# 34 | Anchor Protocol (II): Too Big to Thrive

The Only Thing We Are Asked For Is Paying Attention

We are living through a historical period of intense disbelief, turbocharged by a system that is designed to nudge impulsive reactions through carefully crafted stimuli. It is the job solely of the very few, however, in each field of human activity, to either act or not act. For all the others, truly, it should remain a matter of believing or disbelieving. And someone’s beliefs shouldn’t stagger through life the way flags wave in the winds.

That is what I remind myself every time I feel the urge to do something. What is my job?

Token Activism Next Stop: Anchor Protocol

I would like to thank @jofo_real for providing precious information that has been instrumental to complete this issue. Open collaboration is our superpower.

This is not the first time we write about Anchor - see here, and for a good reason. Since the last time DR indulged in glorifying Anchor’s 20% deposit rate, the protocol’s TVL went from USD c. 4.3b to 11.6b - source DefiLlama. A lot has happened since then: volatility in crypto markets has spiked, listed mid-large tech companies have been demolished by inflation data, and the world is now on the brink of nuclear holocaust thanks to the myopic moods of a thug-elevated-statesman. All good arguments to park liquidity in a 20%-yielding strategy that masks volatility, pretending that the volatility you can’t see doesn’t really exist. Anchor’s yield on deposits, in the meanwhile, hasn’t reacted to the swinging moods of the world, resisting within its 19-20% band. Its currency of denomination too, the $UST, has resisted the cross-chain storms (read Abracadabra) remaining pretty much loyal to its 1-for-1 peg with the USD for the pleasure of all depositors. Why should we worry then? Shouldn’t we simply enjoy the beauty of reliance and have in Anchor our harbour of stability in a world of uncertainty? Pretty sure we could.

» Skip Recap (at Your Own Peril)

Anchor, as a reminder, is Terra’s borrowing protocol. A borrowing protocol that is different from Maker, in the sense that it is not the ultimate minter of its own currency, and also from the Aave-Compound duo, in the sense that it lends out only one asset - the Terra-native Stablecoin $UST. Like others, it has opted to whitelist as usable collateral only assets that are yield-generating in nature: $LUNA and $stETH today. The logic is simple:

Anchor attracts depositors that deposit $UST in exchange for a deposit rate → the protocol pays such rate from its reserves

Simultaneously, Anchor attracts potential borrowers that pledge (or better bond) yield-generating assets as collateral → the protocol retains most of the generated yield as part of its reserves

Borrowers can now borrow a certain amount of $UST based on a parametric loan-to-value ratio (or LTV - e.g. 50%) → the protocol retains the interest rate paid in the reserves

Anchor retains other ancillary fees in the reserves, like a portion of airdropped rewards, liquidation fees, slashing fees, etc.

If we ignore for the time being the reflexivity that occurs between Anchor and the wider ecosystem due to some of the crypto assets involved (like $UST and $LUNA) and the incentives paid in the form of $ANC, Anchor is not very different from a commercial bank. As a simplified bank, it should make more money from its asset side than what it spends for its liabilities. Banks typically clip a positive spread between the interest asked to borrowers and that paid out to depositors; is this the case for Anchor as well? Not really.

Anchor is a negative spread bank. Not a great position to be. In cost of capital terms, actually, Anchor reminds more of a private equity fund than a bank: while banks make money from managing independently both assets and liabilities - although this concept has been stretched in a world of negative interest rates, investment funds attract money from limited partners (promising a high rate of return) and need to actively manage the assets in order to more than compensate the yield promised. The equation above means that, looked differently, for every 1 unit of collateral provided, at most 0.75 units can be attracted as deposits to breakeven. Assuming a fixed LTV of 50%, this means in other words a minimum deposit utilisation ratio of 65-70% - Anchor has stated in the past that the number is 60%. The number is plausible when the asset side of the equation is growing, fast, and there’s plenty of borrowers looking to lever their position. $LUNA was one of the best performing assets in 2021, with a LTM return on investment of c. 750%. Right until the beginning of December the buoyant market was enough to ensure a positive cash flow from interests for Anchor.

But with a negative spread, you are running against the clock and it was just a question of time before the protocol would have suffered for its pro-cyclical nature. With increasing volatility across all markets, demand for leverage stalled while on the other hand such demand morphed into one for stability - that, within the Terra ecosystem, translated into less borrowing and less depositing for Anchor. Fast forward to today, here’s where we stand.

In the land of Adam Smith, market forces would have reduced the incentive to deposit (by reducing the deposit rate) and, potentially, improved the incentive to borrow - by again reducing the borrow rate. Anchor is not alien to the concept of an algorithmic interest rates - looking at the documentation, the borrow rate is parametrically modelled based on a utilisation ratio. Interestingly, the same isn’t happening for the deposits, with the rate remaining anchored around the 20%. Providing a stable and predictable rate is ultimately Anchor’s ambition - hint, it’s in the name. This suggests two different questions that we will try to tackle separately: (1) how can Anchor sustain the persistent negative yield, and (2) why is Anchor so resistant in adopting market forces. We will try to tackle each individually.

How Can Anchor Sustain the Persistent Negative Yield?

Things get murky. In the previous commentaries, we have purposely omitted the incentive to borrow that Anchor deploys in the form of $ANC minting. $ANC, the protocol governance token, is allocated to borrowers incentivising them to provide yielding assets to the protocol and borrow $UST. At the current levels, the yield (in $ANC form) for the borrowers is higher (16%) that the negative APR (12.7%) on debt taken. Borrowing, in other words, currently happens as a farming strategy and a levered bet on the price of $ANC. The minting incentivises protocol usage - benefiting $ANC indirectly, but at the expense of aggressive dilution and selling pressure - harming current $ANC holders. As most, if not all, liquidity mining incentive programs, it is not sustainable. You might have got an iPhone if you opened a current account at a bank, probably not anymore, but definitely not a continuous flux of shares of the bank itself.

Beyond being unsustainable and harmful for current $ANC holders, with 9b deposits vs. 2.5b loans, it isn’t working. Documentation states how Anchor’s deposit rate is primarily adjusted by calibrating the rate of $ANC emissions to borrowers. Based on the current flow dynamics it is evident how either the feedback mechanism has been ineffective, or the target deposit rate has been maintained excessively high.

When $ANC farming is not sufficient to parameterise flows, the protocol relies on direct subsidisation from its reserves. This isn’t necessarily a bad idea - reserves are functional to smooth cyclicality around the long-term growth trajectory of the protocol, but not when the protocol’s reliance on reserves is structural. By early February, it became evident how unsustainable the status quo was. Interestingly, in @nrmo forum post, the imbalance was proposed to be solved in the long term by a revamped borrow model that to me is as scary as they come, while the deposit rate was proposed to remain at 19-20%. In the meanwhile, to let the patient survive while the bleeding continued, a recapitalisation of USD 450m through the newly-created Luna Foundation Guard (LFG) was suggested. The LFG was constituted via a 1b capital increase via a private token sale led by Jump and 3AC, with the participation of many others. The ambition of the UST Forex Reserve created through the capital increase, and denominated in the digital gold par excellence - BTC, was to act as a stabiliser and reserve of last resort for the $UST. Not many chain-native stablecoins have the benefit of a backstop worth 1b to protect their pegs. As good as algorithms can be, they are not enough to gain our unconditional trust.

These are not small numbers, and I was impressed to see how the orthodoxy of the 20% anchor rate was worth more than half a billion dollars. I wasn’t the only one disliking the proposal. @Pedro_explore, prolific Anchor commenter, was strongly against the use of funds that were originally allocated to improve sovereignty, security, and sustainability of the Terra ecosystem. If Anchor was deemed to be too big to fail, making it bigger without solving its problems wouldn’t have made things better. In simple terms, Anchor could indeed remain Terra’s most powerful marketing machine, but nobody could afford such a glossy marketing machine for too long. History, however, doesn’t care about the will of the common people, and on the 17th of February Do Kwon announced the USD 450m reserve increase.

But the capital increase is just a capital increase and it didn’t chang the trajectory Anchor was on. Since recapitalisation day, reserves went from c. USD 510m down to c. USD 450m. In less than a month. The deposit yield, again, hasn’t changed.

Why Is Anchor So Resistant in Adopting Market Forces?

The importance of Anchor for the wider Terra ecosystem cannot be understated. There are c. 14b of $UST in circulation, with 9 of those being deposited within Anchor. To that number we should add the c. 150m (50% of the 300m pool) provided to Astroport’s $ANC liquidity pool, and I am sure other Anchor-related things I am missing. There’s no doubt that Anchor constitutes Terra’s cornerstone today. It might not remain like this in the future - with Astroport, Prism, Mars, Mirror, etc, but that future is not here yet.

In Terra’s integrated and transparent monetary system, $LUNA and $UST are directly connected.

Terra is a financial centre in the metaverse, and it interacts with the rest of the universe by importing and exporting capital flows.

Contraction phase → When inflows slow down the $UST suffers of de-pegging pressures, that the system tries to counteract by issuing more mining power (trying to incentivise further external actors to interact with Terra) and using the proceeds to buy-and-burn $UST. In macroeconomic terms, Terra wants to increase participation of externals in the medium term, while using the proceeds of those auctions to stabilise currency in the short term - but at the expense of current $LUNA holders

Expansion phase → When inflows accelerate the $UST can become more expensive in USD term, and the system tries to counterbalance the effect by minting more currency and using that currency to buy-and-burn mining power, i.e. $LUNA. In macroeconomic terms, Terra inflates the currency (which is a representation of an economy’s purchasing power) immediately and uses the extra currency to push up the price of $LUNA - this is beneficial for everyone

Said in yet another way, Terra keeps shifting volatility between $UST (its system’s liability) and $LUNA - its system’s equity. One is a reservoir for the other, and both are existential. $LUNA couldn’t afford an aggressive outflow of $UST due to a reduction in Anchor’s deposit yield, as it would lose the ultimate stabiliser of its price. The Terra ecosystem needs Anchor.

So What?

We need to make an extra step though, and state clearly that the interests of $LUNA holders are not fully aligned with those of $ANC. Unless, of course, we assume that every six months a Good Samaritan will inject half a billion dollars (and growing) into Anchor’s reserves, thus subsidising $ANC issuances into infinity.

The result of this clash of worlds have been three distinctive proposals to improve Anchor’s tokenomics: (A) veANC by Retrograde and ParaFi, (B) Dynamic Anchor Earn Rate by bitn8, (C) Tokenomics Governance by Polychain and Arca.

(A) → veANC by Retrograde and ParaFi

ON the 17th of February Retrograde and ParaFi published on forum a proposal to expand $ANC’s role within Anchor. Retrograde, based on their first Medium post, intends to improve governance practices within the Terra ecosystem by “building the governance master key for Terra”. How that will shape is yet unclear, but looking at their proposal we could guess Retrograde wants to become some kind of Convex-esque voting aggregation protocol - and for this reason we cannot consider the proposal as entirely free of conflicts. The receipt isn’t new (to DeFi and ParaFi) and is grounded around the Vote-Escrowed (or ve) token model. More specifically:

$ANC can be locked up to 4 years into a vote-escrow contract - or $veANC, in a non-transferrable form, with the mechanism replacing staking and giving more weight to those that stake the token for longer

Borrowers bonding assets like $bLUNA or $bETH will receive boosted $ANC emissions based on their $veANC holdings - up to 1.5x. as well as a portion of protocol earnings

$veANC holder will be able to vote on general governance topics as well as on future $ANC emissions across approved collateral types (gauge voting)

This is Curve Wars 101 - for a more detailed description of Curve Wars see here. So what does this solve? It is clear that the intention of this initiative is to create a vertical ecosystem, similar to Curve’s Curve→Convex→[REDACTED], that would have a positive impact on the demand and price for $ANC. By benefiting the price of $ANC, incentives to borrow would grow and the borrow<>deposit mismatch reduced, with a virtuos effect for the protocol overall. But no value is created out of thin air, and the interest generated in the short term will have to be compensated at some point along the road - a pyramidal Curve War model is nothing but an increase in a protocol’s operating leverage. In a pyramid the base matters: if the system might not be sustainable for a profitable protocol like Curve, I struggle to see how this could be sustainable for a non profitable one like Anchor. We are borrowing time, and at a very expensive rate. I can’t say I like it.

The proposal has another, in my opinion, negative effect on governance. The ve model exacerbates centralisation by benefiting those that already have a sizeable percentage of governance rights in the system. If we believe in decentralisation as a universal good to defend - I do, we cannot not dislike it. There is another nuance that connects to the conflicting interest argument we have stated above: it could be a reasonable assumption that Terra’s core team controls a large portion of governance rights - my back-of-the-envelope estimate is somewhere around 30%, and I don’t see how those same actors would favour Anchor’s interests rather than Terra’s.

Another relevant point was raised by some, including @Jae99 and @Pedro_explore. Should we truly make life more difficult for borrowers, the real source of revenues for the protocol? Why not including boosts for those depositors, instead, that stake $veANC? In addition, will the $veANC introduction ignite a war with positive (short term) effects for $ANC price? Among borrowers, Anchor doesn’t have natural competitors for the $LUNA market, while outside of the ecosystem its position is weak; it would be difficult for an Anchor War to explode.

(B) → Dynamic Anchor Earn Rate by Bitn8

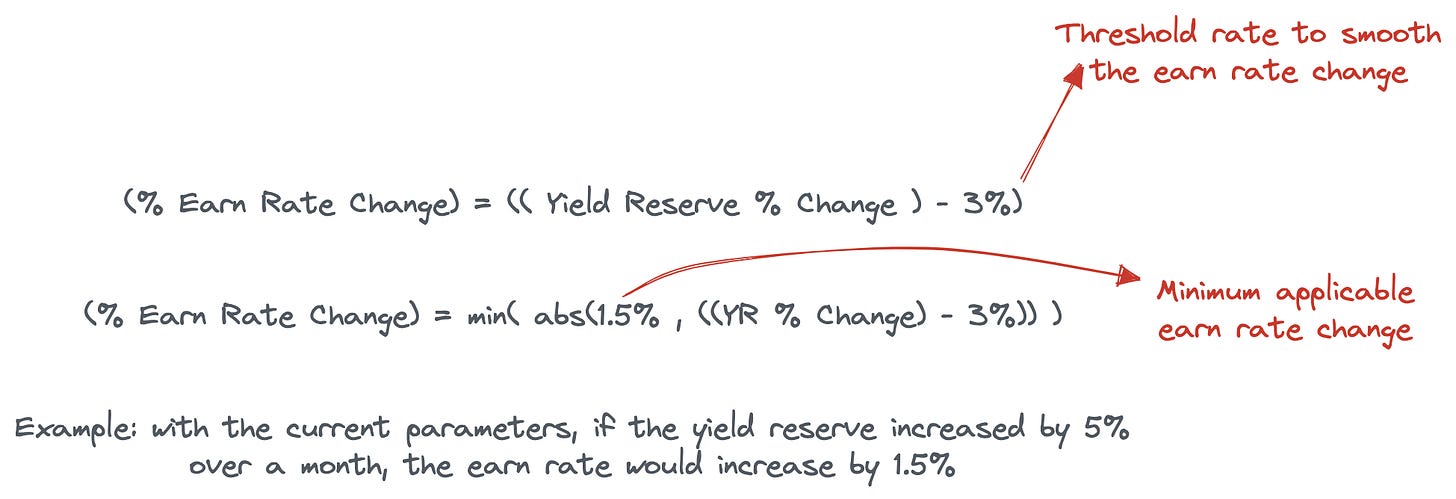

On the 1st of March @bitn8 published an alternative proposal to create a semi-dynamic earn rate for depositors, linked to a measure of change of Anchor’s reserves. If reserves are falling, then yield should be reduced, and vice versa. @bitn8 is defining a discrete dynamic system that would push a rate change, implemented on a monthly basis, as described below.

I am not planning to provide an uneducated opinion on the discrete dynamic model proposed here by @bitn8, as I am sure there are better trained and informed people to do so, but I can say I would welcome a mechanism that would help reflecting in the deposit rate the reality of things. Interestingly, the proposal isn’t aiming at welcoming market forces into the protocol, but rather at making the protocol sustainable without continuously relying on external sources.

(C) → Tokenomics Governance by Polychain and Arca

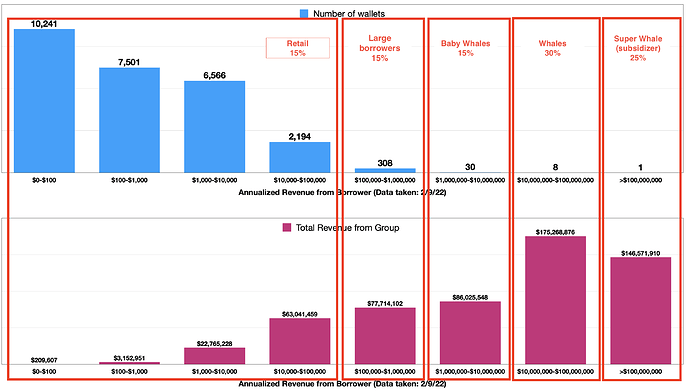

The third proposal comes from Polychain (@josh_rosenthal) and Arca - @Matt_Hepler. This is not the first time DR meets Arca as part of its research on activism - see here on Sushiswap. Their proposal, originally released on the 25th of February, has gone through a few amendments and published in its final form only hours before the release of this article. Its core principles, however, haven’t changed: the proponents do not believe the deposit rate to be sustainable and they don’t feel appropriate that very large institutional players are the ones benefiting from the value transfer. Their proposal, in an era of mathematical sophistication within DeFi, is brutally simple: below $UST 100k you can continue to benefit from the c. 20% yield, and above the threshold depositors will see their earn date progressively reduced to either 17.5% (for deposits within 100-500k) or 10.0% (for deposits above 500k) in the span of 540 days - with the new rate struck every 30 days.

Based on the table shared above on deposit concentration, the new mechanism could be effective in targeting the large whales that represent 85% of the deposit volume. Does Terra really need those large depositors if they intend to become a distributed and decentralised financial services centre cheap enough for everyone to use? And how many of those large whales are also token investors in Anchor and Terra ecosystem as a whole? As always in DeFi, the conflicts of interests could be everywhere. The proposal is now live on governance.

We are still far from reaching either quorum or majority, but Arca is bullish. Using their words:

“The attention and activity that is currently being paid towards Anchor governance is at an all-time high and has helped drive a 200% price improvement. With our proposal, we believe $ANC stands to gain immense, well-needed balance sheet sustainability that will ensure a vibrant Anchor Protocol , Terra ecosystem and significant value creation. We believe a broad base of $ANC holders agree.”

As usual I maintain a fair degree of skepticism, but the proposal’s lack of mathematical complexity could be more positive than negative, as it paves a very clear route for the future of Anchor’s rates. It isn’t surprising that some of the TradFi folks behind the proponents believe that stopping the bleeding should come before any fancy parametrical mathematical innovation. Interestingly, in some sense their proposal would mark also the introduction of a forward guidance concept within Anchor’s ecosystem. In a DeFi environment dedicated to the short-term mathematical optimisation dictated by arbitrageurs, institutional investors have missed clarity over sustainable longer-term rates. Visibility over the term structure, coupled with trust for those who set it, being a committee or an AMM, is of paramount importance to expand DeFi’s use cases beyond trading, trading on the margin, and farming. Many projects are working on this problem - and at DR we are planning to dedicate a few releases to the quest. The Polychain-Arca proposal goes on this direction and, although imperfect as it doesn’t take into consideration neither market nor treasury dynamics in setting longer term rates, it would be a healthy step forward for the protocol.

But we are back at the start: conflicting interests. Activist investors, token holders, traders, depositors, farmers, enthusiasts, Anchor builders, Terra developers. Nothing has changed under the sun, but everything has changed. Now we can see. The only thing we are asked for is paying attention.

Anchor is trying to attract stable farms with an ease of mind, they just need to be a little better than other defi yields. They dont need to be 20% vs curves 10%. Each increase in % yields have diminishing return on TVL attraction due to limits of crypto ecosystem. Even if rates were to be 100% lots of people outside of crypto would still be hesitant to join to farm anchor, but can more easily steal users from other defi. They just need to be better. I would do something like:

base_yield = (weighted average yield of all other defi farms) + 2-5%

yield = max(base_yield, 19.5)

I think what I would propose would be to change the yield number dynamically every week/month.

enforcing deposit limits to whales sounds like a stupid idea in blockchain era where you can create 1000 wallets instantly