# 28 | Sushiswap: the Dusk of the Samurais

Will Salvation Come In the Form of Token Activism for the DeFi SuperApp?

In 1853 US Commodore Matthew C. Perry arrived in Japan, with guns. For more than 250 years the country had been closed to foreign influence under an isolationist foreign policy known as Sakoku. Commercial relationships with the outside world were kept at a minimum, while Japanese nationals were forbidden from leaving the country. During this period, several attempts were made to break the country’s seclusion. Portuguese, Russian, French, Chinese and American ships tried to enter national waters in multiple occasions. The year after Perry’s successful attempt, in 1854, at the Convention of Kanazawa, Perry forced the Shogun to sign a Treaty of Peace and Amity, establishing formal diplomatic relationships between Japan and the US. To the Japanese elite it was evident how antiquated the country was, militarily and more broadly technologically, when compared to the western forces, as they felt there wasn’t a better choice than reopening the gates.

The country acted on two fronts. On the one hand, it opened the doors to foreign technology, reforming the military ranks and leapfrogging two hundred years of stasis, while on the other it restored the centralisation of power under imperial rule. Emperor Meiji ascended to the throne on the 3rd of February 1866, signing symbolically the end of Japan’s feudal society and the beginning of its modern, market-oriented, economy. The restoration of the Meiji coincided with the end of the world of the samurai and of the warrior values formalised during the Tokugawa shogunate. Samurais had played a central role in policing and administering the country, adhering to multiple codes of conducts, balancing military powers, and linking diplomatically the various feuds that had control over the territory. Interestingly, however, it was only during the Meiji restoration, i.e. after the end of the age of the samurai, that the term bushido, that in modern literature stood to represent the mythological code of conduct of the warrior, started to gain momentum. As often happens, while growing in popularity the term started to attract purified connotations that were only remotely connected with the true practices of the time. Beyond being a period of elegant moral conduct, the age of the samurai was also an age of lawlessness, of slavish dependance, of intellectual immobility, and ultimately of civil insignificance. As often happens, pop culture had tended to recycle the past for more than what it’s worth.

Like Commodore Perry before them, activist investors stormed the 20th century boardrooms to weaponise the rights of the shareholders against the caste of privilege of Rotary-gilded corporate directors. The system despised them, then fought them, then embraced them, then invested in them. So they moved on, and finally arrived to knock at the door of the incredibly liquid though experimental organisations of the token economy. They won’t be loved there either I bet. But if you ask me, I’d rather put my money on impersonal and clear governance processes rather than on the ethical and intellectual superiority of the lonely heroes. Every time.

The Honourable Restoration

Sushiswap is one of the very first DeFi superapps. Sushi is a multi-chain AMM, a farm factory, a lending technology (Kashi) adopted by some of the largest protocols out there, and a broader ecosystem open for financial applications named the BentoBox.

The First Age: Founding Myth

The birth of Sushiswap is in itself a story of ruthless community activism, as described by Mario Gabriele’s wonderfully written Sushi and the Founding Murder. Thanks for the inspiration Mario.

On the 24th of August 2020 somebody known as Chef Nomi took Uniswap’s code and forked everything into a new venture that would have added a twist on top of the leading AMM’s success: a revised distribution of value from users to token holders. Two days later, on the 26th of August, Nomi announced Sushi’s birth. The key differences between Sushi and Uni were, at least at the beginning:

Token holder compensation → The distribution of 0.05% (out of the 0.30% fee charged to the AMM users) directly to the holders of its governance token $SUSHI

Governance participation → The allocation of governance rights to $SUSHI holders, igniting the creation of a Distributed Autonomous Organisation that would have continued to support the evolution of the project

In Nomi’s mind, given the ability of the team to directly copy the open source code of its main competitor, enhanced governance and financial rights for all community members could have helped Sushi leapfrog Uni in the span of few weeks. To complete the heist, Sushi started a liquidity mining program on Uniswap aimed at compensating with newly minted $SUSHI the liquidity providers in Uniswap’s liquidity pools.

Targeting Uniswap’s users to distribute the initial tranches of $SUSHI tokens was a brilliant idea: those liquidity providers could have been, on the one hand, the most instrumental stakeholders in a newly launched AMM, and on the other the ones with the highest incentive to pack bags for the new platform. In only three days Sushi had sucked >50% of Uniswap’s liquidity.

The Second Age: Kingdom

From then on Sushi enjoyed a prolonged period of peaceful development.

Not really.

On the 5th of September 2020 Chef Nomi decided to sell for his own benefit $SUSHI tokens worth c. USD 14m, part of the allocation originally dedicated to the the project’s development fund. The community raged, rallied by Sam Bankman-Fried from FTX. Nomi was forced to hand over control of the project to SBF, that a week later passed it to a politburo including SBF himself, Robert Leshner from Compound, and other prominent figures of the crypto scene. Among those was 0xMaki, self-appointed co-founder and general manager of the Sushi community. In the meanwhile Chef Nomi had repented and wired back the funds, but it was too late to resume his public role. In January 2021 Joseph Delong, an engineer previously at ConsenSys, joined Sushi as CTO. The community continued evolving and working on the next big launch Trident, Sushi’s answer to Uni v3. On the 18th of September 2021 Maki resigned to become an advisor, some say voluntarily some others pushed by a new inner circle of power that included Joseph Delong, Omakase, Rachel, and Keno - renamed the JORK or JORKN if you still believe in Nori’s ephemeral existence in the Discord server. Then came the allocation drama among core team members of a voluntary c. USD 10m bonus granted by BitDAO for their successful token launch on Miso, Sushi’s ICO platform… then the allegation over Omakase’s misappropriation of funds… then a mess during the exploit of the Cream protocol… then the firing of another core member named AG… and ultimately Delong’s step-down, that came while advocating the installation of a C-suite from outside the DAO to effectively manage the mess and an emotional post mortem.

There is a correlation between Sushi’s TVL evolution (below) and the turbulences within the community. It is just difficult to discern correlation and causation.

The Third Age: Republic

Among the reorganisation proposals that flooded Sushi’s forum while the Delong step-down drama was unfolding, was Arca’s.

Arca, an asset management firm offering institutional investors the ability to get exposure to digital assets, wasn’t new to this type of campaigns. In September of 2020 the hedge fund started a campaign to overhaul Gnosis, claiming that the USD 12.5m token sale which occurred in 2017 (valuing Gnosis at USD 300m) was nothing short than an interest rate free loan against which the team had failed to deliver the products proposed during the fundraising. On the contrary, the products created focused entirely on generating financial value for the management team, Arca claimed. As a consequence, Arca was asking Gnosis to make a tender offer for all circulating $GNO governance tokens, giving the opportunity to investors to cash out. On the 23rd of November, Gnosis announced the creation of GnosisDAO, infusing $GNO tokens of new meaning and completely changing the financial profile of the governance token as an investment.

Arca’s proposal for Sushi developed around few key pillars - I have tried to reshuffle a bit the text to make it more palatable:

New formalised entity through a community mandate

New operational multi-sig within the new entity

New organisational structure for current and future DAOs that could allow Sushi to be properly resourced and continue to scale

Further checks and balances between the various teams developing under Sushi’s and the Sushi’s community

Further frameworks to install community-driven leadership and vision

Formalised entity → A new legal entity should be established, providing oversight and protection over contributors - that currently have significant although often overlooked personal liability risk. The entity would follow the legal frameworks of a DAO with governance oversight, formalising and updating all processes and structures, as well as establish an organisational level hierarchy for onboarding Lew contributors. The proposal isn’t too specific on what this would entail, legally.

Operational multi-sig → Importantly, such entity would also lead the annual reporting and budgeting efforts for the DAO - starting from 2022, as well as to the creation of a multi-sig to fund operations throughout the year.

Organisational structure → DAOs were born as free-flowing and non-hierarchical, fluid, structures of humans, probably mimicking the free-flowing nature of the idea generation process. As they move from idea generation to implementation and problem management, the need for a structure becomes evident. But DAOs are also open organisation, meaning that i) there are no entry gates managed by HR or the legal department, and ii) there tends to be a bottom-up rather than top-down evolution of the leadership class - leaders tend to grow from the bottom and are rarely airdropped in the organisation, and when that happens it is rarely successful. DAO’s organisational structures, therefore, tend to have a dominant temporal dimension when compared to legacy ones, at least at this stage of their development. Community members get in contact with the organisation, start contributing, and with time become trusted contributors and ultimately, potentially, leaders. To each of those tiers should correspond systematic, community-led, gates, and responsibility sets.

The Fourth Age: Empire

The proposal, originally submitted on the 6th of December and co-signed by Alex Woodard (Arca) and Dean Eigenmann - Dialectic, received several heated and polarised comments, as it had to be expected.

A good compromise? On the 16th of December, a revised version of the proposal was published on Sushi’s forum, incorporating both Arca’s inputs and Daniele Sesta’s - Frog Nation. We have already encountered Daniele - here, proof that the DeFi space is incredibly (some might say worryingly) small. The new proposal stressed the importance of transferring the multi-sig to the discretion of a new collective that will remain subject to governance. For this new group of people, philosophically similar to the Community Selected Council originally proposed by Arca, the proposal identified a few members already:

Daniele Sesta, as Head Visionary/ Strategist

Omakase, as Head of Operations and Business Development

Matthew, as Head of Engineering

It sounded and smelled like a compromise. The idea of increasing community controls over the group of leaders is what had been advocated by many, but rather than involving senior professionals from the outside world (both self-candidates and brought forward by large holders) the choice fell on existing community figures and other powerful leaders from other communities - i.e. Abracadabra. Is this the right thing to do? I am not sure. To me, frankly, it seems more like kicking the can down the road: I personally (personally underlined) believe the problem not to be a specific visionary leader, but the reliance of a powerful visionary figure per se. It is true, such candidacy will still have to go through governance approval principles, but we all know the signalling power in the context of a DAO where most members are not fully engaged nor informed. As an indication of such phenomenon, voting tends to be extremely polarised in DAOs, with the winning party ranging between 90-100%. Not the sign of a well-functioning democracy.

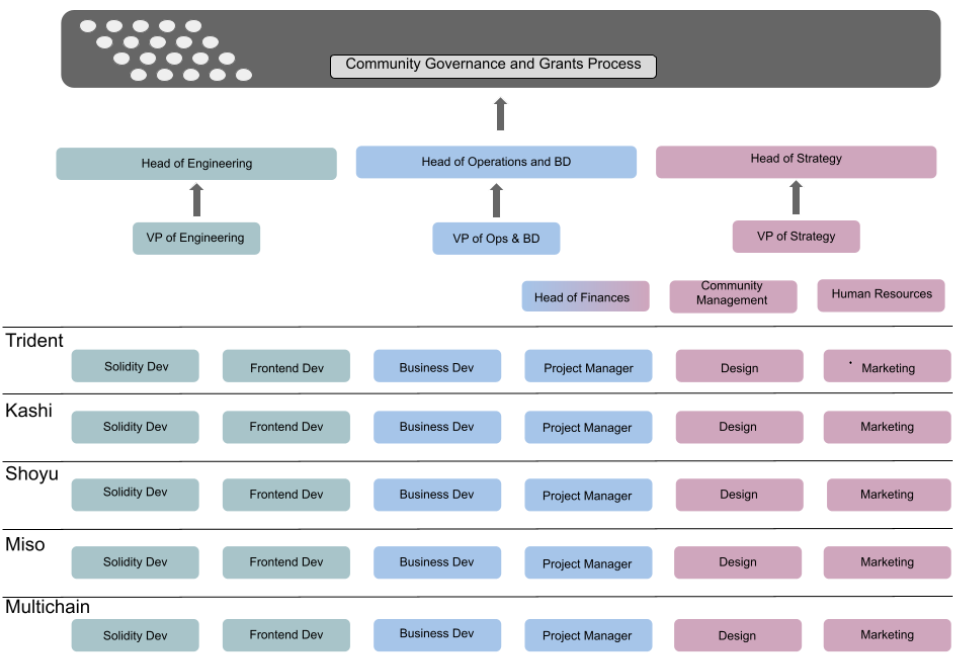

For the rest, the joined Arca-Frog proposal seemed aligned to the original one brought forward by Alex Woodard, with the operating team organised in a hierarchical matrix that includes not only technical talent but also business management, finance, and human resources.

Executive vs. non-executive powers → The leadership team (engineering, operations, strategy) would retain the powers to execute on the roadmap, to allocate resources, onboard contributors, and set up performance metrics. However, and this is indeed an important innovation, such executive team would not have the power to independently initiate changes at the protocol level, including modifications to $xSUSHI and to the broader tokenomics. The proposal, that I won’t rewrite here in full, goes then through other crucial points:

Key governance principles or overseeing and managing treasury assets

Transition period arrangements

Additional checks and balances

The reaction of the community, at least looking at Sushi’s forum, hasn’t been too supportive. A revised politburo including the three leaders seemed to have jeopardised the credibility of the rest of the proposal. I wonder whether the proponents had anticipated it, or whether they would have in any case the power to push such change nevertheless. Representation and participation are not always aligned in the DAO construct, a construct that has at the same time similarities with the corporate and the modern state model. Time will tell.

The Fifth Age: Charge of the Tokenholders

The paths for innovation available to DAOs are numerous as there isn’t, yet, a widely accepted good governance and tokenomical model broadly accepted by investors, contributors, and academia. To Sushi’s proposed hierarchical, top-down, community structure, others like Maker oppose flexible set-ups gravitating around a few coordination units. It is the never-ending trade off between effectiveness and robustness, one that still lives in a flux inside or outside the world of the blockchain.

While we, the researchers, debate in perpetuity what should be the most appropriate model to embrace, projects haven’t been waiting. Pushed by VCs and non-institutional appetite, building teams have focused on shipping. Hundreds of governance tokens have been issued, often without a clear idea of how exactly the holders of those tokens should have been represented and compensated. In the age of narrative investing this hasn’t impacted the success of their release, as investors often look at governance tokens as project value proxies without bothering with the price-to-earnings calculations.

There couldn’t be a better environment for activist investors to thrive in. Next stop? The metaverse. And so we beat on, boats against the current, borne back ceaselessly into the past.