# 42 | Valkyrie: MakerDAO and Our Side of History

DAOs In 2022: Dystopian Authoritarian Oligarchies

2 AM. The adrenaline from having rallied a good portion of crypto’s investing society still pumping in. Without having met almost any of them in person. The thick Italian heat. Drinking merely sparkling water. In my mouth, the wonderful metallic flavour of blood that follows the punch. The irony of Dirt Road’s first anniversary coming today. The immature excitement of the Good Samaritan making space, at almost 40 years of age, to the unemotional conviction of the professional. We wanted to make a point, and we did. Writing feels wonderful tonight.

MakerDAO, arguably one of the most influential and definitely experimental DeFi project there is, just completed the voting cycle with the highest $MKR participation in the history of the protocol — c. 294k or c. USD 300m voted in. Probably in the history of any DAO. Being at the centre of the events as proponent of Maker’s overly debated Lending Oversight Core Unit (or LOVE) I believe it is my right to tell the story first. And so I exercise it. Trust me, it is worth writing. And reading.

I will be dry — I carry no universal truth. I will be direct — I am scared only of much more serious things. I will be optimistic — I believe in what we are doing and what we can improve. I will be unpolitical — I represent myself and myself only. I will not be stupid — I do speak solely in my Director’s capacity at Inneres Auge Limited. The rest is on you. You want to see it, see it. You don’t want to see it, pray. I think praying should be preserved for the unquestionable twists of fortune. If you instead want to avoid driving your car into a wall at 120 kph, just don’t drink and drive.

Do Your Own Research

I don’t like bullshit. It’s a personality trait. And I am also an obsessive-compulsive insecure overachiever. In certain fields this has served me well. In crypto-land, pretty well. With the average professional quality being often so low, and the cockiness that comes with the huge money at young age running so high, making predictions can be an easy game.

Late last year, as an independent researcher, I started looking at the governance mechanisms of some of the largest protocols in DeFi. I started with Abracadabra. A good start. In December someone suggested to give a look at the ongoing merger between Fei and Rari. The schizophrenic term sheet resembled the attempt of a teenager to play M&A banker — exchange ratio mess, no control premium, no insider lists, no protection of non-voting stakeholders, the TRIBERagequit mechanism. Six months later Rari’s founder Jai Bhavnani left not exactly with kind words. I guess it didn’t feel good to swallow your own medicine. Still in December, I looked into Arca’s unsuccessful activist campaign at Sushiswap: a nice try gone bad. Then, in January, I shifted my attention to what was going on at Anchor. Often a thorough analysis of the financial dynamics is enough to assess the riskiness of an endeavour, but I guess my CTAs weren’t enough — here, and here. We know what happened to Anchor and Terra. It is not that I get it right all the time, but when the value transfer is so evident you know what you can expect as soon as the flows stop coming in.

My Baby Steps Within MakerDAO

And so I got head down into my role at MakerDAO. I had started working with the community after seeing Maker trying to onboard real-world borrowers to provide financing in $DAI form. To someone that spent a lot of time in credit and in alternative lending in general (here) the potential of an almost-perfectly elastic balance sheet was obvious.

The early days → My first official assignment for the DAO was an external audit of one of their very first deals — FortunaFi. The guys at FortunaFi were awesome but, to me, the risk profile of the exposure wasn’t consistent with Maker’s competitive advantages (the extremely low cost of capital and balance sheet elasticity) and disadvantages — the peculiar organisational structure that would have made a workout rather clumsy. In addition, I noticed the absence of healthy power separation with one Core Unit (CU) acting within Maker as originator, structurer, and risk oversight for any complex exposure. It was understandable for a bootstrapping effort, but at scale it could have led to very nasty surprises. Differently from VC, credit is a zero-sum game. Apparently, many in the DAO were intrigued by the work, and so the Sustainable Ecosystem Scaling (SES) CU proposed to grant funds and expand it into what was called the Real-World Sandbox report, also discussed on DR #24.

The incubation period → Those were choppy days for Maker’s real-world initiative. Seb, the Facilitator of the CU, had just been off-boarded by direct intervention of Rune Christensen, founder of the project. A new member of the DAO was rising to take over the reign, and a team gathered around him to proceed with the evolution of the program. Within this context I progressed in developing the idea of a new auditing function, called Lending Oversight, or LOVE, that would have provided senior guidance, additional assessments, process auditing, as well as the strategic oversight of the DAO’s activities when dealing with real-world counterparts. With all power remaining with $MKR holders, the initiative seemed uncontroversial. The CU started its incubation within SES and proceeded operating in its ad interim capacity, with the blessing of pretty much everyone.

The Monetalis Saga → Life can’t be boring. In March, a company called Monetalis came forward with a request for Maker to back their lending platform for the financing of c. £100m/ month of volumes originated by SME-focused alternative lenders in the UK. Maker → Monetalis → lender → ultimate borrower. The ask was for an initial $DAI 400m check for a unitranche loan at 2.0% fixed + variable stability fee. I won’t open the Pandora box again in case some from the Monetalis team read this — I would encourage credit professionals to read directly proposal and assessments here. My risk assessment, as well as that of the Real-World Finance Core Unit (the underwriting core unit) were deeply unsatisfactory. Obviously the prospective borrower didn’t like it, and they had all the right not to. Peeping into their self-declared shareholding structure I knew that things would have gotten truly interesting. I had joined MakerDAO to protect the protocol from adverse selection and entangled interests and I surely got what I wanted.

Most of the prominent names in Monetalis shareholders’ list were parties related to Maker. UDHC — a spin off of the Maker foundation, Dragonfly Capital — large investor at Maker with Rune as venture partner, Rune Christensen himself, Pat LaVecchia — former Head of Compliance at Maker, Claudia Rivero — current member of Maker’s SES CU. Based on my on-chain back-of-the-envelope calculation, the group represents at least c. 140k MKRs, enough to obtain relative majority in any past governance vote at Maker — and almost enough to tilt the most actively voted so far aka the one on LOVE. The almost is important. Wouldn’t the cap table lead to an intricate entanglement of interest? The Monetalis team seemed to have thought about it providing the inspiring answer below — emphasis is mine.

I say no, because, of all the investors on the planet, only investors with long-term Maker affiliations and MKR holdings, will know that the crown jewel of Maker is it’s active Maker Community - and that any actions that would have negative consequences for the vitality and growth of the Maker community would be detrimental to the long-term success and survival of Maker. This set of investors will listen to the community and respect the community opinions and governance processes. And should anything unintentionally go wrong in any Maker related process, this is the set of investors who will voluntarily engage with the Community to correct and ensure all is concluded as intended.

The existence of this blatant conflict of interest was flagged by many, including myself, but it didn’t seem to please some large $MKR holders. Thankfully others in the community noticed the irony — including @monetsupply and a16z.

Ultimately Rune himself suggested his distancing from Monetalis, although I find the post belated and unsatisfactory. I will make a long story short. We definitely can say those investors with long-term Maker affiliations didn’t demonstrate to be exactly listening to the community. Following the publication of the double and independent (one from Real-World Finance and the other from incubating Lending Oversight) negative opinions:

Maker governance suggested an alternative, fast track process that wouldn’t involve heavy review of applications — dinged by Signal Request

Monetalis (under Rune’s guidance) suggested a fully-contained YES/ NO proposal that would give absolute priority and the ability to block any other proposal until implementation — another fast-track + blocker, withdrawn

Monetalis proposed again another self-contained proposal, named Lusitano, to receive funding for SME lending (dinged by $MKR holders) alongside proposal Clydesdale to manage a $500m treasury book alongside another asset manager — approved by $MKR holders, and yet another to structure a war bond to help Ukraine — for real, approved by Signal Request and then not pursued

It is a fair estimate that 50% of my time as incubated Lending Oversight was spent on providing professional opinions on Monetalis’ multiple proposals and defending myself for having provided them. Another big chunk went to analyse the proposals brought forward by Oasis Pro Market, a company chaired by Pat LaVecchia — also in the cap table above and Maker holder. One for India Power Green Bonds (dinged) and another for ADT Combusts — passed. The last bit was used on another friendly (although based on my knowledge not affiliated) business to Maker, 6s — that still has a pending draft proposal for a potentially 50-year maturity facility. I would suggest the lawyers among you to spend some time reviewing 6s’ proposed documentation — we asked and paid a renown NYC-based firm and I can’t say they praised it too much.

Personally, I was not interested by human behaviour and the blame game. That is what attracted me into crypto. In a properly decentralised environment no-one, not even the largest and most influential parties, should have unilateral (or excessive) power to get unfair advantages of any sort. Was it the case for Maker, where large $MKR holders were simultaneously bringing forward financing proposals? That is a good segue to what happens next.

The Battle for LOVE

On June 13th the ratification of LOVE came up for on-chain voting after having spent months in incubation and weeks in request for comments. The intention to protect the protocol by acting as an extra source of information for token holders to decide upon was initially overwhelmingly supported, but I was aware that over the months the same function had made at least as many enemies as supporters. And I was right.

The following days saw a frantic escalation, with the vote for LOVE becoming a heated battle for the core values of DeFi. Allegedly. Since the tone of social media approached David Lynch level absurdity, it would be easier to follow the events chronologically.

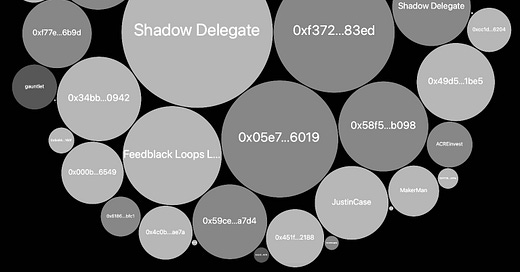

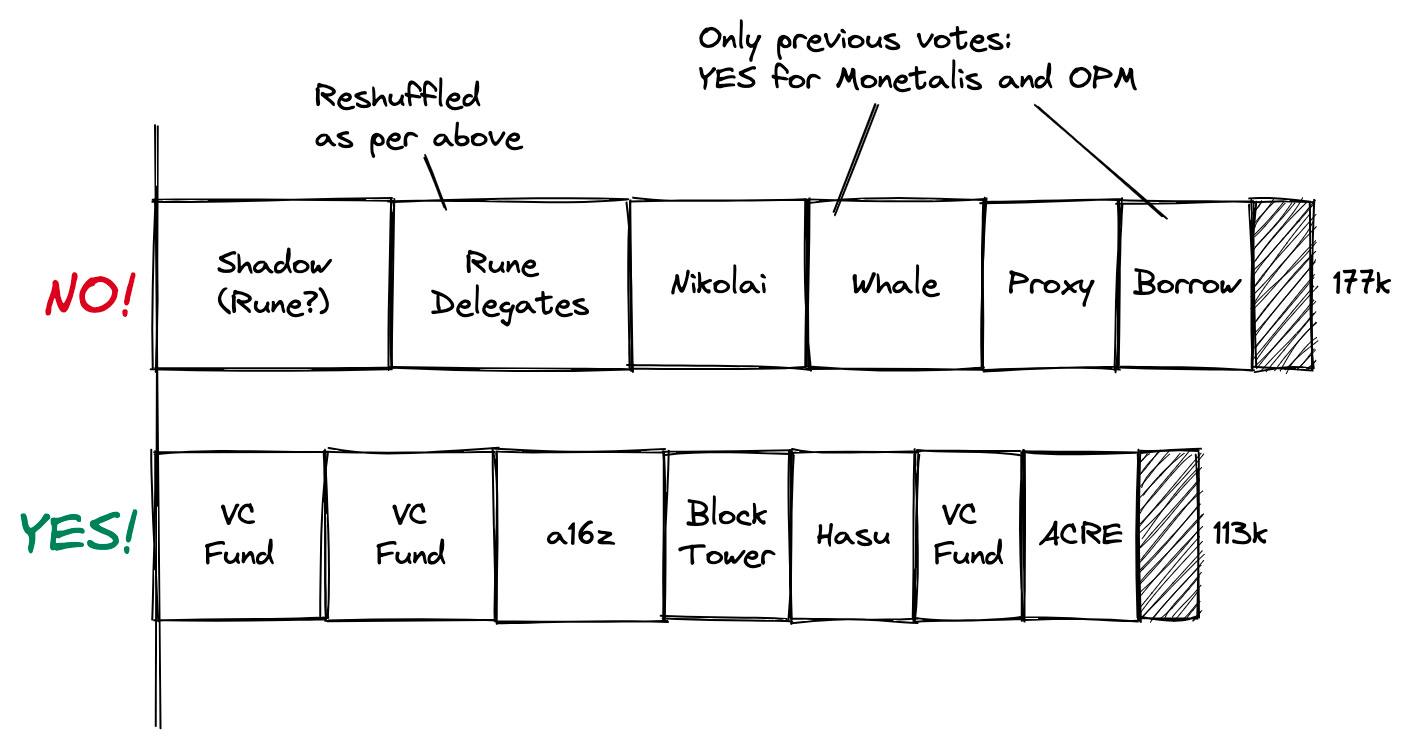

(1) Rune’s self-delegation → Maker has a system of Delegates, where $MKR holders can delegate their voting power to ideally independently-minded proxies. This intermediate layer (theoreticaly) ensures that professional politicians/ decision makers look after the protocol, shielding controlling holders from the accusation of having direct influence over the protocol itself. As s reminder, Maker is not a legal entity, is not regulated to pursue lending activities, and is not very well acquainted with the tax man. So decentralisation tests are of particular importance. On June 16th Rune, who used to delegate his full c. 79k $MKR stack, decided to reshuffle the cards and allocate c. 34k to a secret Shadow Delegate — my best guess is that’s just Rune himself.

(2) Shadow Delegate doesn’t dig LOVE → Rune had been transparent over the previous days that his position was against the introduction of LOVE, and nobody was surprised when the whole c. 34k stack voted NO to ratification. Two delegates, @hasu — no need for introduction, and @ElProgreso — one of Rune’s key delegates, decided to vote in favour of the proposal. Following months of collaboration I wasn't surprised of that either.

(3) Institutional whales pile in → One of the first large independent holders to express public support was a16z through Porter Smith. Kevin Miao from BlockTower followed, jointly with Kianga Daverington — another delegate. Narrative started shifting; on Maker’s #governance Discord channel and on the forum anons started to insinuate agreements and servitude to the VC industry.

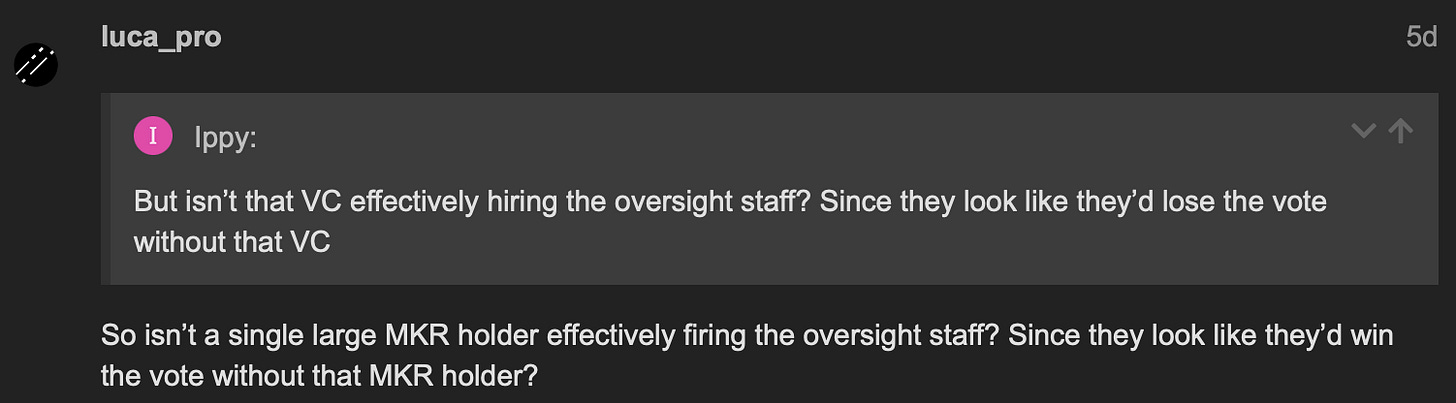

Other whales started piling in. Definitely not everyone voted YES. While I am aware of the identity of every YES vote — I won’t disclose the names of those who didn’t come forward in public but I had indeed called them to discuss the merits of the proposal and they confirmed their vote to me after the end of the voting window, the meaningful NO votes are more obscure. Many operated through proxy contracts, and none of them (apart from the delegates) disclosed their identity nor reasons for voting. Based on the voting track record of some, I can guess their identity, but I am not in a position to assert it. At the same time some of the delegates that had abstained or voted YES for the proposal started changing their vote to NO, and subscribing officially to Rune’s Endgame Party. The Endgame Party is Rune’s facilitated dual party system to allow the declination and implementation of his Endgame Plan — which would require a dedicated post.

(4) The comeback of Nikolai → On June 24th Nikolai, Maker’s co-founder and ostracised blue pill voice in Maker’s blue pill vs. red pill drama, decided to come back to mingle on forum. The presence of Nikolai precedes my time at Maker, but it is fair to say it wasn’t portrayed by many as the most stable of personalities. Again, I have no element to judge this. His intention to vote was made clearer in a subsequent post, although nobody had a clear view on what he would vote on and why, nor on why he decided to get involved again. What people knew for sure, however, was that with an alleged c. 21k $MKR stack those votes could have been the swingers of most polls. Another element of interest from Nikolai’s voting intention post was the indication that someone had borrowed 9k $MKR on Aave — those tokens were used to vote NO on several proposals, and ultimately on the LOVE proposal as well. Examining the voting history of the address gives a bit of colour on its agenda. $MKR rates on decentralised money markets reached 60-70% APY, showing frantic activity.

(5) From head-to-head to Nikolai’s drop → The vote continued with more whales jumping on the YES vote, giving a margin to the victory of LOVE. Early days, but with a total of >200k $MKRs voted we were already in record territory. This until Nikolai started to drop his tokens, in chunks of 5k for security purposes. It became clear that mathematically the YES had no chances to win. Nikolai followed on by explaining with a measured and kind language why he decided to vote and what were his views on the protocol. You can read it here but I report my favourite part below.

I have a suggestion, just a suggestion. FIRST, why don’t you all let me and Rune make a system that allows for collateral onboarding in an incentive-compatible way, and THEN, you can go back at each other’s throats once again.

Rune is not exactly my best friend, so you know things are pretty fucking bad if I am here offering to fix this shit when I left YEARS ago and have been working heads down on alternatives to this bullshit!

Give us a few weeks you fucking barbarians, holy fucking shit. First things first, you have to turn back on the fucking buy and burn, that is just basic fucking mechanism design, you are intentionally running a broken fucking system then complain when there is weird market shit happening!! It is one of the stupidest things I could possibly imagine happening to this project, it has really exceeded my expectations in that regard.

It seems that since then the same Nikolai has been worried about his well being.

(6) The re-delegation slam dunk → With few minutes remaining in the voting window I got busy in writing thank you emails to my supporters, when something else happened. Maker’s delegation system allows delegators to modify delegated $MKRs until the end of the voting window — not a great design, and Rune used this to mark an even wider gap between YES and NO of most votes. I saw it as unnecessary and also as a potentially risky indication of concerted power, but it is not for me to judge other people’s intentions. I report below the swings and reshuffled delegation among Rune’s largest disloyal delegates.

(7) The end → Voting was finally over, with NO overtaking YES by c. 177k $MKRs vs. c. 113k $MKRs. “im officially out of dry powder...” texted Rune on Discord right after. Based on on-chain activity I can reconstruct factions as follows. I was exhausted.

Narrative Wars

The outcome of the vote was portrayed in several ways by the community, and developed its independent life on social media. The most overused description of it: a failed concerted attempt by the largest VCs in the world to transform a decentralised organisation into a for-profit company. I have several issues with this reading, but mainly that it is hard to argue for a victory of decentralisation when such victory has been achieved by 3 large holders with (demonstrated) entanglements. Based on my personal experience at Maker I have my views but I let the reader do her own research, as usual. What I want to leave you with is simply three questions:

Do we believe in Maker’s censorship resistance, based on the existing governance mechanisms and token distribution? A lot has been analysed in the ways virtuous behaviour is incentivised on layer 1s — like Ethereum, so why haven’t we dedicated the same effort to designing the money layer that lives on top? What are the long term effects of flawed governance constructs on protocol solvency?

Do we believe Maker to be a truly decentralised organisation when a group of (arguably) concerted parties has had enough voting power to outvote so many institutional participants? Or is Maker a de facto company that operates through a redundant decentralisation layer?

Do we think Maker is structured to effectively tackle use cases (and borrowers) that bring even a minimum level of complexity and opacity? Or should Maker reform heavily its internal delegation of power and responsibilities in order to avoid the onboarding of sub-par collateral?

The first phase of DeFi’s history has already had its fair share of failures due to the over-reliance on enlightened leadership. Which is ironic for decentralised finance. I believe it is time we start acting in order to prevent this to happen rather than dedicate all our efforts to write sophisticated and accusatory post mortem. The battle for LOVE might be over, but can love ever be defeated?