would be a very complex exercise. Treasury mints new OHM tokens in order to compensate bonders, and does the same symmetrically to pay the DAO, expanding the monetary base and diluting all OHM holders. We can see from OHM’s price behaviour (netted of the dilution effect) that the market hasn’t worried too much.

The bond price - or better the discount vs. market price, is as many other things in Olympus, parametric, and will change to attract into Treasury the liquidity that the DAO will consider satisfactory. The Olympus Policy dashboard on Dune gives a great overview of what’s going on for the geeks among us. We can see how, for example, the BCV parameters are growing constantly each epoch, making the bond progressively more expensive and limiting escape velocity. By looking at the parameters it seems that the DAO is quite satisfied with how things are going.

Retention Force: Staking

The rational strategy for a holder of a rapidly diluting security would be to sell that security in the secondary market as soon as possible. That’s where staking comes in the picture. OMH can be staked, in isolation or in pair with another whitelisted crypto asset, for incredibly high nominal returns. Those should be close to the underlying monetary expansion and be much lower in real terms, but the marketing effect of a 7,000%+ APY is powerful. In this way OHM holders are incentivised to keep their OHM within the system both in a bull - where the incentive of bonding and therefore minting new OHM grows, and in a bear market - where stakers are incentivised to keep their OHM staked waiting for the reward rate to push them back into the green. Unsurprisingly, all rational OHM token holders remain staked.

This is where OHM’s liquidity mechanism differs from most traditional liquidity mining / farming models that are yes extremely successful in attracting new capital flows but that, conversely, struggle to keep the yield-farming junkies happy for long. Nat Eliason described this eloquently in his post - h/t to Simon for forwarding this to me, although I do not necessarily agree in full with Nat’s conclusions.

The Black Sun

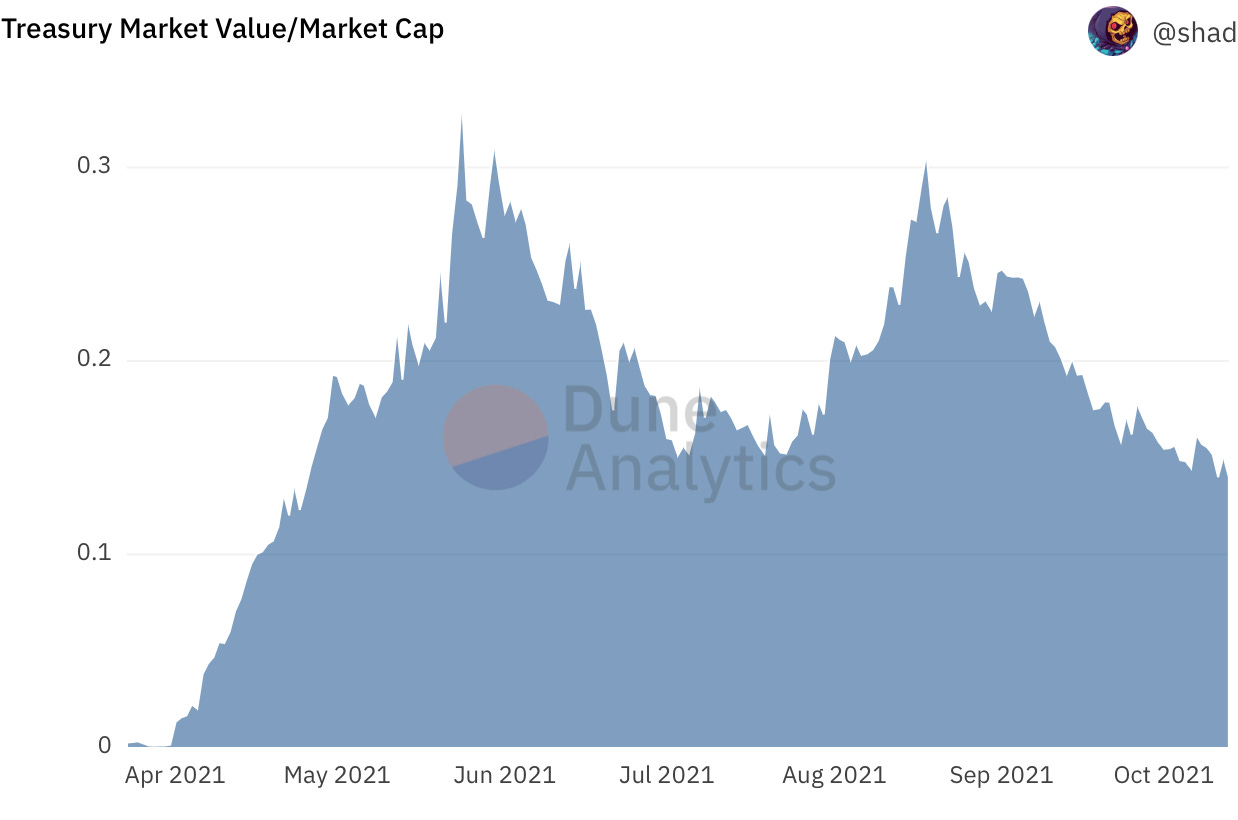

On the day I sat to write this post Olympus’s Treasury had accumulated c. USD 450m of assets - at market value, although only c. USD 110m of those were held in Treasury while the rest sat in liquidity pools, exposed to impermanent loss - mainly in the form of DAI plus LUSD, FRAX, and ETH.

Said in a different way, Olympus currently controls the vast majority of its own liquidity pool in the DEX, providing an almost seamless swapping experience, keeping the market stable, and internalising all the liquidity fees that otherwise would go to liquidity providers - c. USD 6.5m cumulative as of today.

For as much as Olympus’ ability to capture assets within Treasury has been impressive, OHM market cap has been way more astonishing and sits today at c. USD 3.2b, or > 7x the fair value of the treasury book. It is true, the DAO has the power to floor the OHM tokens at the value of the hard assets and to stabilise price by deploying those assets in the open market to buy OHM if needed, but is it enough to justify such valuation? What is the implied growth of the OHM’s ecosystem priced into such multiple? Not sure I know how to approach this question.

Proof By Contradiction

Doing a proper analysis of the centrifugal and centripetal forces happening within Olympus’ core is very difficult, but we can take a shortcut learned from mathematics, a reductio ad impossibile or proof by contradiction. We can, in other words, assume that there are no forces able to counteract Olympus’ power of attraction. What would happen in that case? More and more assets would get trapped in Treasury, with more and more of those remaining outside fighting to get whitelisted as eligible for bonding. Would it be plausible for all universal liquidity to remain trapped beyond the event horizon without causing destructive effects in the fabric of the DAO or the whole DeFi ecosystem?

This is even more relevant now that Olympus is licensing out their liquidity trap tech, branding it Olympus Pro, to other protocols that would have used liquidity mining programs instead to gather early-day interest around projects. Interestingly, for their Pro product Olympus has changed narrative and stopped referring to themselves as providers of the ultimate reserve currency, but rather as the new industry-standard platform to help protocols acquire their own liquidity. By adopting Olympus Pro’s bonding and staking framework protocols could attract liquidity from pockets within DeFi circumventing the toxic effects of liquidity mining programs. Protocols could finally own their own liquidity, increasing retention forces the more the liquidity pool expands. Olympus’ (and DeFi’s) hope is that this will improve cohesiveness and sense of purpose within the DAO.

Could this series of mini black holes disorderly emerging across the DeFi ecosystem expand forever? Swallowing crypto-matter around them indefinitely? I haven’t done the math, but I don’t think they will. And for one simple reason. We can perfect the mechanisms to attract liquidity further and further, but this exercise doesn’t answer the fundamental question of what the different projects are ready to do with such liquidity. The question becomes more and more difficult to answer the larger treasuries get. At some point, my gut feeling tells me, centrifugal forces will outpace centripetal ones, and the attraction process will revert. Probably as brutally as it had started in the first place.

The powers of Olympus are vast and must be handled with care. The results could be catastrophic otherwise.

Innovating is a communal effort. If you have great ideas you want to explore together, great companies that should be on Dirt Roads radar, or topics you would like to co-author on DR, please feel free to reply to this email or contact me on Twitter.

Hey Luca! Can you delve a bit deeper into why you didn't like the "reserve currency" terminology? You gleam to it with your "maybe a pun to the USD", but I'd like to understand better why you don't like the terminology if being a reserve currency is exactly what the USD is. Is it because OHM isn't pegged, or because you don't see it being used as a main reserve asset/collateral in other protocols?