# 29 | Fei <> Rari (II): I Can't Sleep and It's the Ragequit

I Came Without Ribbons, I Came Without Tags. I Came Without Packages, Boxes, or Bags

I am a broken record.

Everyone has had, at some point in time, a favourite topic of discussion with a very specific opinion attached to it. It can easily turn into an obsession. We have seen the COVID-19 version of this socio-anthropological phenomenon during the last twenty-or-so months. Personally, I give most responsibility to the unconscious overestimation of our own influence and, ultimately, the fear of death, but I might be blowing it out of proportion. In any case, let me introduce you my very personal guilty December obsession: the Fei <> Rari merger. After having written about it in #26 I decided to dedicate another issue to the (so far) largest merger in DeFi. I promise this will be the last one, and that I will stop ranting before being possessed by a crusade that seems, ultimately, not to bother anyone. Merry Christmas people.

The Fei <> Rari Merger Proposal, Again

I have written extensively on the merger proposal and its merits (here again) and I will try not to repeat myself too much. Instead, we will focus on a few details and on the way the merger proposal has been welcomed, by the community and the market. There are two ways you can look at a merger.

Strategically. A merger can position two or more companies in a better way when it comes to challenges within and without the organisation. The combination of the two teams could improve throughput - so-called revenue synergies, increase operating leverage - i.e. cost synergies, or favour the combined entity’s competitive positioning - i.e. competitive synergies. Revenue synergies tend to be very inspiring but actually overcompensated by the accelerated entropy within the new and more complex organisation. I do not believe in those too much. Cost synergies are more achievable but often come with quite a lot of implementation costs. Competitive synergies can instead be powerful, but the regulator tends not to tolerate them too much as they increase pricing power and profits at the expense of consumers.

Tactically. Mergers can be awesome/ awful value shifters among the stakeholders of both companies, i.e. between the shareholders of Company A and shareholders and Company B, between liability holders and shareholders, etc. In TradLand there is quite a bit of regulation floating around to protect all kinds of interest groups: minority shareholders, debt holders, employees, clients, suppliers, etc. In DeLand, there’s none, and given the immaturity of the sector and the centralisation of the decision making process the value shifting becomes even more prominent. In this issue of Dirt Roads we will focus entirely on value transfer, without engaging on the medium to long term effects a merger might have.

At DR we love to go deep and scrutinise the details of value flows. In the case of merger proposals, such love for the fine print comes with the genuine intention of doing some good, demystifying the rhetorics. It is inebriating to be the nerdiest version of a superhero. Doing good through asking challenging questions has been what has motivated me to analyse the Fei <> Rari merger proposal and to follow it through completion. As often happens - $SUSHI’s price movement following DR #28 still hurts, it might have been advisable for me to invest on the back of the research.

Following the release of DR’s first piece on the combination, a few among the readers reached out to tell their own version of the story. Most of them asked not to be quoted. It was, however, nobody’s surprise that the final proposal passed with smashing majority through the governance gates of both protocols. It is ultimately the nature of the beast, even if decision making by acclamation is not necessarily a good thing. But let’s cut the chase and move to the post mortem. As a reminder - again you can read more about the document here, the merger proposal had a few points that were crucially affecting value transfer:

Token swap → $RGT owners can exchange their tokens into $TRIBE at a swap rate of 26.7056:1 $TRIBE:$RGT ratio through the PegExchanger smart contract - a Snapshot request (here) to adjust the rate upward was not implemented, but more on this later

Quit → The TRIBERagequit smart contract allowed previous $TRIBE owners to opt out and receive newly-minted $FEI payout in exchange, for 3 days following execution of the Fei DAO vote, at a so-called intrinsic valuation (here) of 1.08 $FEI - or USD, considering the existing peg

Hack refund → $FEI will be used to pay back the victims of a Rare hack previously occurred, for a maximum committed value of c. USD 11.7m $DAI

Following the amendments to the initial proposal put together by GFX, a revised merger agreement was brought forward to the communities for voting. If you have worked in M&A and have been used to the infinite loop of negotiation → document drafting → regulatory discussions → commercial and legal amendments → again negotiation →…, you will be relieved to know that also here DeFi moves fast. Only slightly more than a month passed between the initial announcement and token voting. The reaction of the communities was overwhelmingly supportive, with 93% of the Rari community voting in favour, as well as 91% of Tribe’s.

The merger could then move to execution phase, and so the new era of Tribe could start. An era of increased productivity, liquidity, and significance for the combined protocol. An era, however, also of few founders a bit richer, a few whales happily more liquid, a larger number of unsatisfied minority investors, and a balance sheet slightly more stretched.

The Deal’s Non-Standard Nature

The reason why so many seasoned bankers with a keen eye on DeFi are writing about the Fei <> Rari merger is that it was non-standard in several ways, some more important than others and too many to be listed in a single post. In the commentary below we will narrow the attention to the tactics and the value transfer, as described above.

Beyond GFX’s involvement in drafting the agreement and working on the smart contracts, the Fei and Rari counterparts haven’t had appropriate financial and legal representation. In the legacy world, an independent valuation of the businesses is performed by financial advisors - i.e. investment banks often with the help of accounting firms, and debated at length. Nothing of that sort was done here. The same can be said about legal, and regulatory, representation. Most of this is boring, I know, but some of the paraphernalia is actually useful.

The Exchange Ratio Mess → The most obvious effect of such lack of representation was the calculation of the $TRIBE:$RGT exchange ratio, set (and maintained) by the parties as the 7-day TWAP leading up to 27th of November, i.e. 11 days after the deal announcement. Strangely, the TRIBERagequit locked-box was instead aligned to announcement date - i.e. you couldn’t buy $TRIBE after the deal was announced to enjoy the Ragequit mechanism afterwards. Also, a 7-day window was particularly short given that merger information tend to drip from insiders to the market progressively over a longer period of time - unless you are Elon Musk and decide to take private one of the largest companies in the world while sipping a Sazerac. A 14, or even 30-day pre-announcement window would have been advisable. Ultimately, a more appropriate calculation of the exchange ratio would have increased the implied relative valuation of $RGT by a factor of 20-40%, depending on the calculation agreed upon - this, also, should have been part of the negotiations. A Snapshot vote was brought forward by CometShock on the 15th of December to amend the ratio, but it is my understanding that notwithstanding the support this didn’t lead to a change in the ratio ultimately used.

The Control Premium → Shares or tokens do not only give holders the ability to receive part of the economics of a project, but also that of influencing its course. The concept of distributed influence or control is even more important in a DAO. As for everything, such ability has value. In a hypothetical situation where a company has three shareholders, Mr. A with 49%, Ms. B with 49%, and Ms. C with 2%, that C’s 2% is worth definitely more than any other 2% out there, and that is because by purchasing C’s shares A or B would gain control over the whole entity. Control is valuable. In an acquisition, such value is often referred to as control premium, and can be translated into a 10-20% top-up over a fair market valuation. Not only we can argue that $RGT was undervalued based on market parameters by a factor of 20-40%, but also that a control premium should have been recognised to $RGT holders. The undervaluation suddenly tips beyond 50%.

Insiders Lists → Every project has insiders, individuals that are closer to the source of information and the decision making process. By the virtue of their position those insiders have the ability to exercise disproportionate power and obtain disproportionate profits. In TradFi, regulation tries to limit the movements of insiders and related parties in several ways. DeFi is, let’s say, less stringent. The ability that insiders and related parties have had to interfere with the Fei <> Rari merger plans was, to an old guy like me, shocking. But more on this later.

Protection of Non-Voting Stakeholders → A company or protocol is not only composed by the governance token holders, but also by the contributors and users of their services. In DeFi, such users are the stablecoin owners, liquidity providers, farmers, and collaborators. It is arguable that the Fei <> Rari merger has acted in the interest of (some) token holders at the expenses of other stakeholders. The Ragequit mechanism is the most important topic of discussion here: by exercising their rights to deposit $TRIBE and receive back newly-minted $FEI at an inflated valuation - more on this later, $TRIBE owners have extracted value from the owners of the stablecoin. The beauty of a stablecoin is that almost nobody has noticed.

Market Reactions

In trying to guess the impact on value of pretty much anything there is nothing more powerful than the market. By aggregating a wide range of voraciously different incentive schemes, market prices act as the very best estimator we have of the net present value of something or, alternative perspective, of the way the majority looks at the way something could be valued. We start by recapping the most important dates of the transaction.

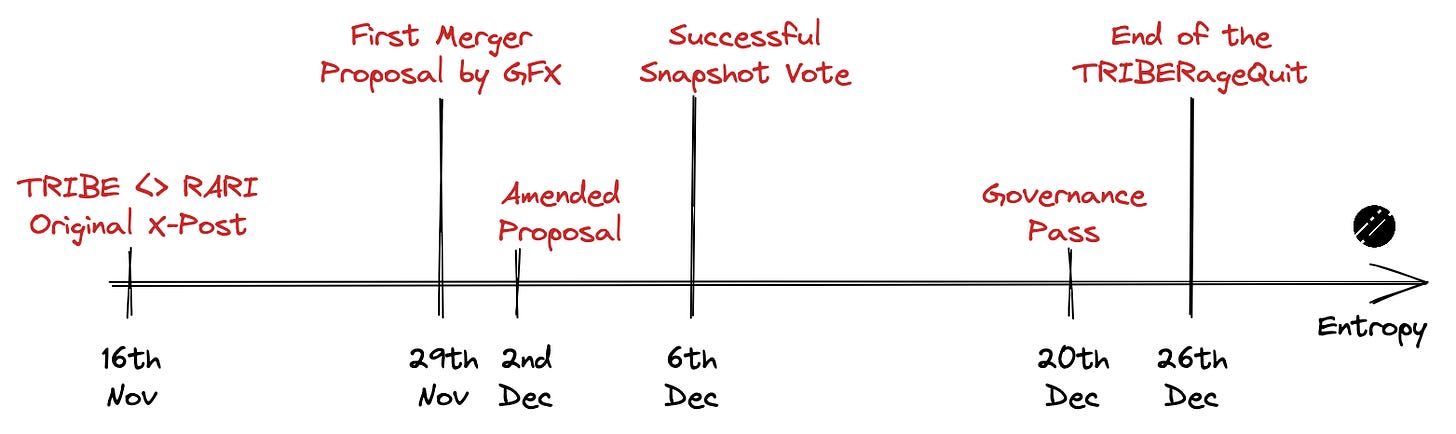

16th of November → The protocol founders post an initial proposal of the Fei <> Rari (or better $TRIBE <> $RGT) merger on the respective forums.

29th of November → Fei <> Rari original merger proposal, drafted by GFXlabs - for which 3M $TRIBE were asked as comp then voted down to c. 300k $FEI, fixing the exchange rate of c. 26.7056 and the Ragequit mechanism.

2nd of December → An amended proposal gets published. Apart from minor changes and the split of GFX compensation - later voted on, the Ragequit mechanism gets changed from Protocol Equity (i.e. Protocol Controlled Value minus User Circulating $FEI) to Protocol Control Value only.

6th of December → Snapshot voting on the amended proposal terminates - successfully. Proposal can move to the next step of governance.

20th of December → The merger reaches quorum on both governance portals. The exchange ratio is confirmed at c. 26.7 $TRIBE per $RGT and the TRIBERagequit smart contract set on an intrinsic value of $1.078903938.

26th of December → The TRIBERagequit smart contract expires at unix epoch 1640480400.

Based on $RGT’s price behaviour relative to $TRIBE it is difficult to defend that the deal has been any good for $RGT holders. Although the token had been trading at significant premium over the agreed ratio for the months before the announcement, it converged around the exchange value and remained there until completion. It is also interesting to see the sharp convergence in the days before the merger was announced, as it suggests some insider trading might have happened. As a $RGT owner, I wouldn’t be happy. Important disclaimer, I am not.

The TRIBERagequit

The TRIBEragequit contract was originally structured to give the ability to $TRIBE owners not in favour of the combination to sell their shares back to treasury. It was a nice gesture to deal with unsatisfied parties and one that would have been possible given the high liquidity of Fei’s treasury. Particularly nice for the large bags. In drafting the mechanism GFX had originally referred to an intrinsic valuation of $TRIBE as Protocol Equity, as the difference between Protocol Controlled Value (i.e. a proxy of the assets of Fei) and User Circulating $FEI - i.e. a proxy of its liabilities. In TradFi terms, such definition would have meant that a bank’s treasury would have committed with its shareholders to buy back shares at a Price-to-Book multiple of 1x via newly issued debt. The bank’s leverage would have increased as a result.

The Quitting Mechanism Was Perversely Priced → The Ragequit was subsequently amended. In the proposal that was ultimately voted by governance, quitters could have deposited $TRIBE and received newly-minted $FEI not based on Protocol Equity, but rather on Protocol Controlled Value only. At today’s price, that difference is c. USD430m, or half of the PCV. Not trivial. In addition, such change wouldn’t have made any sense in corporate finance terms. Going back to our TradFi parallel, it would have meant that a bank would have offered its shareholders (at a certain cutoff date) the ability to sell back their shares to treasury in exchange for a portion of the total assets of the bank. Equity and assets are two very different concepts, and I am sad to break the news to the degens that they do not own the TVL of the protocols they buy the governance tokens of.

The Quitting Mechanism Had Perverse Effects → This artificial quitting parameter has had the effect of anchoring $TRIBE’s price around PCV as previous owners understood the potential to arb by buying $TRIBE in the open market when such token was trading below projected redemption price.

Ultimately, c. 105m $TRIBE (c. USD 112m USD) were redeemed through the Ragequit, or c. 25% of its market cap - not little. Most of this value though exited from the door and entered from the window, as founding teams and team members sold tokens to treasury to buy them back in the open market at more favoured prices. What in the boring legacy world would have constituted fraud, in DeFi is source of bragging. This Twitter thread is not science fiction.

The Quitting Mechanism Had a Destabilising Effect on $FEI → As I have argued many times, exercising the Ragequit, and at an inflated valuation, has had the effect of increasing protocol leverage and destabilising the $FEI stablecoin. In other, simple words, we can state that the arb incentivised by the quitting mechanism has shifted value from $FEI to a certain group of $TRIBE owners. Although, given the pegged nature of the stablecoin, such value transfer isn’t immediately evident in price, it is in volatility. It is difficult to overstate how important is stability for a stablecoin.

As the largest DeFi merger so far, the Fei <> Rari combination constitutes a very important precedent for the future of the industry, and I feel we could have all done a much better job at making it a more transparent and fair transaction for everyone. And with this that’s all folks, happy holidays again. Yours truly.

Disclaimer. I do not own or have ever owned $FEI, $TRIBE, or $RGT tokens, nor have been involved in the merger or in the community discussions in any shape or form.