# 24 | MakerDAO: (De)Central Banking

The Frankfurt Syndrome, or the Self-Fulfilling Power of Influence

This is another issue of Dirt Roads. The time we are sharing is precious to me, I won’t make abuse of it.

Owning a time machine would be useful to me only for the most futile reasons. Betting on the market and get insanely rich would not be one of those reasons, and I would actually try to ban myself from trading in the present in order to enjoy the infinite wisdom that comes from being able to observe the future. The fact is that it is impossible to remain calm and focus on the small winnings if you have such power, and the risk of growing someone’s asset base explosively with the confidence of complete vision is real. At some point, immense powers become immensely destructive. There is no way you can control it, it’s in every comic book.

I would nevertheless use the time machine to go forward and check whether this week’s post on DR will look like an avant-gardist take into the future of distributed monetary policy, or a useless rant. Great wisdom will be writing it nonetheless.

Whatever It Takes

On the 2nd of November, Maker opened its Direct Deposit DAI Module (or the D3M) on the AAVE v2 money market, initially with a debt ceiling of DAI 10m. At the eyes of the borrowers within AAVE, the D3M vault is nothing but a semi-transparent additional source of available DAI. At the eyes of Maker, however, it is much more.

There are two main parameters that MakerDAO’s governance controls when managing the D3M: a maximum debt ceiling, and a target borrow rate. It is the latter that should be remembered. If AAVE’s observed equilbrium borrow rate goes above target, Maker mints more DAI and drops them in the market to lower it; if such rate goes instead below the target, Maker redeeems liquidity trying to bring it back up. The parallelisms with how central banks influence market rates are evident: central banks are not directly tuning an interest rate handle on a dashboard somewhere, they are instead stating clearly what they would do in order to keep interest rates in check and that’s usually enough. By declaring a target rate that (authorised) borrowers should pay, and by stating their intention to do everything in their power to keep such promise, central banks want to influence expectations so strongly that they don’t even have to pull the trigger. In finance, or monetary allocation in general, it’s the expected interest rate that matters.

On the 26th of July 2012 Mario Draghi made history. His speech at London’s Global Investment Conference as Governor of the ECB will for ever remain testament of the power of...power. The stability of the whole Euro area was put under discussion by practicioners of all kinds, sometimes in good sometimes in bad faith, when The Man dropped two, almost casual, closing remarks:

But there is another message I want to tell you.

Within our mandate, the ECB is ready to do whatever it takes to preserve the Euro. And believe me, it will be enough.

Every word of those two sentences would deserve the level of scrutiny normally dedicated to Dante’s Divina Commedia - pardon my patriotism. Does Maker’s D3M have the same power of influence? Is Maker’s promise self-fulfilling in declaring the target rate borrowers should pay when asking for DAI on AAVE? There are two elements that make a self-fulfilling profecies real: ability and credibility. The market needs to believe that Maker can influence rates, but Maker needs to effectively be able to do it. In the medium term, the former is more important than the latter: without the effective ability to do something, market participants will spot the cracks and go for the jugular vein.

Is Maker effectively able to influence market rates? AAVE’s D3M debt ceiling, initially set at DAI 10m, was increased to DAI 50m a week ago, vs. a total borrowing market of DAI 1,740m - or < 3%. Still, the observed variable borrow rate (APY) is currently 3.99%, i.e. exactly at Maker’s target level. Is Maker able to have such a powerful influence on rates even with a minuscule footprint? The answer, as expected, is no. AAVE’s interest rates aren’t set, as it happens in the world of the animal spirit, by market forces, but rather parametrically and based on an interest rate curve that is controlled by AAVE’s governance to manage liquidity risk. Such curve has its inflection point exactly at 3.99%.

So, who is actually determining market rates, Maker or AAVE? Such question is, fundamentally, a question about power. The story has similarities with that of JackMa’s Yu’e Bao fund. Launched in 2013 by Alibaba as a retention tool allowing customers to keep spare change in their mobile wallets, Yu’e Bao grew to become, in early 2018, the largest money market fund in the world. That was before the Chinese government started applying pressure on the fund and the whole group to shrink in size and influence. Such a large pool of capital might have caused systemic liquidity risk within the currency system and, de facto, transferred part of the monetary bargaining power from the sovereign issuer to the intermediary. The Chinese government didn’t want that, among other things. In the case of Maker and AAVE, it might be argued that it is the latter that retains most in control over the monetary system. It doesn’t depend on DAI alone but it is one of the largest pools of DAI market liquidity. Maker, through the D3M, acts as a stabiliser rather than a market maker. And as an asymmetrical stabiliser considering the size of the program - through the D3M it would be impossible at least on AAVE to take enough liquidity out of the system and impact rates when those fall below target. The D3M acts, obviously, also as an additional source of profits for the protocol and a way to further expand the currency footprint during bull times. But their ability to serve the stability of the footprint during the storm, will be limited. At least at this size.

Where Is Your DAI?

The D3M tells only part of the story, as it is by far not the main channel to mint and distribute DAI for Maker. Of the > 9b DAI currently outstanding, c. 450M (or 5%) is actually sitting in AAVE’s v1 and v2 liquidity vaults - much more is on Compound. The choice between borrowing DAI at its primary source (Maker) or on the secondary market is a choice of access as much as it is of opportunity. Even if dishomogeneous collateral requirements and liquidation mechanisms make direct comparison difficult, it is in Maker’s power to influence the whole monetary stack by shaking its base, i.e. setting stability fee rates and other parameters on its collateralised vaults.

Maker and AAVE are both virtual places where someone can ask for money, but going one level deeper fundamental differences emerge, differences that ultimately will decide each protocol’s positioning along the stack. In pure DeFi style it is about transparency that leads to composability that leads to vertical specialisation. When it comes to AAVE vs. Maker, although at the eyes of the ultimate user they might be doing the same thing, it is how they do it that decide their mutual relationship. Lending is not a monopolistic thing, even in the real world. You could in theory go all the way and set up an entity with a banking license and access free central bank liquidity directly in order to finance your mortgage and avoid the bank spread, but why would you? There are costs and there is pain involved. That’s why you have commercial banks and money market funds, and that’s why you have decentralised liquidity protocols. Maker’s Risk Core Unit made a great work in outlining the differences between AAVE’s and Maker’s as part of the D3M risk assessment - you should definitely read it if you have time.

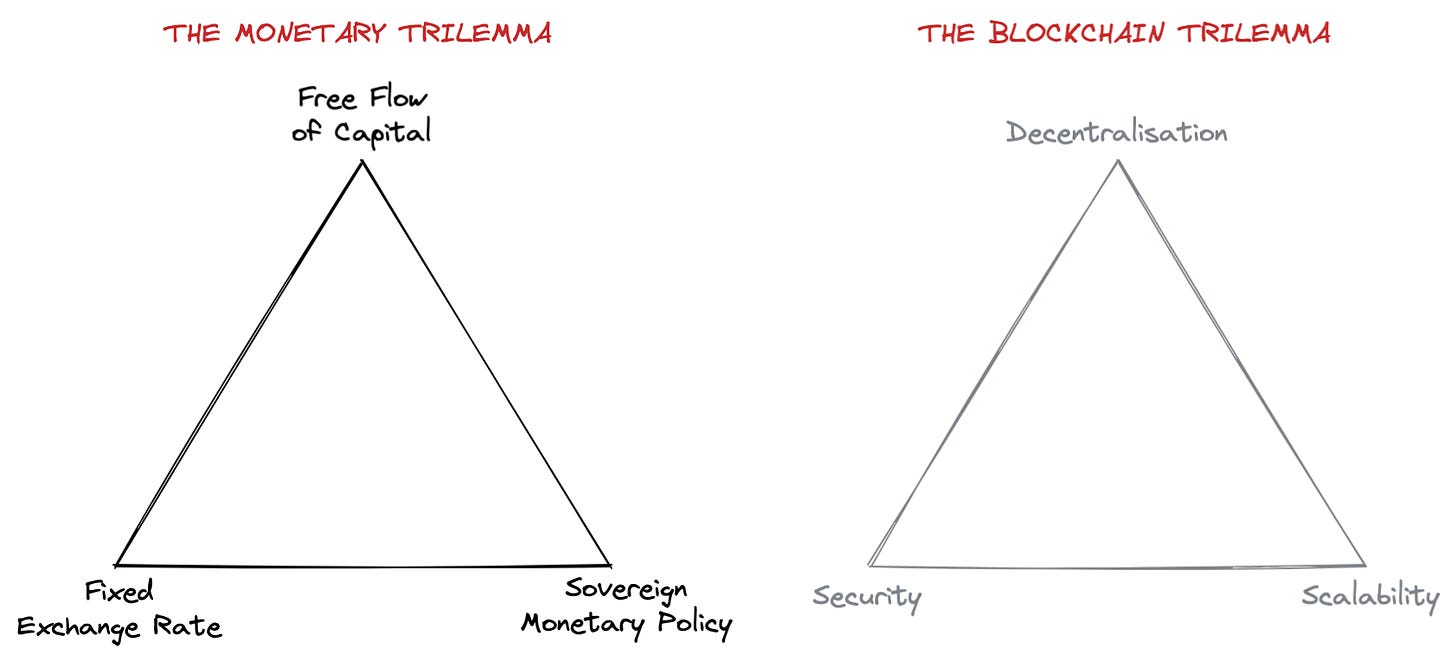

Does it mean Maker is the omnipotent emperor of its monetary system? There is a catch, and that catch is the peg. DAI requirement to hold parity with the USD limits Maker’s ability to fully control its monetary policy. In monetary policy, it is called the monetary trilemma: it is impossible to have, at the same time, a fully sovereign monetary policy and a free flowing capital market, when you have fixed exchange rate. In moments of stress, something needs to give in. Most often, in the long run, it’s the peg itself.

The inherent freedom of smart money, coupled with a pegged exchange policy, limits how aggressively Maker can tune monetary policy. This, far from being Maker-specific, is a commonality of pegged sovereign monetary systems. The Terra system, sponsor of another pegged stablecoin (the UST) faces the same problem but has opted for tighter capital controls (through the Anchor protocol, here) in exchange for a better handle on monetary policy. There is no free lunch. Pegging the DAI to the USD has huge benefits in terms of adoptability, and the fact that Maker doesn’t have to enforce Terra level 15-20% rates on deposits is, first of all, testament of the trust the DeFi community has for it and, secondly, a great shield against future liquidity shocks.

Project Real-World Sandbox

The story doesn’t stop at the world of smart contracts. We can call it DeFi, blockchain-enabled finance, value-net, liquid law, but one thing should be clear to builders, users and investors - although those roles aren’t necessarily distinct anymore: the blockchain is nothing but an infrastructural layer. And as for all infrastructures there is a lot of value in what you can build on top of them. In more practical terms, there is no reason the whole lending and financial intermediation sector shouldn’t start migrating onto it. Apart from the many vested interests of course.

Project Real-World Sandbox → Maker has been open to mint DAI against off-chain assets for a while already, but efforts have been timid. It might have been too early, but times have changed, and it is my belief the day has come to set Maker’s vision in stone and refine all onboarding and managing processes. It is for this reason that I accepted a grant to help kicking off the Age of the Great Migration.

Maker’s expansion to encompass use cases that aren’t native to the blockchain is the ultimate weapon in supporting a sustainable development of the DAI, but at the same time brings forward a new set of challenges. Those challenges have sparked wider questions about what Maker’s role within the wider monetary and lending stack is, demonstrated by SocGen’s recent application (here) and Rune Christensen’s call to action in proposing Maker as an engine for sustainable financing. It is my opinion (one that I have stated many times here on DR among other places) that Maker’s position shouldn’t be too dissimilar from that of central banks in the USD or Euro sovereign systems. With a mandate of sustainable growth, of both the monetary base and monetary velocity, rather than profit maximisation, Maker should aim at becoming the ultimate lender against the highest collateral quality, leaving the rest of the value chain to attack other portions of the risk spectrum.

Trust is the most important asset → Maker, as a community, shouldn’t underestimate the power of being able to mint currency at very low costs; it is a testament of the trust the wider DeFi ecosystem has for Maker’s governance principles and for the quality of the collaterals onboarded. Such trust should not in any way be compromised. It is my belief that Maker should focus more on expanding the collateral footprint rather than on onboarding collateral that yields higher returns. In practical terms, it is my belief that Maker should act as a super-senior, programmatic, lender of the highest quality collateral (i.e. PD 1Y < 1%) in passive partnership with sophisticated and motivated intermediaries. It is also my conviction that with a clear vision of what Maker wants to do, such appetite will be self-fulfilling as it happens in the modern central banking world.

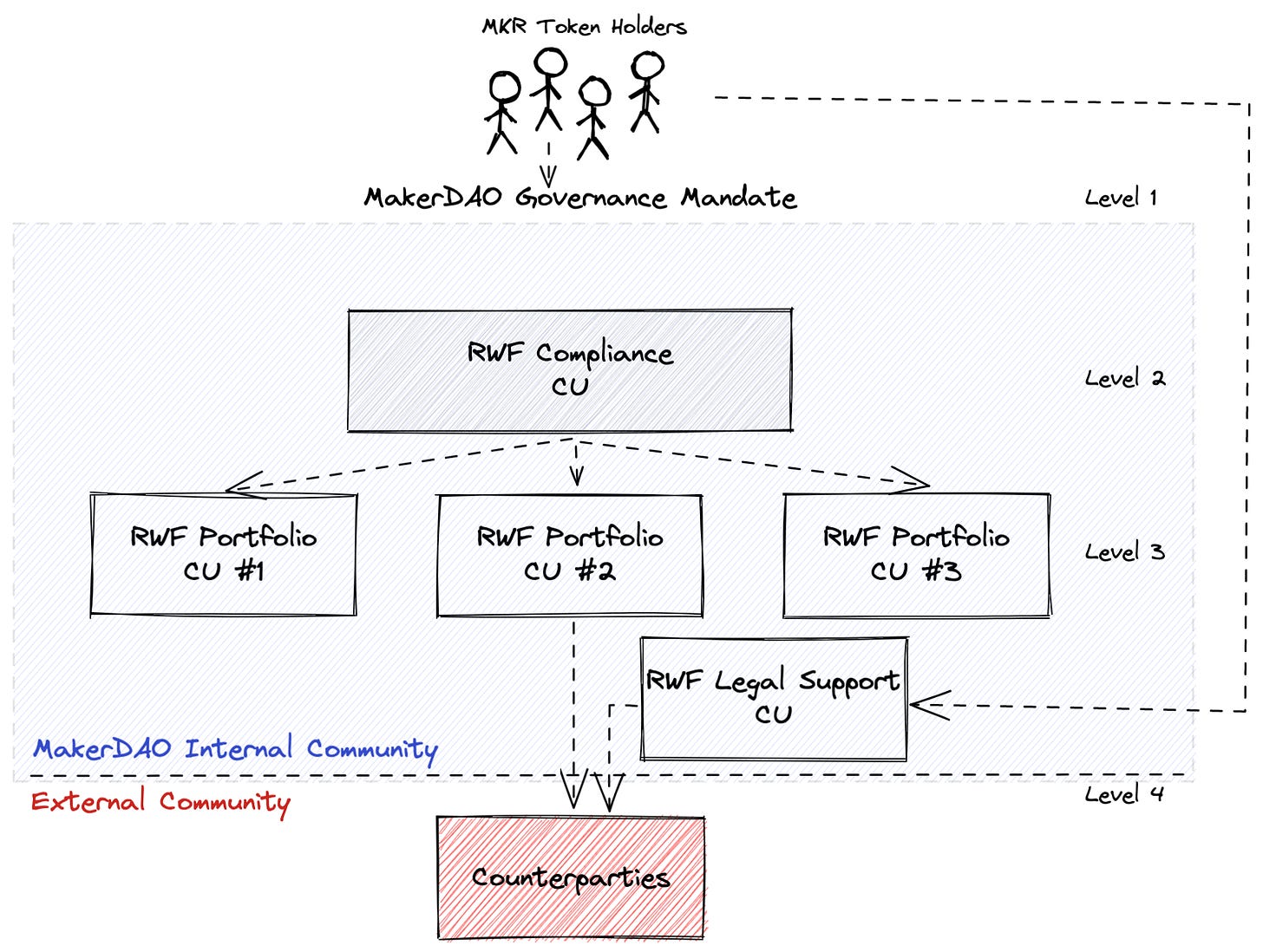

A multi-tiered organisational set-up → Maker, however, is not a stiff and politicised institution, it is a DAO. DAOs are complex animals where decision making flows in a less structured way. It takes a while to get used to it. Developing an internal process that would be apt at elevating Maker’s role as supreme lender will be a challenging task. For this reason, we thought about a multi-tiered set-up, made of more than one layer of control and without a single point of failure:

MKR token holders: retain all executive power for what can or cannot be financed via DAI minting

Compliance unit: codifies and updates core principles, and controls the controllers (i.e. the portfolio units)

Porfolio units: deal directly with the counterparties, trying to negotiate the best possible credit package for MKR token holders to vote on

Legal support unit: acts as an internal legal counsel for the DAO, engaging external advisors and reviewing documentation

Maker community: continuously challenges and provides input

A future of decentralised onboarding → It is not impossible for some or most of those analysis functions to be decentralised to parties that are external to the DAO. Such external underwriters might stake MKR tokens as on-chain guarantee, or first loss capital, in support of their official endorsement of a credit application. Although the decision-making power will remain in the hands of MKR holders, the consultative underwriting process could also be pushed outside.

The Real-World Finance Manifesto → The credit process described above will have to remain solid while not becoming heavy or cumbersome. Such a framework should attract higher and higher quality intermediaries that are ready to go through the approval processes in order to intermediate significant flows, while remaining flexible and not too punitive in terms of requirements, rigidity, and waiting times. All the core principles described above should be clearly defined and maintained in a Manifesto that should be voted on-chain. Such Manifesto, however, rather than being a comprehensive civil code, should aim at acting as the constitutional manifesto of a common law legal system. As in every common law system it will be the judicial precedents, in this case the applications approved or rejected, that will act as Maker’s ever-evolving code of conduct.

Maker Is the Most Powerful Ramp for Institutions Willing to Enter DeFi

Many might think that spending a lot of time in developing a mental model of how the bridge between TradFi and DeFi could work is a waste, especially when real-world assets represent such a small portion of Maker’s total exposure. I disagree. Strongly.

First of all, I dislike the real-world definition as several, more complex, financing use cases should be approached with the similar level of scrutiny even when those exist natively on-chain. More structured use cases, coming from inside or outside the blockchain infrastructure, might significantly reduce the correlation problem that affects Maker and other crypto lenders and limit their scalability.

Secondly, I believe that a strong mental model could act as a powerful roadmap to translate some of the frameworks that exist in the world of legal contracts straight into that of smart contracts. It could save us a lot of time, and credit losses, down the line.

Thirdly, and most importantly, I think there is much more to the TradFi bridge than lending itself. Through an appropriate onboarding program, Maker could become the most powerful ramp into DeFi for traditional institutional players. The need to transport physical billions of liquidity is a non-starter in today’s set-up. It is also unnecessary. An institution owning eligible collateral in the real-world could post this collateral safely (without moving it) and receive financing in DAI form directly on-chain. For a bank, that manages liquidity from multiple sources, such funding would not have to be necessarily transferred back but could actually remain within DeFi. A pledgeable collateral pool, in other words, could be transformed into a quasi-unlimited and slippage-free source of liquidity for institutional investors that want to access DeFi with several billions of capital. Outside of Maker, there is nobody in the space that has the ability to do that.

Here Comes Your Peg

To me, a blockchain resembles more a sovereign nation than a tech platform. Thanks to its ability to merge the fungibility of information with the ineluctability of law enforcement, a big portion of the social contract underpinning modern nations could be replicated into blockchain tech. Ethereum or Terra might not become the crypto version of the US, but could definitely be that of Singapore or London, i.e. trusted centres where to exchange financial value safely. The race will be to transform into a relevant and diversified nation fast enough to outpace the need to get rid of the USD peg. Onboarding real-world assets could turbocharge this process. By onboarding international businesses with multiple sources and uses of capital, operating in several jurisdictions, the DAI could become the true international money of commerce, and a reference value for the globalised industry. It is dreaming big, I know, but history has taught us that often big might not be big enough.

Innovating is a communal effort. If you have great ideas you want to explore together or projects that should be on Dirt Roads radar, please feel free to reply to this message or contact me on Twitter.