# 50 | Eco (II): Pioneering the Narrow Currency Concept

Designing Trust Systems, Bootstrapping Communities, and Innovating Monetary Policy

And so 2022 is gone. As I walk through the valley of the shadow of wealth, I take a look at my research and realise that’s not much left, because I’ve been blasting and writing so long, that even my mother thinks that my mind is gone. But I haven’t ever crossed a project that didn’t deserve it—I think. Me, playing the influencer, you know that’s unheard of. But we better watch how we are talking, and where we are getting, or me and my peers might end up locked. I really hate to trip and I must keep focused here on DR, as I see myself the shouter when there’s smoke. Fool at times and, for sure, pointed as some kind of prophet of doom, on my keyboard in the night drawing charts in the streetlight. Failure is nothing but a heartbeat away, but I am breathing life, do or die, what can I say. I’m the unbendable optimist that some still dislike with anger, but my morale remains high so stop considering me a banker. Now let’s move.

Chasing Trust

Humans like to think in triplets. The Holy Trinity, the Star Wars Trilogy (IV-VI) and Meta-Trilogy [(I-III), (IV-VI), (VII-IX)], the three-dimensional universe—until someone taught about the indefensibility of such paradigm, the triads in Hegel’s dialectics, MJ’s (repeated) three-peat and Puccini’s Trittico, and the trilemmas spreading across every knowledge space from distributed computing to monetary policy. It might well be selective attention, but then why is three attracting us so much and not number forty-two? Money trilemmas are old and well-known, but one that crypto-monetary-economists often forget is that it is impossible for a (sovereign) currency to have simultaneously: a floating rate—vs. another reference currency, independent monetary policy—both direct and indirect, and free capital flows. Something’s gotta give.

Ironically, designers of the most successful decentralised pseudo-currencies of our days (read Maker’s $DAI) have opted to focus on fixing relative stability and sacrificing instead sovereignty in controlling monetary policy—pretty much piggybacking on that of the so-hated-yet-so-respected $USD. Sure, all teams have been trying to cover-up this inconsistency for as long as they could, but truth is ultimately catching up: if you want the growth potential that comes with the inherited trust of a foreign asset you will need to bend the knee in accommodating the needs of such an asset, and there’s nothing wrong with it.

Chasing trust is a meta-game. Relative stability vis-a-vis another asset is nothing but a derivative solution for the more fundamental problem of trust. The fact is that no-one trusts crypto asset—yet, at least not enough to use it to denominate savings and index economic activity. Stablecoins have a been a great bootstrapping tool, with a captivating name, but the model is stretching itself. Nothing though is preventing us from deriving the required (perceived) trust from something different than a foreign monetary asset—as it has been done so far for the vast majority of stablecoin float.

Pegging | Sourcing | Reflexing | Building

When I encountered Eco for the first time it looked like some sort of glorified front-end to me; a blockchain-enabled aggregator with the ambition of internalising merchant margins through agreements, and distributing them out in token form across users. An ambitious and well-funded project I dedicated one of the first issues (#15) here on DR, but that didn’t stimulate my curiosity as monetary economist and scholar of deep finance. Little I knew. Few months later the Eco team reached out willing to exchange notes. Eco, they mentioned, wanted to be way more than a slick and state-of-the-art front-end, and was instead focusing on innovating a currency system from an angle that hadn’t yet been explored by other projects. Rather than importing tout court trust into a currency system from the US economy—and military, Eco intended to create endogenously such trust, grounding it on the strength of its own community of users. I was hooked.

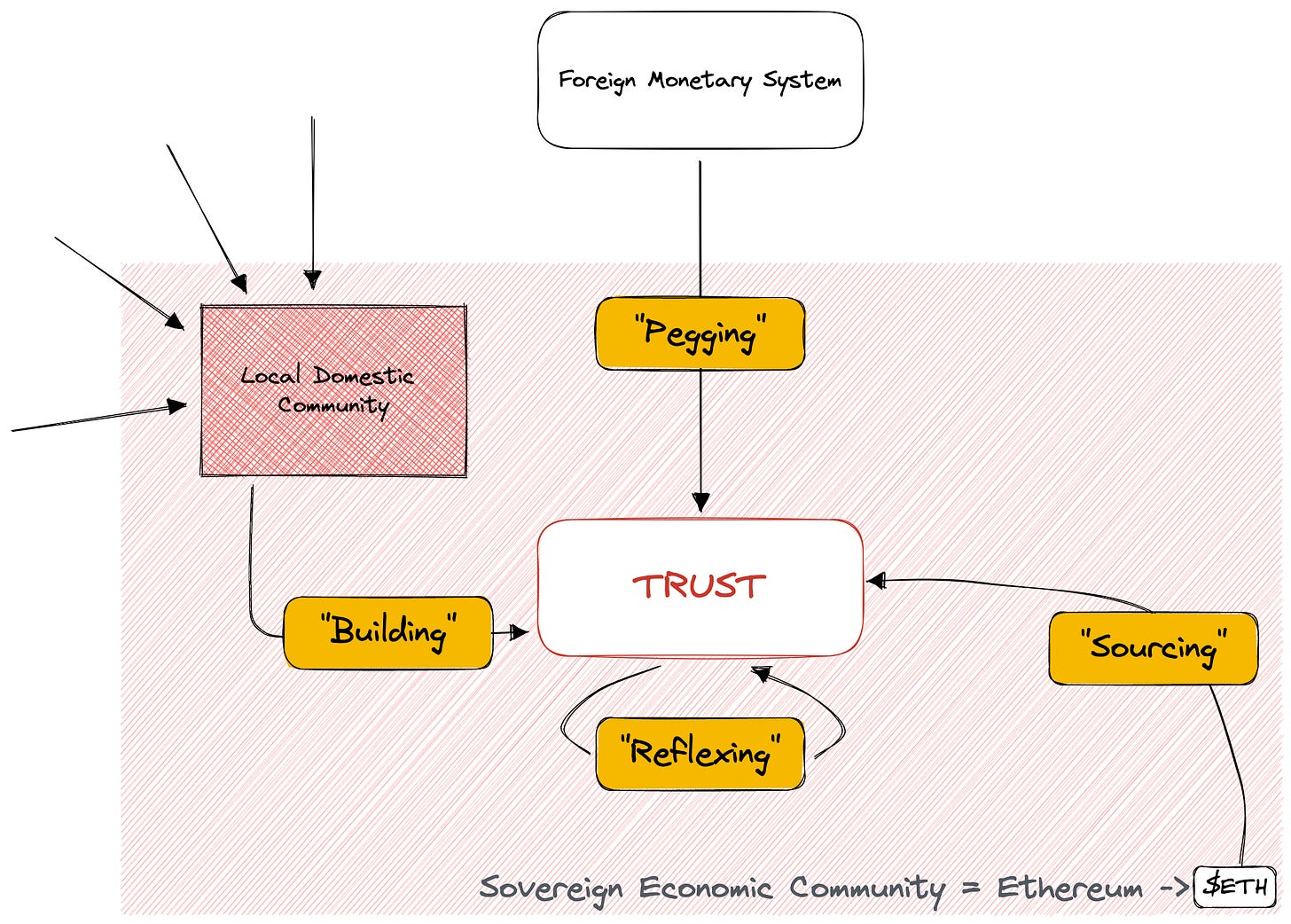

Trust-farming techniques → Although it doesn’t feel like it, we are truly at the very beginning for currency experimentation in the crypto space. We are, putting it in internet terminology, in some sort of 56k bps modem era. The bear market has halted several ambitious experimentations, but hasn’t thankfully killed them entirely. In some way, recent trust scarcity brought in by the retrenching of liquidity has made trust-farming an even more crucial aspect of protocol design. How do currency projects look for trust? In the chart below I have simplified the four most common approaches used by crypto-currency projects—here we use the term crypto-currency in a relatively narrower sense: (a) pegging, (b) sourcing, (c) reflexing, (d) building. Each of those has its set of payoffs, that I will try to explore below.

(a) Pegging → As we have mentioned previously, pegging an asset to another is the easiest way to bootstrap the trust required to grow a currency—by simply importing it from somewhere else. This is the road chosen by most projects today, both by proper currencies (that have some sort of monetary policy) like $FRAX or $DAI, and pseudo-currencies (that are ultimately only payment rails) like $USDC and $USDT. It is an effective choice, but one that ultimately sacrifices entirely monetary policy flexibility and therefore exposes the currency base to hugely cyclical fluctuations. The community has discussed this at length and I won’t indulge further.

(b) Sourcing → Other projects have decided instead to source trust from that of the sovereign economic community they operate in. This is the case of projects like Liquity (here) and Reflexer—here. It is an elegant and self-contained solution that limits as much as possible the frivolous by design, and sources the required trust directly from the systemic equity token ($ETH) they are building on top of. The financial engineers among the readers might see it in a slightly less romantic way, and label those projects simply as structured derivatives of $ETH. Ultimately, I am sure that the behaviour and payoffs of $LQTY and $RAI can be modelled as some sort of put/ call/ collar over $ETH, but that’s also a good thing. The elegance of those projects cannot be understated, and I am fan. Sure, they suffer from huge volatility and difficulty to scale, but by staying fully contained within a system they remain truly resilient to what happens outside of the system itself. This is domestic currency at the core. Their monetary policy, programmatic in nature, has nevertheless limited powers, and those projects are entirely dependant on the evolution of their mothership (Ethereum) to keep expanding.

(c) Reflexing → A lot has been written about what we call here on DR endogenously collateralised currencies. By relying extremely (or solely) on mechanisms of capital efficiency, those projects (Terra still remains their unchallenged dark leader) have benefited from immense growth during the most recent expansionary phase, simply to crash even faster as soon as fresh liquidity stopped coming through the gates.

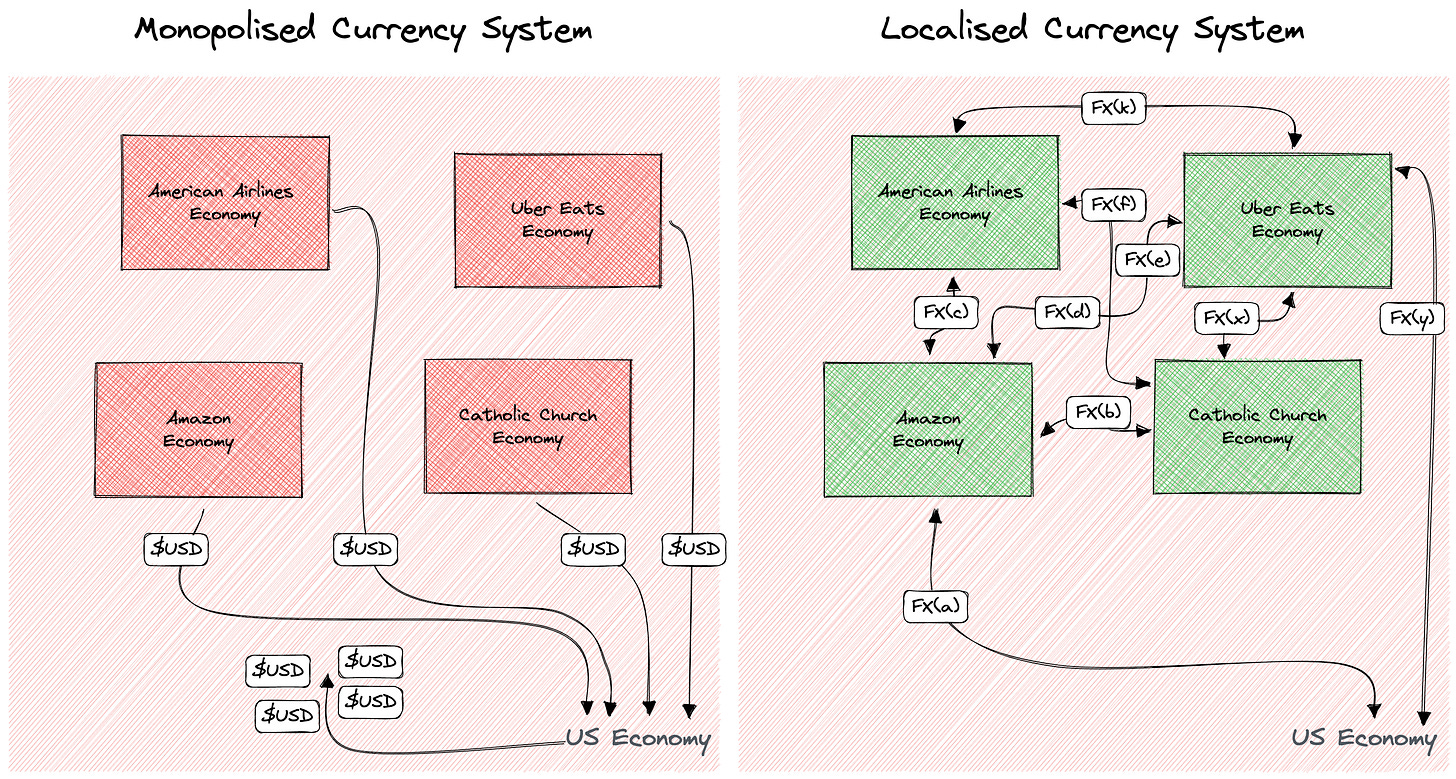

(d) Building → Another road is possible, one that to my knowledge has been attempted only by Eco so far—at least at scale, and it’s the creation of an economic subset (some sort of local domestic community) within which a narrower currency can come to fruition. This is, ultimately, what issuers of award programs do: they create narrower economies that build around users’ needs and trust for the issuer/ supplier. And so we have the American Airlines Economy, the Uber Eats Economy, the Amazon Economy, the Catholic Church Economy. Those economies do not (or don’t have to) talk to each other too frequently, and therefore price discovery between the American Airlines Currency and the Catholic Church Currency or the US Economy Currency can be done disorderly over-the-counter. Beyond feeding the dollar monopoly, this is truly inefficient. Connecting those tiny-economies directly among themselves can be immensely powerful, providing organic communities with the ability to organise themselves more fluidly and interact with each other in a more direct and bespoke manner. There is no free lunch, and the ambition of spinning out narrower currency sets within a larger economic community comes with a huge price to pay, at least at the start: volatility.

Eco: Narrow Currency Meets Decentralised Trust

Eco wants to build the first of those narrower currencies.

At inception, the Eco model will involve two distinct tokens: $ECO and $ECOx. $ECO is the proper currency, originated in the form of points through agreements with merchants, freely exchangeable on-chain, and subject to human-based monetary policy—more on this later. For the avoidance of doubt, $ECO wants to start as a medium of exchange rather than a source of leverage. The implication of this is that functionality, rather than cost or ability to leverage, is the key success factor, making bootstrapping very challenging yet potentially resilient to liquidity shocks.

$ECOx is a de facto derivative contract that is closely linked to the $ECO supply, providing the ability to (a) receive nominal transaction fees deriving from $ECO transfers, (b) convert $ECOx for $ECO (uni-directionally) based a specific formula—below, (c) participate in governance. $ECOx is minted in finite amount and can only decrease with time.

Why two tokens? I believe there are several reasons, but funding and engagement might be the main ones:

Funding → Eco, as any project, needs external funding to develop tech and product, and that funding can come in the form of some sort of security. Investors chip in money because they are expecting those securities to appreciate, obviously, but it would be extremely impractical for Eco to push for the appreciation of a token that, serving as a currency, should be subject to different forces. For this reason, the project rightly opted to source funding via selling $ECOx to investors, rather than $ECO—connecting the value of $ECOx to that of the broader economy denominated in $ECO

Engagement → A similar, yet not identical, argument can be said for first users. The Eco project builds around a nascent community of users and governors, and those community members should be incentivised in a way that is linked to the success of the project without being excessively inflationary for the monetary base

The relationship between $ECOx and $ECO, described in the whitepaper, is formulaic, and provides an incentive for early participants to contribute to the expansion of the economy for as long as possible—within a predetermined period.

In the spirit of the designers $ECOx would “insulate customers from volatility by allowing different parts of price discovery—the immediate value of $ECO vs. future value of the $ECO-denominated economy as represented by $ECOx—to be undertaken in parallel”. It is hard to say how successful the insulation will be, and I suspect traders of any sort will play with $ECO as much as they will with $ECOx, but we will need to wait and see.

Non-Algorithmic Governance: i.e. Just Governance

It is undeniable. Currencies on crypto-rails offer monetary politicians way more powerful data gathering and monetary manipulation tools. While in the fiat world central banks need to rely on spurious and delayed data to base their policies on, and mainly indirect tools to act upon, their crypto counterparts can do this through real-time dashboards and wallet-connected tolls. This means crypto monetary experiments an unprecedentedly powerful testing ground. It is not coincidental that governments are marching ahead with Centra Bank Digital Currency (CBDCs) projects, not only driven by dystopian intentions to monitor and control, but also by good-faith ambitions to better act on their mandate of price and employment stability.

Trustees → Eco intends to rely on a set of trustees that independently monitor data, decide on adjusting measures, and execute them on-chain, under the unique mandate of maximising the aggregate wealth held in the Eco-nomy. (Sustainable) wealth maximisation implies the sub-mandates of adoption and stability, but trustees are independently equipped to weigh on one vs. another. Initially, those trustees would manage $ECO monetary policies through:

Linear supply change: allowing account balances of all $ECO holders to be adjusted by a multiplier, effectively minting or burning tokens directly and controlling instantaneously the monetary base

Randomised supply inflation: local optima aren’t necessary (close to) global optima, by airdropping $ECO tokens to a randomly selected set of wallets non-linear wealth effects can be implemented

Interest rates and lock-ups: $ECO doesn’t live in isolation, and an interest rate policy is crucial attraction and retention tool

Transaction fees: nominal fees can be forced onto $ECO transactions, potentially impacting money supply—and currency base through $ECOx retention

Trustees can submit and vote (through a modified Borda count system) their proposals during specific periods, and will look after the evolution of the monetary policy throughout the duration of their mandates—indicatively 1 year. In exchange, they get compensated via receipt of $ECOx tokens that become viable following vesting. The active monetary policy and set of proposals can be found on Eco’s governance portal. On the 7th of December 2022 Eco presented the list of first potential trustees up for election: 22 candidates including economists, DeFi analysts, finance specialists, and central bankers. If elected, those trustees would start enacting their monetary policy decisions during the January 7-21 2023 system generation block. Managing volatility won’t be an easy task I anticipate, with infant currency mortality way into double-digit territory. $ECO use cases are still limited and general sentiment absolutely awful, but someone has to try.

I am one of those candidates, and couldn’t be more excited. Too much in DeFi lately has been spent on scamming post mortem, in the same way too much was spent on reckless shilling during the bull market. But this is not what DeFi and crypto-economics should be. We should not be all here for a get-rich-quick scheme, nor for sourcing I-told-you-so arguments to throw on the face of naive enthusiasts during Christmas dinners. We should be here to innovate, to experiment, to test the boundaries of what is right or wrong in constructs that today we consider carved in stone, but that just a few decades ago would have been treated as total insanity. It is thanks to those at the fringes of society, both the good and the bad ones, that we keep leaving the cosiness of our nest to explore the greatness of the unknown. We should go back doing it more often.