# 26 | Fei <> Rari: This Is Not an Exit, or Is It?

Confessions of a Retired Banker, or My Take on The Biggest DeFi Merger So Far

When I was 18 I thought investment bankers spent their long nights holding 5 kg mobile phones while debating aggressive corporate raids overlooking empty New York City streets. At 25, such image was updated into one of entitled hedonism and obsessive compulsion for the most useless details. I must confess that, as I guess it happens for many immature and insecure young people around the world, that dark image of pampered power attracted me.

I hit the M&A floor of a Wall Street bank armed of the Borsalino hat and double-breasted blazer I believed indispensable for the job, and it took me a full week to realise the uselessness of such tools. Although there is a bit of truth in every horror or fairy tale, the mix and match of fidelity and bullshit that constituted my investment banking experience was ironic at best. The streets were indeed empty but overlooking Canary Wharf suburbia rather than the Upper East Side, and the 2 AM phone calls most often involved utterly useless conversations about the colour of a pie chart or the orientation of an appendix index. I have had a lot of painful experiences in my life but nothing at my eyes beats the dullness of a junior banking career.

Nevertheless, I like to think that there is always something positive coming out of pretty much anything, and from my years of monkey business I emerged with a tight group of long-lasting friendships, an unbeatable level of skepticism and cynicism for anything related to business combinations, and an obsession for detail that the new generation of Twitter personalities might struggle to appreciate. So, when Joey and Jai dropped on social media the idea of merging two of the biggest protocols in DeFi, Fei and Rari, it felt like the perfect occasion for a revenge of the nerd in me.

What about this merger then? In every transaction, including marriage, nothing shouts as clearly and powerfully as the official documentation. And what do the documents of the Fei + Rari merger tell us? I am sure there is a lot to talk about, but I will try to give the debate a gentle nudge.

Mergers: Motivations, Reactions, and Side Effects

There is a lot to talk about when assessing the (still not approved) merger proposal between the Fei Protocol and Rari Capital, and this issue of DR will surely not be able to cover every aspect of it. In debating my points I will try to remain as unbiased as possible, while at the same time cover what I believe are the most important aspects of the transaction. We will proceed systematically:

Fei Money: a Currency Protocol

Rari Capital: Interests-as-a-Service

The Merger Proposal

The Effects of the Merger

Market Reactions

Conclusions

1. Fei Money: a Currency Protocol

The Fei Protocol has the ambition of installing $FEI as The Stablecoin of DeFi. $FEI is a USD-pegged stablecoin that is backed by protocol-controlled collateral. Differently from what happens with $DAI, it is the Fei Protocol that controls the treasury, is exposed to its volatility, and benefits from its yield. This article doesn’t want to be a deep-dive on Fei, but a good review of the rationale of the Fei + Rari merger must start from an understanding of what the protocols actually do.

Bonding → The Fei Protocol mints $FEI in exchange for whitelisted assets - for now mainly $ETH, at an oracle-determined exchange rate, in accordance to a pre-set bonding curve. Fei bonding curves are buy-only, meaning that those who want to receive $FEI can do it by feeding the asset to the bonding curve and receiving $FEI in exchange, while in order to get the asset back they should use a liquidity pool to swap their $FEI. A Burner role is used, separately, to deal with deflation and disincentives. The shape of the bonding curve incentivises $FEI to sit pegged to the $USD - plus a buffer.

As a reminder, a bonding curve is a function that connects the current token supply with the price to pay for the marginal token. In the example below, where the relationship between supply and marginal price is a linear one, it is easy to see how Buyer 1 pays a total price for the 5 tokens purchased equal to an area of 30, whether Buyer 2 pays a total price equal to an area of 80. Bonding curves can work, theoretically, in both directions, i.e. to buy/ mint a token and to sell/ burn it. Curves come in many different shapes, depending on the price behavior that the engineers want to incentivise. Sigmoid-shaped curves, for example, want to further incentivise early adopters while disincentivising supply beyond a certain optimal value.

Use of funds → As a consequence, circulating $FEI is collateralised by Protocol Controlled Value - or PCV, currently for c. USD 1.2b. In order to deal with the volatility of the whitelisted collaterals the protocol over-collateralises circulating $FEI - currently with a 3x collateralisation factor. Such over-collateralisation is way superior to that of stablecoins like Angle - here, that instead apply a volatility redistribution mechanism that reduces the need for the collateral. The Fei Protocol deploys the assets within the PCV to generate yield while managing liquidity for $FEI owners.

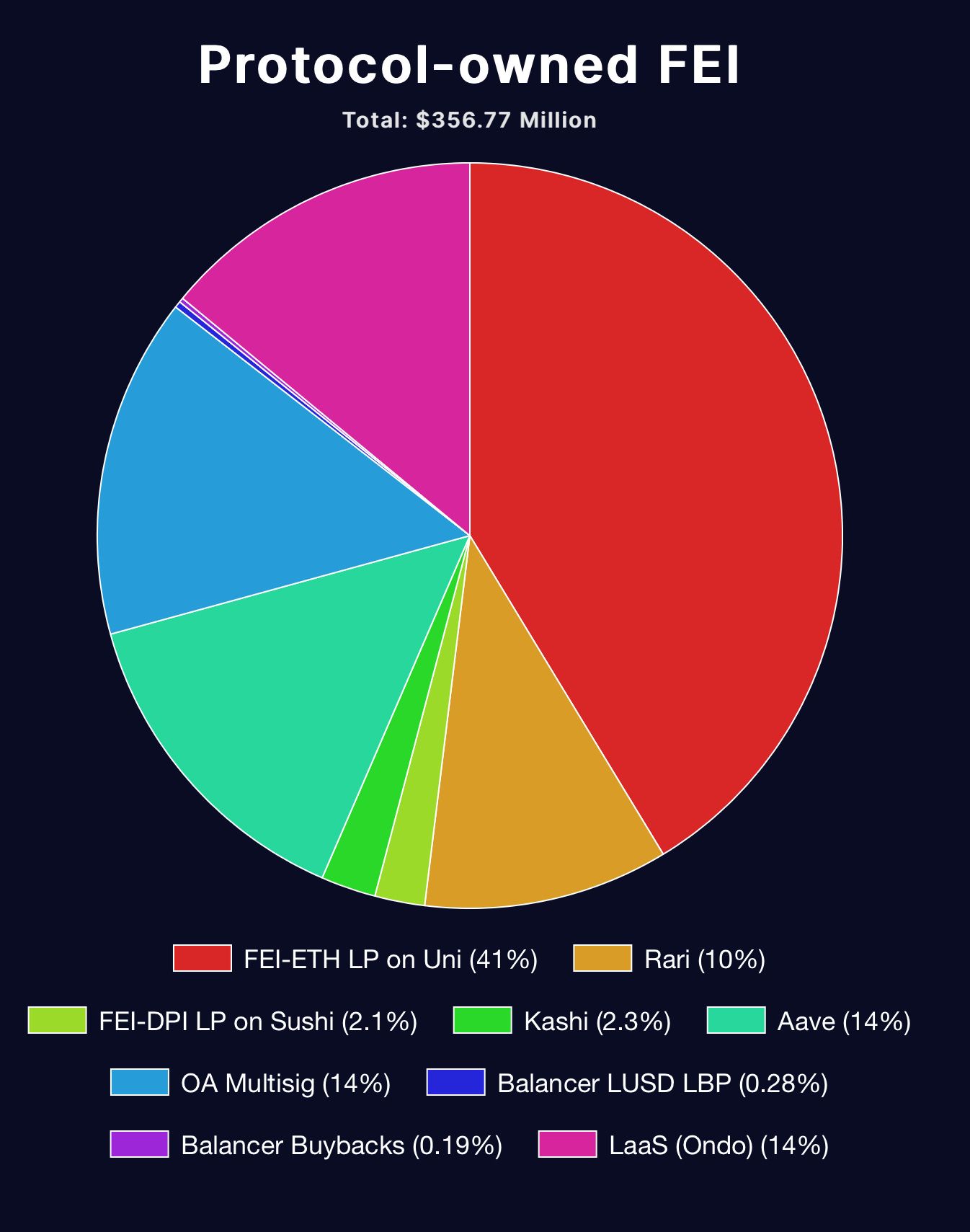

There are c. $FEI / USD 390m in circulation, with a similar amount controlled by the protocol. As we can see from the picture above, the protcol deposits a big portion of ETH on DeFi money market such as Aave and Compound - 50%, with a good portion providing liquidity on Uniswap - 12%, and a bit staked on Lido and Liquity - 9%.

On the flip side, 40% of the controlled $FEI is used to provide liquidity to the Uniswap pool. As for all stablecoins focused on the interoperability of their coin, also Fei provides significant staking incentives in the form of $TRIBE (their governance token) for providing liquidity on Curve, Aave. And Rari.

The Fei DAO was the first DAO to control a Fuse pool on Rari Capital.

2. Rari Capital: Interests-as-a-Service

Fuse pools are the most relevant solution currently provided on the Rari Capital platform. The pools allow anyone to instantly create a tailored (and isolated) lending and borrowing pool. It is, in other words, an open interest protocol, or white-labelled Compound or Aave. The creators of a pool can tailor several parameters through the interface, including: custom assets, oracles, platform fees, admin fees, liquidation incentives, whitelisted addresses, collateral and reserve factors, etc.

The (DAO administered) FeiRari pool, for example, has the following characteristics:

Assets accepted: $TRIBE, $FEI, $DAI, $ETH

Platform fee: 6%

Liquidation incentive: 8%

Total assets supplied: USD 175.5m

Utilisation rate: 11.6%

Collateral and reserve factors: asset-specific

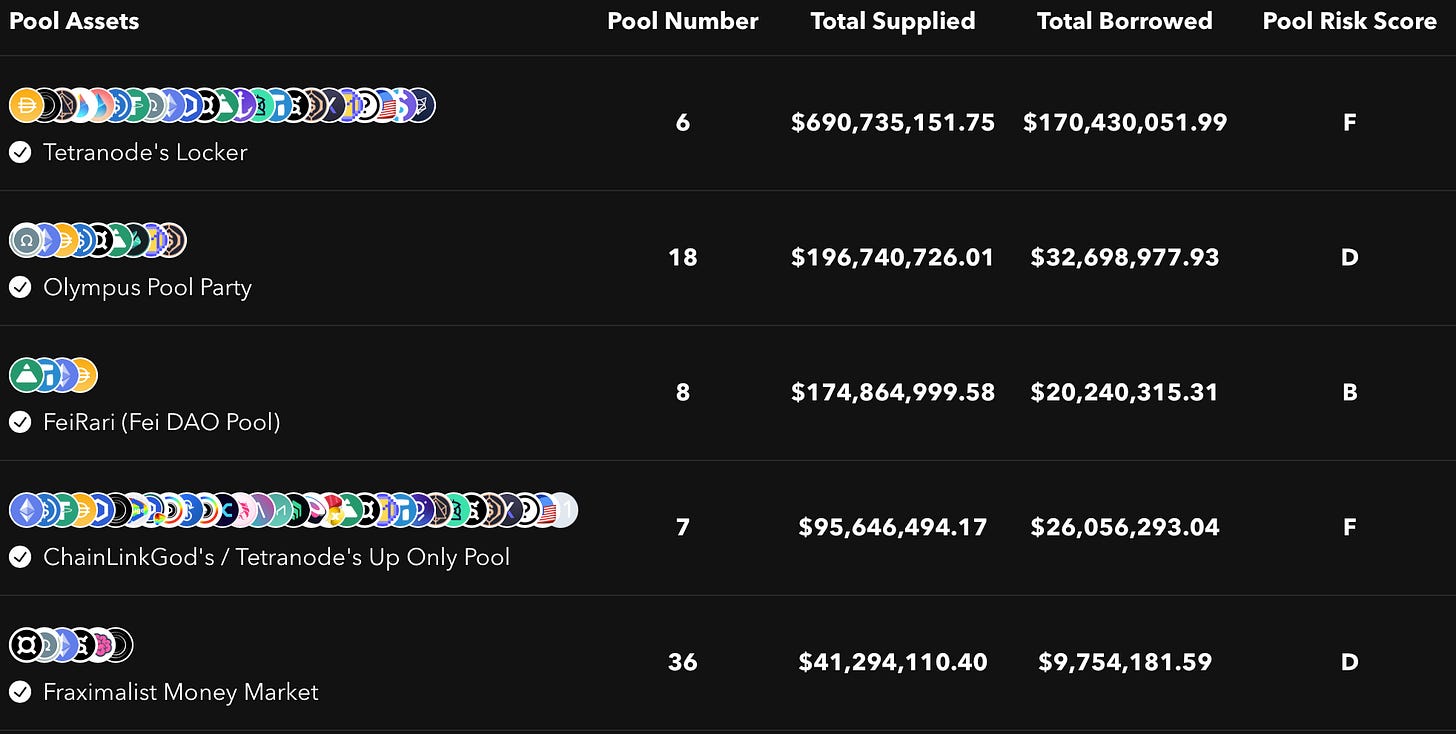

There are currently USD 1.35b supplied through all Fuse pools, with an overall utilisation rate of 20.4%. Below are the five largest Fuse pools currently verified. It is interesting to see that $sOHM (staked $OHM) owners are using Rari to get liquidity and yield on their staked tokens - wasn’t Olympus supposed to aggregate whitelisted assets to do that internally on the first place? The overlapping nature of DeFi’s composability still confuses me.

In addition to Fuse pools, Rari has developed products that abstract out a lot of the details for the casual user who wants to use Rari to generate but doesn’t want to do the homework. Earn is an algorithmic yield aggregator that searches for the highest yield through a collection of whitelisted DeFi protocols such as Compound, dYdX, KeeperDAO, mStable, yEarn, Aave, and Fuse. Users can deposit into a $USDC, a $DAI, and a $ETH pool, and Rari captures a nice 12.5-17.5% fee on profits that is almost as good as the old 2/20. Rari is doing few other things beyond setting up liquidity or yield aggregation strategies, like for example integrating with Saffron Finance for fixed/ risk-mitigated yields through tranching. They have the ambition of becoming a yield supermarket.

3. The Merger Proposal

On the 16th of November, the founders/ leaders of the Tribe and Rari DAOs cross-posted (here and here) on the respective forums a proposed integration of the two governance protocols. The transfer of Rari’s administrative capabilities to Tribe would happen through a governance token swap, with $TRIBE assuming control of all governance rights and of Rari’s treasury assets - and liabilities.

Token swap → $RGT (Rari’s governance token) will facilitate an exchange into $TRIBE (Fei’s governance token) at a swap rate written into a PegExchanger smart contract following a successful vote, and within a specific window of approximately 1 year. The exchange rate defined in the financial disclosure section has been defined at c. 26.7057 $TRIBE to 1 $RGT, using a mechanism called locked box in M&A. In other words, a snapshot of the balance sheet of both protocols has been taken at a specified Snapshot Block - # 1362333378 on the Ethereum blockchain, that occurred at 12 am +UTC on November 16, 2021. As a consequence, both Tribe and Rari committed not to engage in any extraordinary action as detailed in a, customary although slim, reserved matter schedule. The swap rate would have valued, at the Snapshot Block, Tribe and Rari respectively at (circulating) c. USD 535m and c. USD 300m.

Quit → A TribeRagequit smart contract will allow $TRIBE owners at the Snapshot Block to opt out and receive newly-minted $FEI payout in exchange, for 3 days following acceptance of the merger proposal by both communities. $TRIBE tokens will be available for redemption at a one-hour-low-water-mark intrinsic valuation, calculated based on an oracle price for the Protocol Controlled Value backing $TRIBE in the time window ahead of the redemption trigger.

Hack refund → $FEI will be used to pay back the victims of a Rari hack that has previously occurred - this would be paid in $FEI at the $ETH price from the time of the hack. Rari Capital had committed to the repayment of these tokens for a total value of c. USD 11.7m $DAI.

Assuming a successful merger, and assuming full take-up, current $TRIBE owners would own c. 70% of the combined entity. Obviously the assumption of full take-up is a big one.

4. The Effects of the Merger

Shipping sinergies → Fei and Rari founders, Joey Santoro and Jai Bhavnani, discussed the motivations that drove them to propose the merger in a great interview. I can give you the summary: joining the communities under a single coordination mechanism could massively improve throughput (shipping rate) thanks to positive network effects. I have had enough M&A experience to shiver at the sound of synergies, but I will give this specific merger proposal the benefit of the doubt: governance tokens can be a great coordination mechanism, and consolidating two communities under a single governance tool might truly have significant benefits for shipping solutions. Interestingly, however, Jai points at maintaining independence between the two communities as an important factor for the success of the merger.

I propose:

$1:$1 conversion of RGT to TRIBE, created from both the existing treasury and newly minted TRIBE

Fei creating proper contributor incentives as a mechanism to scale Fuse / yield aggregator

Fully pay back the Rari DAO’s debts from the ETH yield aggregator exploit (to REPT-b holders) in Fei (full compensation in Fei, at Dai price at hack time)

Keep independent communities (Fei, Rari) building together under a shared Tribe family

There is no free lunch out there, and a good investigative piece should try to stress-test what would be other indirect effects of the proposal.

Expand liquidity control → The Fei + Rari merger is what antitrust authorities call a vertical merger. The two protocols are not direct competitor but can be, and actually are, stacked one of top of each other. Integrating the two would mean integrating a chain with potentially an enhanced control over liquidity. I say potentially, because in the world of permissionless smart contracts an integration of governance might be completely redundant to achieve such control. Fei could just plug into Rari and use their solutions, as they are doing already. End users, however, are far from being rational, and given the myriad of entry points into DeFi, verticalising liquidity might actually have a survival benefit when it will stop being so abundant. We are all waiting for the Final Battle of the $OHM Forks.

Attract regulatory scrutiny → Mergers, however, tend to attract a lot of regulatory scrutiny, and especially when they happen in regulated industries. By merging with Fei, a stablecoin, Rari exposes itself to a lot more regulatory risk. We all know of the regulatory push towars constraining the innovation that is happening in alt-coins; such push might at some point reach crypto-native coins and if Fei succeeds in becoming The Stablecoin of DeFi it will definitely be at the centre of the storm.

A Brief History of Our Antitrust Policies

In the old world antitrust authorities tended not to dislike vertical mergers too much, because of the potentially positive impact they could have for consumer prices - thanks to enhanced efficiency. Based on the so-called Chicago School that gained ground in the 70s and 80s, antitrust authorities have tended to focus on price theory and consumer surplus when assessing the impact of mergers. Whether vertical mergers could be justified by a search for improved efficiency and therefore an ultimately positive effect on the prices paid by consumers, so-called horizontal mergers (i.e. mergers among competitors) tended to have mainly an effect on market power, and a negative impact on consumers. Antitrust hasn’t always thought about those topics in this way, and back in the days of Standard Oil authorities were applying an approach called market structuralism that focused instead on the characteristics of the market (i.e. how many players are there, how big, how dominant, etc.) when assessing the appropriateness of a company’s positioning. The reasoning was simple yet powerful: more control over the market might have negative long-term effect on competition that are difficult to model but that should in any case be avoided. Standard Oil was dissolved in 1911. Recently, however, the price-focused Chicago School has been challenged by vertically-integrated, ultra consumer-friendly, global companies that have expanded so rapidly to become globally dominant in the span of less than 20 years. Amazon, the titan of e-commerce, is the poster child of this phenomenon. While looked through the eyes of consumer price impact, Amazon is the most pro-competitive company there is. The long-term effects of a fully-integrated juggernaut, however, might be less rosy. If it was the superior operating leverage granted by Web2 tech to facilitate the rise of those powerhouses, the same reasoning should be applied to Web3 protocols that can be seamlessly launched and integrated. Although the short term effects on user’s friendliness might be positive, an expansive control of the liquidity might be catastrophic. If antitrust policies haven’t caught up with the internet era yet, I imagine how long it would take them to catch the decentralised revolution.

Provide liquidity for whales → The merger, as designed, would provide additional liquidity windows for $TRIBE and $RGT (large) holders:

The TribeRagequit contract would provide the ability to swap $TRIBE for $FEI at an intrinsic valuation calculated based on Protocol Controlled Value and token supply - I might be wrong, but the calculation based on the merger schedule is USD 1.73 per $TRIBE, significantly above current trading. $TRIBE trades below PCV simply because it is difficult to refer to PCV as protocol’s net asset value. Using a banking comparison, when trying to assess market sentiment over the quality of a bank’s balance sheet and its ability to grow, investors don’t look at price-to-net-asset but rather at price-to-book multiples that refer to the market value of equity vs. the fair value of such equity. If JP Morgan would trade at its total asset value its market capitalisation would be USD 3.4tn - rather than USD 475b

The TribeRagequit contract would provide the ability to dribble out $TRIBE (already existing) holdings into more liquid $FEI with no slippage, while increasing leverage of the Fei Protocol - being the $FEI used for repayment newly minted

The PegExchanger contract would give the ability to $RGT holders to swap tokens for freshly minted $TRIBE; $TRIBE average liquidity (daily USD 15m on centralised exchanges as of today) is much higher than $RGT (daily USD 7m), with the slippage point made above holding here too.

5. Market Reactions

Following a merger proposal the relative prices of the two securities tend to align to the proposed swap rate. The spread between the observed and the proposed ratio is a good indicator of the likelihood that the merger would happen, and at what relative valuation. There are hedge funds that day-in-day-out trade this spread through so-called merger arb strategies - in general, they believe they have better information and better reaction times than the market and want to profit from this belief.

Did the same happen in the crypto markets after the announcement? Not really. Since the 16th of November the price ratio has gone progressively down (meaning that $TRIBE has been appreciating over $RGT) and currently sits at c. 22 - i.e. below the 26.7 indicated in the locked box. What does this mean? I don’t know. The market could anticipate a break up of the merger idea - unlikely, or an appreciation of $TRIBE towards its intrinsic value given the exit window, the inability to short $TRIBE in order to clip the spread if the merge closes, or simply market inefficiency.

So far, the reaction of the communities has been mixed. It is difficult for DAOs to love each other given the amount of tribalism existing in crypto. The founders, however, have been vocally supportive, portraying with enthusiasm and, I believe, good faith a future of revamped innovation. Both communities are currently going through their governance mechanisms, and given the unprecedented nature of the transaction it is not clear what would be the required steps and timing to get us to a conclusion. Given the importance of sentiment in DAOs, I believe the leaders of the communities would want to ensure that the groups are cohesively backing the proposal rather than forcing it through their voting powers. We will have to sit and wait.

6. Conclusions

The Fei <> Rari proposal is ambitious, and constitutes a crazily important precedent on so many levels: industrial vision, innovation management, tokenomics, regulatory scrutiny, distributed governance, etc. My head spins when trying to project the long term potential effects of such merger.

The short term ones, however, shouldn’t be neglected. Unfair treatment of some of the stakeholders involved might have destructive effects for the DAOs. In the way it is constructed, the merger might constitute a great way to, simultaneously, enable the teams willing to stay engaged to collaborate, while providing a great exit window for those who want to liquidate their position - and potentially at a valuation that could be overly generous.

Joey and Jai should listen to the people’s concerns and weight carefully what a final proposal might look like if they want to protect their long-term vision.

Innovating is a communal effort. If you have great ideas you want to explore together or projects that should be on Dirt Roads radar, please feel free to reply to this message or contact me on Twitter.

really liked this :)

Very well written and insightful!