# 57 | PayPal $PYUSD: Does It Really Matter?

NQA-ness, the Money Printing Machine, and FinTech vs. Crypto

“No questions asked”, or NQA-ness, is one of the key properties of well-functioning money—h/t @stephensonhmatt. You use money without having to ask too many questions about its origin or its destiny. Money, or shall we say well-functioning money, just works, and it works so well that users stop bothering about what’s truly happening in the printing factory behind the curtains. Money, as we love saying here on DR, is the most complex mass-market product ever invented.

But NQA-ness is, effectively, also the root cause of the deepest misconception about what money truly is, or better what its origins are. The canonical definition (unit of account, storage of value, means of payment) is an absolutely user-centric one, and overlooks entirely the reasons money was created in the first place. Far from being built as a barter facilitator, money was born as a promissory note or, in other words, a way for an issuer to finance itself. The ability of the issuer, through wealth, wisdom, or brute force, of honouring its obligations, which is at the basis of money NQA-ness, does not eliminate the fact that money is ultimately debt.

The philosophical dichotomy between money as infrastructure vs. money as a (payment) product runs deep inside the financial services industry, defining an apparently insurmountable divide between money producers and money users. Here on DR we have spent an immense amount of time trying to bridge this gap, and mostly unsuccessfully: money producers have no intention to help—ultimately they profit from other people’s ignorance, and users have no intention to do the homework either. Why shaking the coziness of NQA-ness? We shouldn’t underestimate the human ability to romanticise potentially damaging experiences.

What Does PayPal’s Move Actually Mean?

On August the 7th, 2023, PayPal announced the launch of its branded, fully backed—more on this later, USD-denominated stablecoin, called $PYUSD, in collaboration with Paxos—as the issuer. Most likely, $PYUSD (that is the name of the token) would integrate with PayPal’s existing platform, and offer a seamless (for PayPal’s users) experience to buy and sell goods, purchase (proxies) of crypto assets, send and receive funds across customers. Being built on the ERC-20 standard, $PYUSD could also be used to interact with the rest of the Ethereum ecosystem.

The news of the integration of one of the largest payment tech players with the Ethereum ecosystem has been heralded as a turning point for the crypto industry as a whole, a sign of institutional interest and future adoption, and an early warning to tech investors that good times in blockchain-land are soon to be coming again. Countless crypto/ tech/ fintech influencers have praised PayPal’s move, extrapolating its reverberation across the industry. But what does the event actually mean for the industry? And of which industry are we talking about? With the risk of being out of sync with most of the establishment, below is the way I see it.

Recap: a Taxonomy of Money

Here on DR we have debated at length useful taxonomies of money, particularly in:

# 54 | M^ZERO, Singleness of Money, and Proofs By Contradictions

# 37 | Capital Structures for Stablecoin Protocols: the Revenge of the Sith

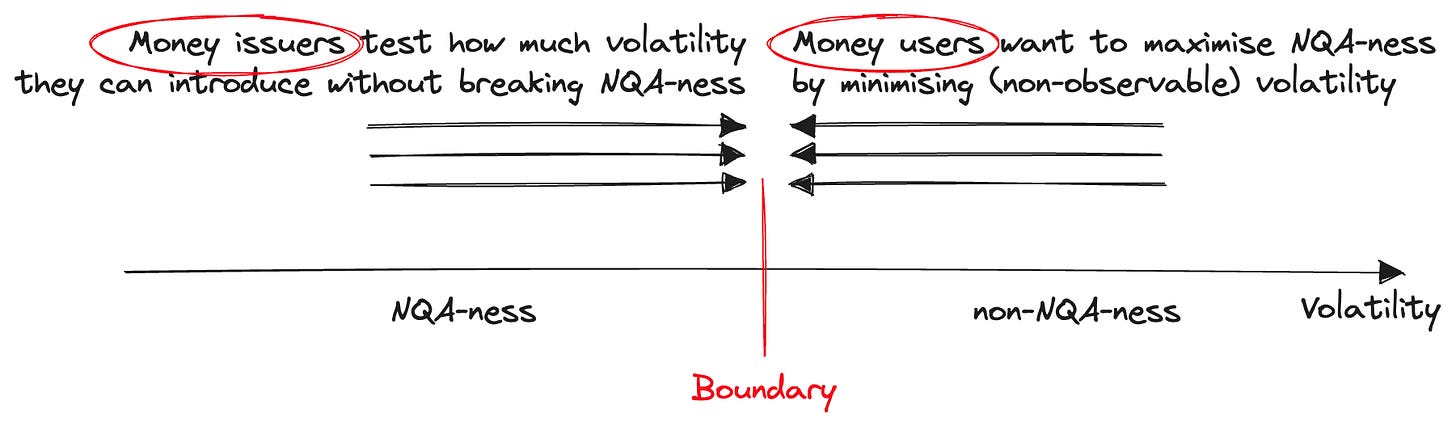

NQA-ness as a bounded function → What concerns us here is simply that money doesn’t exist in isolation in a system, and there is someone (the issuer) actually producing it. There is an inherent conflict between the interests of users and producers: users experience NQA-ness as a binary function (it works until it really doesn't) and issuers test the boundary of such a binary function—how much volatility they can introduce into a currency system without breaking NQA-ness. Breaking NQA-ness is bad and takes a lot of time to be fixed, more work for us here @stephensonhmatt. To make this more real, you can think of sovereign leverage as some form of volatility, and imagine state treasuries asking themselves how much they can lever up their balance sheet (and how much money they can print) without breaking market confidence.

The printing machine → But how can money be printed—and distributed? We are accustomed to a two-tier system (we call it here the TradFi system) where central banks allow commercial banks to print and distribute money subject to a set of incentives and rules. So-called payment stablecoin issuers like Circle, Paxos/ PayPal, and all the other e-money providers existing out there aren’t disrupting the two-tier system, but actually building an additional technological layer to facilitate compatibility of money with new tech stacks: this FinTech system is the system we live in now. The premise of crypto-friendly FinTech players is to use certain characteristics of the DLT infrastructure to optimise for very specific use cases, augmenting the incumbents’ competitive positioning while capturing part of their value accrual strategy. So far, however, there hasn’t been any clear sign that the world actually needs a novel solution for the use cases that have been attacked: payments work seamlessly across digital and non-digital worlds—although there is space for improvement, institutions have been transacting massive pools of assets continuously reducing the cost they pay, digital deposits have been already brought into existence by e-money institutions with limited profitability if not for the suite of additional products they intend to create on top. For DLT, the market hasn’t (yet) shown signs of mass adoption, let alone value capture.

The crypto machine → What we call Crypto, however, is something different. We refer to crypto rather than DLT here, since the term encompasses more than mere technology, but actually (when in good faith) the intention to streamline and disintermediate at least part of the value transmission stack. Crypto’s premise is one of individual empowerment, nimbleness, open-sourcing, and innovation. When it comes to value transmission, or even stablecoin design, this ambition translates into the intention to develop a genuine and legitimate alternative way of creating and distributing value. Although we are very far away from reaching a mature stage of satisfactory transparency and professional standards, the market shows there already is product-market-fit for this approach. The Bitcoin movement is its quintessential expression, but also Tether’s dominance of the stablecoin space (notwithstanding its unacceptable flaws) should act as a reminder. It is not surprising that regulators do not like, nor intend to facilitate the emergence of, those projects: crypto questions at the core the status quo and shakes very powerful profit centres. While regulators keep steering the public debate towards fraud prevention and consumer protection, their actions have an aftertaste of industry protection and politics. My participation in the latest Point Zero conference has confirmed this, if there was any need.

$PYUSD: the Good, the Bad, and the Ugly

It was a long introduction, but one that allow me to express clearly and synthetically what I think of PayPal’s $PYUSD, and why, beyond unfounded or uninformed claims. You are free to disagree, and I might well be wrong.

The good → PayPal’s move to include natively the ability to mint/ redeem/ use USD-linked ERC-20 stablecoins could end up being a very powerful liquidity ramp into the crypto ecosystem. PayPal’s interest could also act as another catalyst toward the acceptance of crypto and DeFi as a reality that needs to be dealt with, rather than an aberration to suffocate. The fact that PayPal has decided to build on top of the (decentralised and permissionless) Ethereum ecosystem is also testament to its potential—IMO Ethereum is the real winner here. Yet, better channels for liquidity won’t be enough, as we need reasons to port that liquidity into a new system; in the most recent bull market that reason was purely speculative, and crypto is still today a sector mostly folded onto itself. But this is a subject for another time.

The bad → Sadly, there is no true monetary innovation within $PYUSD. The system does not challenge the status quo, doesn’t improve its core efficiency, and bends the knee towards all requests of regulators. As an electronic payment tool issued by a centralised company under regulatory supervision and tight T&Cs, Paxos maintains the ability and right to freeze and upgrade all tokens regardless of where they are being held, and must comply with any legal directive to freeze access to the stablecoin or to the assets backing it. We have observed Circle’s recent difficulty in retaining liquidity because of this: the market has shown appetite for some sort of dollar-pegged crypto value storage away from value capture—read Tether, but not for yet another payment tool. Crypto’s initial value prop around payments has been massively, and consistently, oversold vs. one of composability and freedom from compliance and regulatory red tape. Sustainability is also an open question: what would be $PYUSD’s (and $USDC’s—with Circle the real loser here) competitive hedge against a FED-sponsored CBDC if they all exist under the same regulatory umbrella? Liquidity fragmentation, in a system with several non-compatible digital versions of the dollar, is a real problem, and one that wasn't experienced by e-money wallet providers. Framed like this, $PYUSD seems just yet another payment ramp, a bridge to other venues for value storage.

The ugly → $PYUSD holders, through Paxos, need to digest a fair chunk of counterparty risk: if you are holding the stable you should be aware that turbulence for BMO Harris, Customers Bank, or others might constitute a very unpleasant surprise. Circle’s near-miss with SVB should be a good reminder that these things matter. We don’t need this level of counterparty risk, and today we can and should do better.

Call To Action: Let’s Kill the Term Stablecoin

Whether the introduction of $PYUSD is more positive than negative for the crypto ecosystem is not for me to say—although I think it is. Something is definitely true, however, and is the fact that a lot of today’s confusion is due to the fact that we use one term (stablecoin) to call things that are so deeply different from one another. The term itself points to the stability against a reference asset, disregarding all the other fundamental properties of the token. The top 10 stablecoins by TVL are fundamentally different, and bundling them based on their observed behaviour (in good times) isn’t good. We shouldn’t forget there was a time we used to call an uncovered hybrid instrument yielding a 20% PIK a stablecoin. A Rolex is a watch, and the fact that someone uses it to bribe officials or to recycle proceeds doesn’t make it a currency or a washing machine. Confusion and opacity can generate monsters.

Thanks for this, Luca.

Agree with your assessment. I do believe $PYUSD will have a net positive effect, primarily as an enabler of liquidity into crypto. However, the innovation is definitely not there (even though expected as they obviously want to be in the good side of regulators and centralized players).

The stable coin terminology “call to action” is a much needed one. The challenge I see is that only sophisticated players care about the technical variations, and it is unrealistic to think that the average user ever will (they will instead always gravitate towards the USD representation with the most access/use/adoption).

And thanks for the Holmstrom paper reference. It is a great paper.