# 25 | Angle Money: Berkshire-as-a-Service

The Vol-mart Is Awesome, as Long as Treasury Doesn't Blow Everything Up

This is another issue of Dirt Roads. The time we are sharing is precious to me.

I know, I am obsessed about currencies in the same way other males salivate at the thought of a Ferrari 430 Scuderia, but it’s not my fault that crypto keeps throwing new currencies at me like a fake friend would gift cocaine into a celeb’s nostrils during Tulum rendez-vous. I am a currency junkie hitting back-to-back rave parties between Bretton Woods and Terra Money, I admit it. So, when Angle came to the scene, I couldn’t resist.

The fact is that currencies are just such an awesome product. They bundle so many crucial functionalities (accounting, exchanging, reserving and, I might add, allocating) into a seamless experience that has resisted and improved over the centuries. I might push myself to say that the invention of currencies has been the highest philosophical achievement of the human being on the other side of set theory.

Although bundling has been a phenomenal marketing strategy, in principle all those awesome functionalities do not necessarily need to co-exist within a single brick, as long as the experience remains smooth. We already live in a multi-currency world, but one where currencies tend to live one next to, rather than on top of, each other. Using a crypto comparison, modern currencies are hard forks of a similar concept deployed into incompatible sovereign currencies bridged by the FX market.

That might change.

Angle: Cheap Volatility Supermarket

The battlefield for the next best stablecoin is a crowded and bloody one and that’s probably why Angle, a part-collateralised-part-algorithmic-Euro-pegged stablecoin, opted to start its whitepaper on the offence. Angle states that existing stablecoins are bad, because:

The largest ones, $USDT and $USDC, are shacky or at best centralised

Decentralised ones like $DAI are capital inefficient and difficult to access for everyday users

Under-collateralised and algorithmic stables like Basis Cash or Titan have been exposed to bank-run situations

There isn’t among those a good Euro-pegged alternative

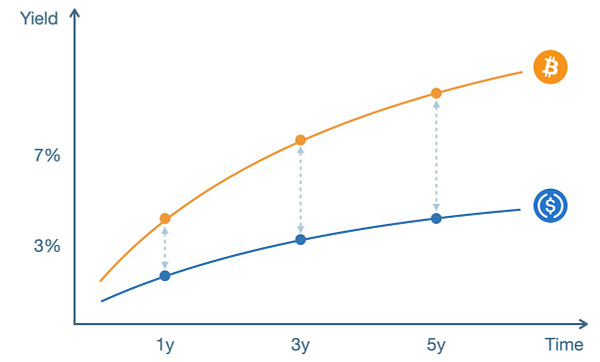

The CTA is functional to onboard users. The reason is that currency users are one of the best sources of capital out there: they have a lot of purchasing power to park, hopefully in perpetuity, and demand in exchange a zero or negative return since they are ready to pay some fees for the pleasure of parking value in a convenient form. Buffett’s most devoted scholars know that although the stock picking stories sell books, his and Munger’s most impactful intuition has been that of understanding the power of insurance as a long-dated and negatively priced source of capital to invest into good companies. Grandness lives not in squeezing 20 bps of alpha to repay hungry LPs looking for 10% post fees, but in squashing the cost of capital below zero and completely forgetting about investors’ expectations. Today the smartest DeFi stables are aiming at replicating the same model in fungible, decentralised, disposable, available, form. In a way, they are wrapping an insurance contract with Dollar (or in this case Euro) denominated banknotes and merging it with money market investment dynamics.

Angle: a Decentralised Money Market Fund

In its simple form, Angle is a decentralised money market fund. Or better, a new version of decentralised money market fund.

Mint new $agEUR → Users send to Angle whitelisted collaterals (e.g. $ETH or $USDC) and receive in exchange an amount of newly minted $agEUR based on oracle pricing (Uniswap V3 Time Weighted Average Price). With no slippage but subject to a transaction fee. Differently to what happens for stables like $DAI, it is now the protocol that owns the underlying collateral (and connected volatility) and not the user.

Burn existing $agEUR → Users send back to Angle $agEUR and receive chosen whitelisted collateral in return, without slippage, based on oracle pricing and subject to a transaction fee. Received $agEUR are then burnt.

Ensure $agEUR-$EUR peg → Given the protocol’s hard commitment to mint or repurchase $agEUR at oracle Euro pricing, when $agEUR moves outside of a band with the Euro (band influenced by the protocol fee) arbitrageurs are incentivised to close the gap.

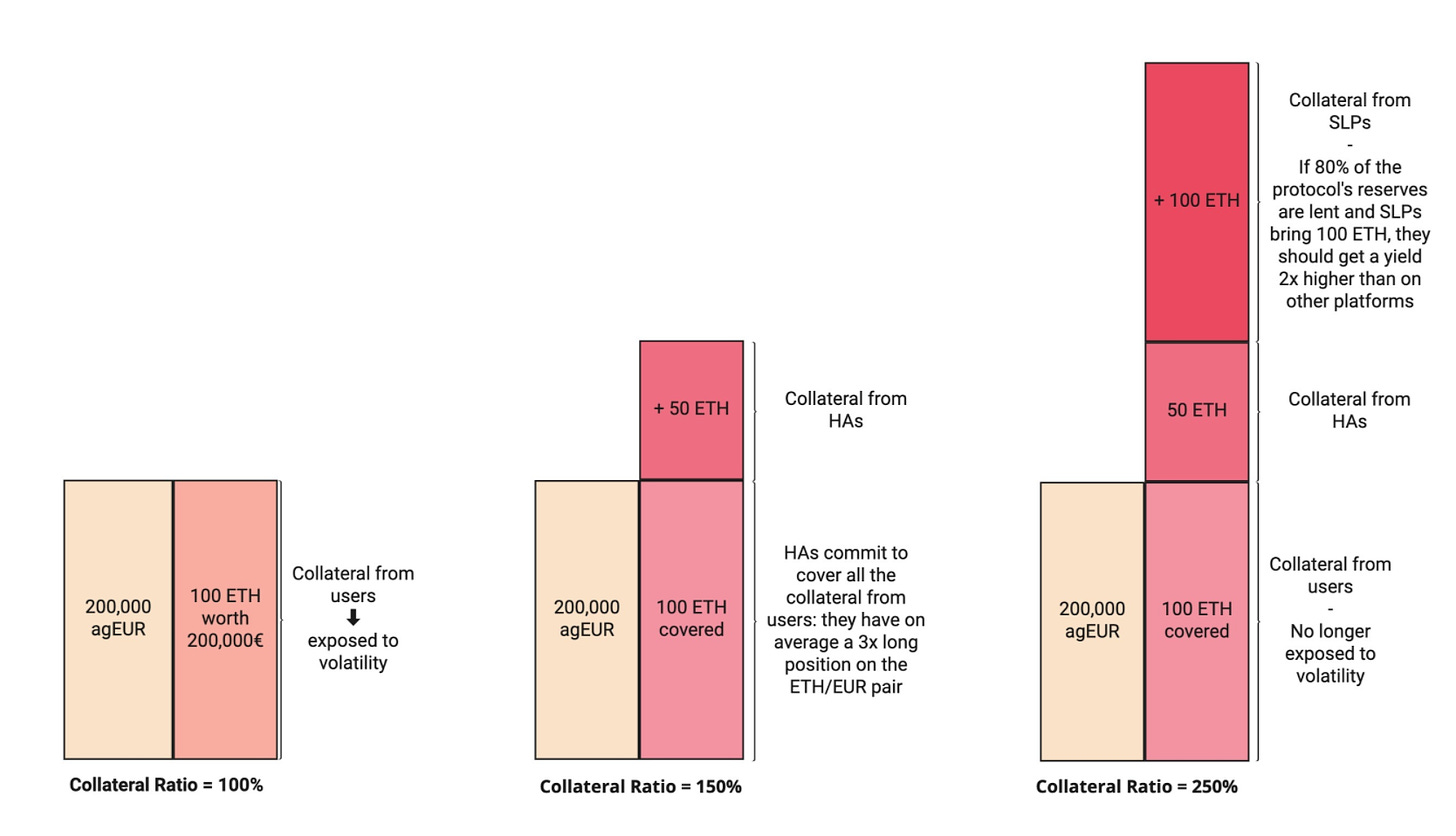

In the simple case of 1:1 / $agEUR:collateral minting, however, the stablecoin would be exposed to all collateral dowside risk. Let’s assume that the Euro price for $ETH is 1,000 and that there are no Angle fees. A user deposits 1 $ETH and gets 1,000 $agEUR. If the price of $ETH goes to, let’s say, Euro 2,000, the user will bring back 1,000 $agEUR when he wants and receive 0.5 $ETH in exchange - with treasury retaining 0.5 $ETH. But what would happen if the price of $ETH goes to Euro 500? Angle would be exposed to the most obvious of bank runs because there’s not enough money to redeem all $agEUR in circulation. Angle is bust.

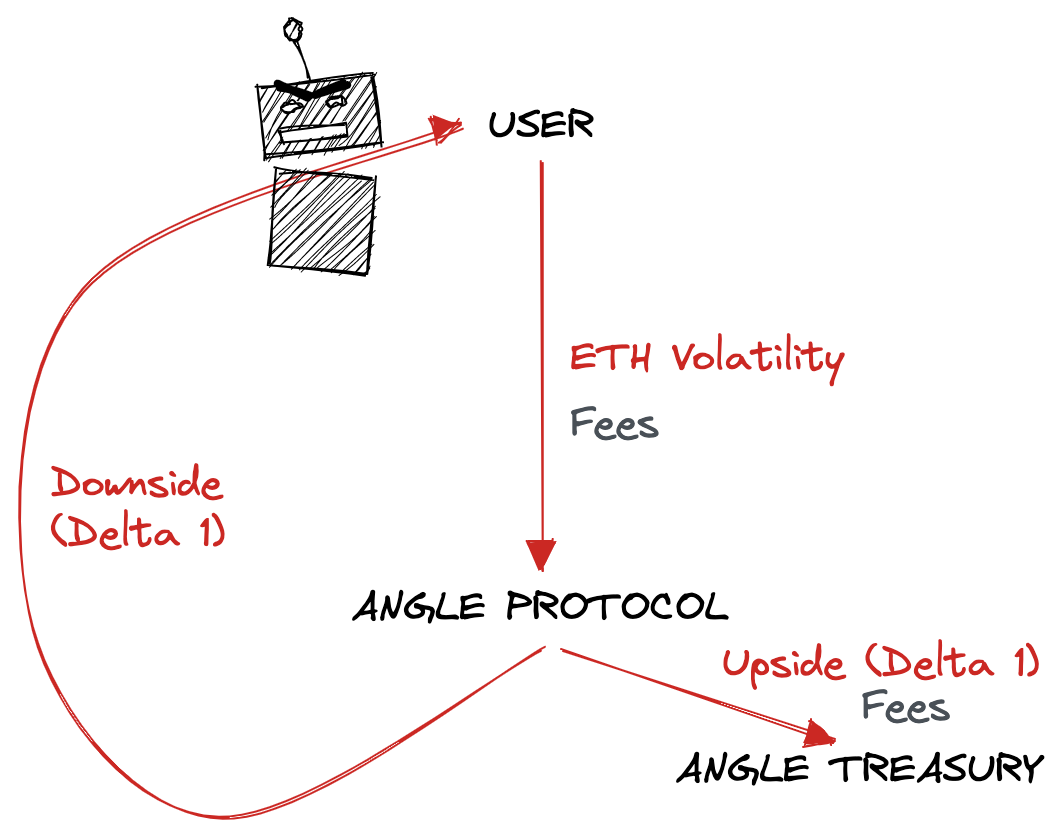

Angle: an Internalised Futures Market

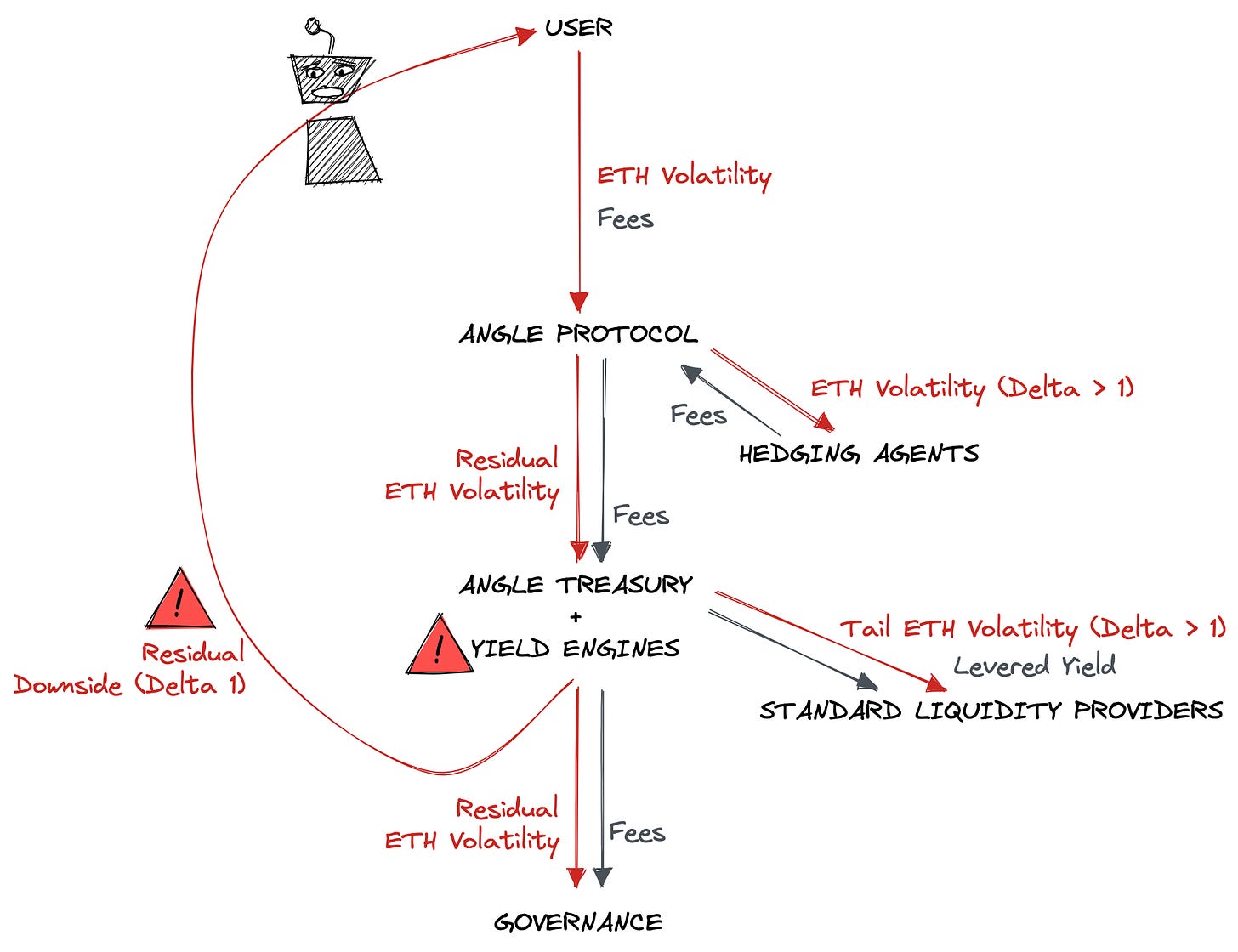

By purchasing whitelisted collateral at the time of minting with a promise of seamless $agEUR redemption, Angle is long collateral volatility. Users that instead sell whitelisted collateral in exchange for $agEUR are on the other side of the trade. The direction of that volatility, however, is important. In the framework we described before, the benefits of collateral appreciation would be entirely enjoyed by the protocol - and the user wouldn’t care about it because that was part of the deal; Angle is long collateral price. Although the impact of collateral depreciation instead would be entirely dumped on the users, the bank run that would follow would be destructive also for the protocol itself. Effective and perceived currency trustability is existential for a currency, hence Angle must short some or all of such token volatility. The decision on the net exposure to retain is a design decision.

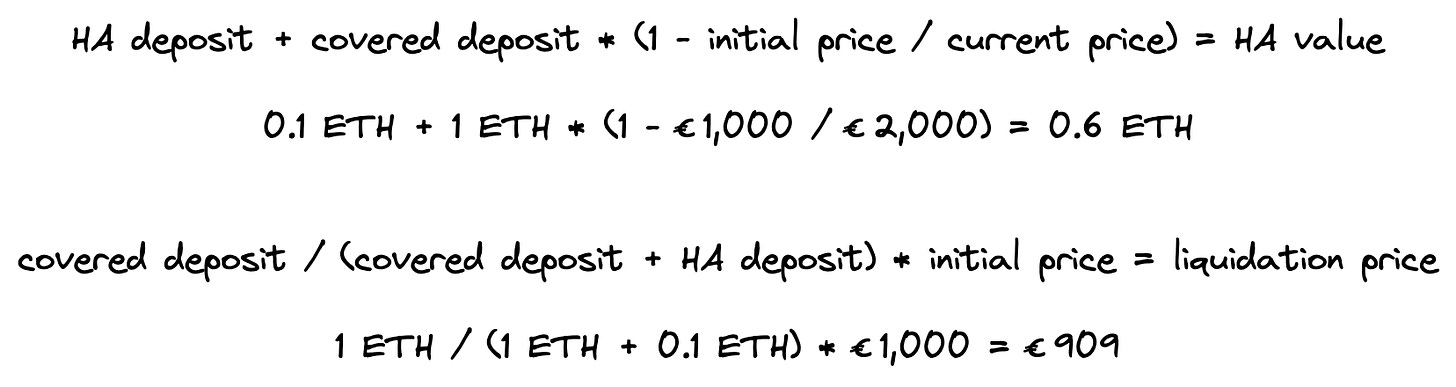

Enter Hedging Agents (HAs) → HAs provide additional cushion to the protocol. Let’s go back to the example where a user deposits 1 $ETH and gets 1,000 $agEUR in exchange. A HA comes to the protocol and deposits 0.1 $ETH and chooses to cover the full 1 $ETH deposit existing. In the case $ETH would go to Euro 2,000, the HA will get back its full 0.1 $ETH plus 50% of the 1 $ETH deposited. HAs would however be liquidated if the price of the collateral would fall below a break even point.

HAs are purchasing part of Angle’s volatility, benefiting from the chosen leverage. In other words, HAs are levered long collateral price. HAs have to pay fees in order to access the benefits of leverage. Such fee will depend on the deposit amount that has already been covered by other HAs - the more is already covered, the more expensive it gets to become a HA and the less expensive it is to exit a position. Those positions are coded as tradable NFTs.

Enter Standard Liquidity Providers (SLPs) → SLPs are the tail risk insurers of the protocol. In classical form, they deposit liquidity in the protocol in exchange for a portion of the protocol fees. The risk they swallow in exchange is that of incurring slippage if they want to cash out while the protocol is not well collateralised. In addition, Angle intends to have an active investment strategy of their reserves - more on this later, and SLPs will benefit from a portion of such yield as well. SLPs are levered (protocol fees and) yield farming.

The Bear Market Test

The volatility supermarket is open 24 hours a day, every day of the year, but keeping the machine well fed, as usual, is expensive. Users do not ask much, it’s true, since in the current crypto markets there is plenty of volatility and buying it is cheap business. Selling it, however, it’s a different story, and it gets more expensive the further we go along the (thick) tail. In addition, we are humans, and although we have all heard about returns log-normality and martingale movements, we can rest assured there will be more buying interest for volatility in bull rather than bear markets. As usual, in credit - because that’s credit that we are talking about, you can’t be sure liquidity will be there when you’ll need it.

That’s why you can’t do it without at least a bit of over-collateralisation. A good buffer makes the lazy comfy and allows the brave to make some money through cheap leverage. In a bull market (while there is a lot of buying interest for directional volatility and volatility in general) it’s all good, but how would the incentives for HAs and SLPs behave in a bear market? We can try to dissect.

Leverage available to SLPs is a bliss → SLPs are de facto Angle’s first line of defence. Their return depends on (1) underlying yield generation, and (2) protocol leverage. In a bear market we don’t know how (1) would behave but we know that (2) would compress because the whole stack will be worth less than before. SLPs however have the luxury of staying put and wait for the storm to pass, un-termed leverage is a luxurious leverage to have, and that is the reason for them to get in the game in the first place. In geek finance terminology, they are writing a super long-dated European put option to the users.

HAs have little incentive to stay in when it matters → It is unclear what type of incentive HAs would have to stay engaged in moments of trouble - apart from fee slippage. They have directional, levered, exposure on the underlying price movement, with the omnipresent threat of liquidation. If we assume that HAs abandon completely the protocol, SLPs would remain fully exposed to the downside. That’s why we call them first line of defence.

Users’ behaviour will depend on competition among stables → What users would do is more difficult to predict. On the one hand, stables would be in higher demand during a bear market reducing burn pressure on $agEUR. On the other, knowing the protocol mechanics users might get nervous and go and get their collateral back to park it in other over-collateralised stables. During the early days of the protocol, such uncertainty will be even more important given that trust is an asset that requires a long time to be acquired.

Treasury risk is real → Based on the whitepaper, Angle is not remaining agnostic in managing its liquidity. Treasury liquidity can (and will) be deployed through smart contract yield strategies provided by platforms like Yearn or Convex. Treasury and SLPs want it - that is the Berkshire play indeed. We could get to the point that Angle invests its treasury through Yearn and Yearn offer the Angle-augmented version of its strategies directly on its platform for others. Yield strategies, however, especially when levered, do not come without risk, and users should monitor Angle’s risk appetite when picking its horses. Thankfully this is possible in the world of smart contracts, and hopefully it will happen in reality. @FabiusMercurius Twitter thread on the sustainability of yield farming is a little piece of art.

Lessons from Angle

To me, Angle’s lesson has been the attempt to use a well-trodded product wrapper and do something way more powerful with it. This is financial acumen at its best, and something that reminds of the intuitions of the Buffett-Munger golden days. The difficult part, obviously, resides in well executing on the idea, and in having some luck.

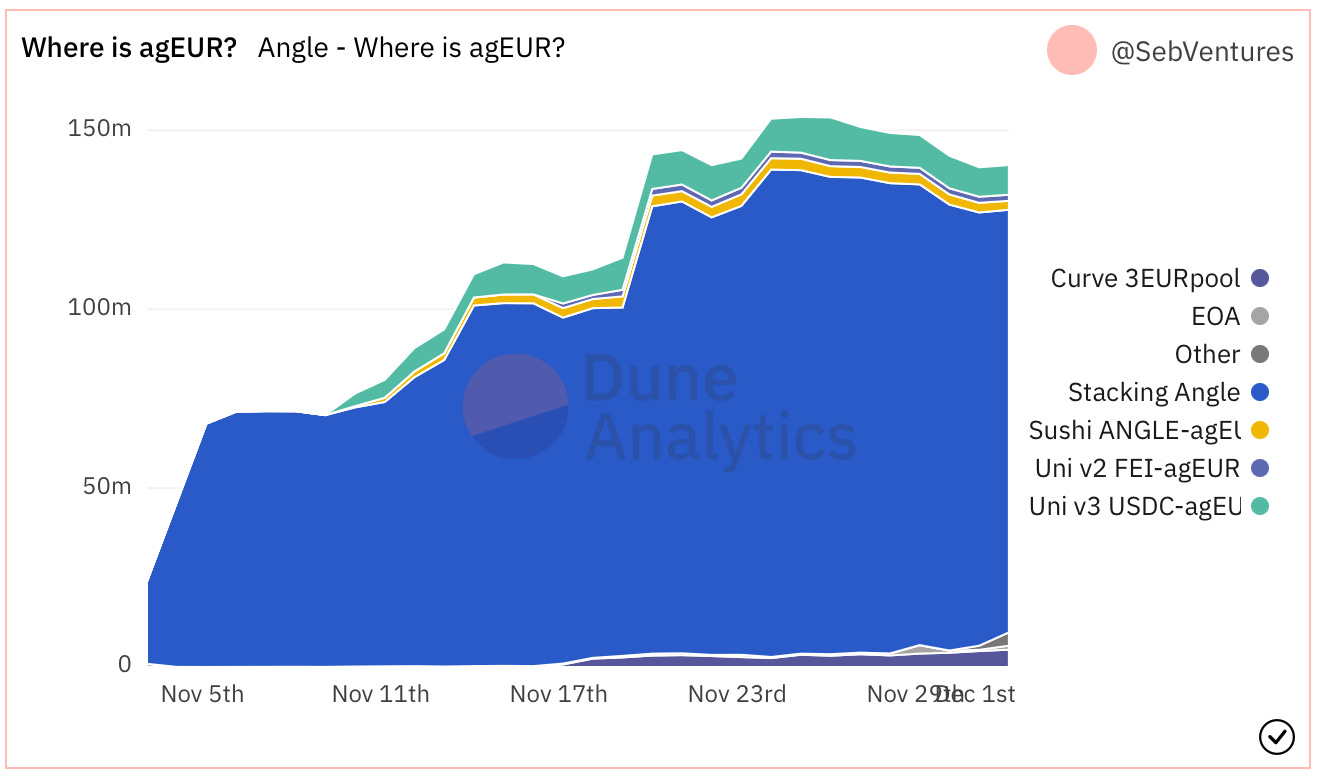

On the 3rd of November Angle launched on Ethereum’s Mainnet. As of December 1st it had reached USD 220m of TVL (40% over-collateralised) across 4 pools: $DAI, $FEI, $FRAX, and $USDC. The focus on wrapping stables has lowered the volatility distribution problem - compared to whitelisting platform tokens like $ETH, but the fact that we do not observe volatility in stables doesn’t mean there isn’t any. It was Angle on the first place that told us that other existing stablecoins are bad! The protocol generated c. USD 1m of fees for itself, USD 320k for its SLPs, and breadcrumbs for the keepers - that do some risk-free execution that cannot be automated in a smart contract. At the same time, treasury deployment strategies have generated USD 230k for SLPs and USD 155k for the protocol. $ANGLE, the protocol’s governance token, points at USD 140m of market cap. I am abstaining from saying whether I think it’s a good valuation or not. That’s beyond the scope of the article.

Angle has been very active in incentivising new users, and rightly so given the massive externality effects of a currency product - ask the USD. On the 17th of November they started a bonding program with Olympus Pro tech - more on Olympus here, for promoting $ANGLE-$agEUR liquidity on Sushi. Such move has the double effect of deploying Angle Euros in the system, and sustaining the valuation of the governance token. As for all currency providers, it’s the liabilities (i.e. the currency) that are the product. On the 22nd, they allowed $agEUR and $ANGLE to be bridged to Polygon. On the 25th, they announced a partnership with Superfluid to use $agEUR as a programmable cash flow asset. We are huge fans of Superfluid here on DR and wrote extensively about Francesco’s project here and there, but particularly here. This week, Angle started also its more traditional liquidity mining program.

That’s a lot of initiatives, with dilution effects for $ANGLE owners, but with the potential long-term benefit of expanding the $agEUR footprint to become a relevant, and broadly-used, source of cheap leverage for institutional yield farmers in the space. The long-term benefits (in terms of fees and interest generated) might outpace the costs. Most of $agEUR are currently staked as part of the liquidity programs, it is early to tell whether those will be successful in stimulating wider use.

As a potential user of stable Euro / user of cheap leverage / contributor to stablecoins design, I will keep watch. I guess, however, I will stay on the fence and wait for a few proofs of concept.

(1) Proof of adoption → The liquidity mining / farming storm will pass, and $agEUR will conquer the right to consider itself among the useful currencies if the owning wallets and contracts will be way more widespread than today.

(2) Proof of sustainability → We will need to wait for a few big shocks and a prolonged bear market to see whether the algorithmic side of the currency design can resist the shock. Although different, and potentially accretive, among each other, stablecoins compete among themselves and with the father of them all (the USD) to remain the safe harbour for liquidity parking in moments of crisis. Angle will need to pass the test.

(3) Proof of uniqueness → Angle multi-tiered capital optimisation strategy, with users + HAs + SLPs is smart, but replicable. Designs like the DAI could incorporate portions of it to make the currency more capital efficient and attract other users. That would provide an additional challenge for Angle.

Buffett and Munger openly criticised and despised cryptocurrencies, getting to the point of defining them “contrary to the interests of civilisation”. I had thought such harshness was due to lack of deep understanding, but I now wonder whether they hadn’t spotted a new formidable competitor playing a revised version of their own old game. Only a Sith deals in absolutes.

Innovating is a communal effort. If you have great ideas you want to explore together or projects that should be on Dirt Roads radar, please feel free to reply to this message or contact me on Twitter.