This is another issue of Dirt Roads. Those are not recaps of the most recent news, nor investment advice, just deep reflections on the important stuff happening at the back end of banking. The time we are sharing through DR is precious to me, I won’t make abuse of it.

The Terra Money Tetralogy:

Episode I: Terra Money: a Primer

Episode II: Demystifying Anchor, Terra Money-Spinner (this post)

Episode III: ?

Episode IV: ?

Terra is a sovereign economic system aimed at issuing, managing, and manipulating financial value. The Terra system has its own currency, $UST - implicitly pegged to $USD, and its own governance token $LUNA. Terra is an observable pegged monetary system where the volatility within its currency (vs. the pegged sibling) is transferred from currency holders to the system’s equity holders: the treasury, the domestic companies, the token holders. In the traditional world a pegged system works well, until it doesn’t, when the economy needs something that the fiscal policy cannot provide and the peg becomes unsustainable. Will Terra’s destiny be any different?

We stand at the gates of Terra. Here be dragons. A voice whispers, of riches and adventures. A voice makes promises. One’s destination is never a place, but a new way of seeing things. It warps the mind at times, but this is the way it goes, at the beginning of everything there is always a promise, a story that squashes fear and fires up desire, and hope. It’s in the chemicals, it’s in the hormones, it’s in the genes. We know that, and they know that too. So can we trust what we see?

In the lands of the Great Financial Revolution that promise is often prosaic. Cash. Cash to be made if you move fast enough. Real cash. You can touch it. But can it go on? That’s a different story. Where does the buck stop? We need to draw the whole picture to answer such questions, although we might never know for sure.

So here we stand, admiring the blinding light of the Anchor gates. It is time we cross the river and see for ourselves whether Terra is the land of milk and honey, or just another mirage. Red pill.

Anchor: the Gates of Terra

There are five and only five motivations for somebody to settle activities within Terra:

$UST is a (relatively more) trustable harbour of value preservation

$UST is attractive liquidity for the use of borrowers, lenders, and investors

Providing services within the Terra ecosystem is relatively more profitable

Services within the Terra ecosystem offer a better experience to users

You like Terra and that’s enough

Only if some of those conditions are satisfied the system will grow in value, and that value will accrue to $LUNA holders. For anybody aiming at interacting with the Terra sovereign financial hub in order to satisfy one of the conditions defined above, the Anchor protocol acts as the entry gates.

There are several ways to approach what Anchor actually does within Terra.

(1) → Anchor is Terra’s Distributed Money Market

The protocol offers the possibility for depositors/ borrowers to get yield/ liquidity in $UST in exchange for an interest rate. Depositors are incentivised to participate by being rewarded with a deposit rate that is algorithmically defined based on supply and demand - although the protocol aims at keeping it close to a target rate defined by policy. Borrowers, on the other end, are incentivised to participate by receiving $ANC tokens that represent economic and governance ownership of the Anchor protocol. Newly minted $ANC is also distributed to liquidity providers of the $ANC-$UST pool. Earlier in October Messari published a well-researched piece on Anchor that highlighted the transformational importance of providing a policy-driven reference rate for $USD-pegged deposits within the DeFi ecosystem. In a world where rates are set on a block-by-block basis, fixing a target remuneration rate for pseudo-dollars might have the effect of rising water levels across the board - with the risk of seeing someone drawn. Anchor currently holds $UST 2.0b of deposits and lends $UST 1.2b out to borrowers.

(2) → Anchor is Terra’s Industrial Flywheel

At current rates, borrowers can get $UST at almost zero (negative 42 bps) net interest. How is this possible? In order to borrow from the money market, perspective borrowers need to pledge certain types of whitelisted collaterals, and all borrowing positions are required to maintain a minimum loan-to-value ratio with the threat of being otherwise liquidated. Before being pledged, those collaterals need to be staked, or better bonded, making themselves yield-generating. Differently to what happens for other money markets such as Compound or AAVE, only yield-generating assets can be pledged. The yield generated by those bonded, and pledged, collaterals is converted into $UST by the Anchor protocol and distributed to depositors - if the yield exceeds the target deposit rate such portion is retained within a yield reserve. Borrowers, in other words, forgo their ability to earn yield on those productive assets in exchange for a liquidity window and for their ability to participate to the ecosystem as $ANC token owners and liquidity providers. Still, they maintain exposure to the underlying collateral price movements. As many protocols before, Anchor incentivises borrowers to come into the ecosystem by distributing part of its equity at depressed rates - tweaking this rate in a process of mint & burn depending on the observed rate of participation.

The incentive for depositors to participate in Anchor’s ecosystem is clear, assuming they believe in the $UST stability: they can get better rates on $UST compared to what they can get on other stablecoins - or on $UST but outside of the Terra ecosystem. But what about borrowers? Things here are a bit more complex, let’s try to unpack:

(-) Borrowers forgo their staking rewards: on $ETH, that’s c. 5% currently

(-) Borrowers pay negative rates on borrowed $UST: that’s c. 25% today

(+) Borrowers receive $ANC: currently at a c. 25% rate

(+) Borrowers can use those $ANC and $UST to provide liquidity and earn LP fees

(?) Borrowers are exposed to $ANC profit generation that come as bAsset rewards, excess yield, and collateral liquidation fees - that profit could also be negative in principle

(?) Borrowers are exposed to $ANC price movements

Said differently: borrowing from Anchor is a (levered) bid on Anchor’s development itself, in a race against the dilution arising from $ANC minting to reward future borrowers’ participation.

(3) → Anchor is Terra’s Volatility Reduction Engine

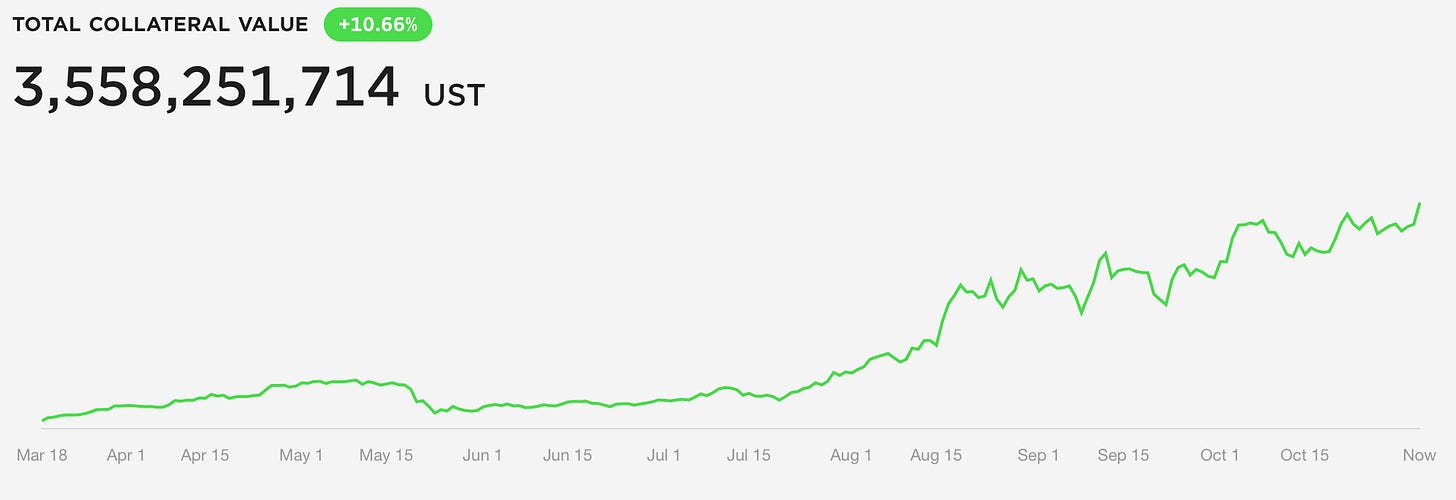

There are currently c. $UST 3.5b worth of staked collateral pledged to Anchor, with $LUNA representing the vast majority ($UST 3.1b) and staked $ETH constituting the rest. The feedback loop of $LUNA tokens being minted by Terra’s treasury to be then pledged to Anchor is evident. Through Anchor, the Terra ecosystem is trying to retain both $LUNA and $UST within the system reducing selling pressure and dampening their volatility. As we discussed in our Primer, $LUNA tokens represent equity claims on Terra’s future revenues - i.e. the closest it gets to be equity holders of a sovereign system; by offering rewards to $LUNA stakers in the form of $ANC tokens, Anchor is sacrificing its own equity value in favour of the wider system’s value and stability. As usual, there is no free lunch, and volatility dampened in one area must be transferred somewhere else. On the other hand depositors are incentivised to keep their $UST liquidity within the system thanks to the superior passive yield they can get, thus relieving some pressure from the peg.

(4) → Anchor is Terra’s Distributed Sovereign Fund

Anchor is Terra’s GIC or Norges. It is controlled, through $ANC, by roughly the same group that controls its wider economy - through $LUNA. It acts as a magnet to attract external assets (although currently only $stETH is on a list that might in future expand) and retains what already exists within Terra. With time, it might amass the ownership of foreign equity in a way that resembles the sovereign funds of cash-rich (but industry-poor) countries. How's it going? Not bad.

Anchor Nucleosynthesis

The question, as we discussed before, is: where does all that money come from. For Norges, it is oil, for GIC, the diversified service and trade economy of Singapore. Anchor’s generated fees are not enough to cover its marketing expense. Already in the cold days of May 2021, Terra Form Labs (Terra’s Politburo) had to step in to recapitalise Anchor’s depleted yield reserve with $UST 70m from their Stability Reserve Fund in order to sustain the policy rate. It was the first example of fiscal policy supporting the monetary one. It is a slippery slope.

DeFi is always about two things: attracting liquidity (the OlypusDAO model) and efficiently using it - the Uniswap model. Anchor’s force of attraction towards Terra is strong, but can this be the end of the story? Like a dying star, Anchor is consuming itself, diluting its equity $ANC holders in a systemic liquidity mining program. One day, that cosmic fuel might finish and swallow all $UST and $LUNA value in its implosion unless huge value will start being generated within the Terra ecosystem. Unfortunately gravity is directly correlated with density.

Anchor’s sustainability will ultimately depend on several Anchor-specific and Terra-specific factors. A wider and more profitable set of external collateral assets could relieve some pressure on Anchor’s coffers and provide healthy risk diversification - if there is any thing resembling diversification within the crypto markets. In addition, a more vibrant and profitable Terra economy would translate into higher staking value for $LUNA, and more incentives to borrow $UST to interact with the ecosystem.

Nevertheless, at some point the balance will have to be restored: $ANC subsidy to borrowers will need to be normalised and/ or the reference yield rate get more connected to free market dynamics. This is nothing new in DeFI, what differs for Terra is $UST promise of sustaining a peg with a larger, more diversified and resilient, economy. Pegging is a powerful mental and emotional artefact but one that can’t be enjoyed for ever. The trick is that not many know when is the right time to cut the cord.

But this is a story for another day.

Innovating is a communal effort. If you have great ideas you want to explore together, great companies that should be on Dirt Roads radar, or topics you would like to co-author on DR, please feel free to reply to this email or contact me on Twitter.