# 58 | Bite By Bite: NounsDAO's Natural Demise

A History of Spending, Forking, Burning, and Ragequitting

Some trends age better than others. It’s shoulder pads against Hokusai. And you never know what is gonna stick with us. The wheel turns.

The summer of ‘23 was a hot one. Apparently, the hottest ever in the northern hemisphere. But not everywhere. In the world we live in, where believing in the unlimited promises of the future is a necessary trait, the scene has been battered by climate change, uncivil wars, political unrest, and interest rates. If your business is that of building stuff that doesn’t yet exist with the promise of far off tangible results, the summer of ‘23 might have well been the most boring of the new century.

Yet, it has been a good summer for builders and researchers: when the present seems to slow down, you have more time to reassess the past and put the necessary hours in to get ready for the next dance.

Go Fork Yourself: Our Summer of ‘22

The summer of ‘22 was a different one, when for a short period of time experimenting with incentive schemes and governance frameworks became a cool and profitable thing to do. Whether it is still the case today—and I doubt it, we will discover it based on the metrics of today’s piece.

On August 1st, 2022, @packyM, @divine_economy, and myself decided to collaborate on a piece dedicated to internet-native governance experimentation, on the back of our direct experiences within some of the largest Decentralised Autonomous Organisations (DAOs) in crypto-land. Go Fork Yourself intended to describe some of the key challenges affecting the preeminent governance models tested in crypto at the time, and stimulate novel ideas to productively manage dissent. At the centre of it was the concept of forking, or actually native forking, through which communities could better manage incentives within their design space. Rather than imposing (often complex) decisions on the (often silent) minority, native forking would have created a credible financial threat and ultimately maximised consent within a community through a process of continuous governance meiosis.

How would native forking work? Following a specific proposal, a defeated minority would have had the ability to part ways with the majority, carrying with them a proportionate slice of the organisation’s endowment, including a viable venue (or set of smart contracts) to facilitate future collaboration. This mechanism would have, on the one hand, disincentivised governance capture by a relatively small group of participants in a context of lacking voting participation, and on the other stimulated continuous specialisation around a common goal. Forking could, in other words, maximised intra-group consent while maximising inter-group dissent.

The summer of ‘22 was indeed a good one for governance nerds, and DR’s back-to-back governance-dedicated pieces (#42, #43, #44) were a sign of the times. My real-time depiction of the most participated (by $$$) vote in decentralised governance as the proponent of more checks and balances within MakerDAO remains the most read entry here on DR. Most of what I am doing today has been influenced by what I went through during that summer.

Interestingly, and most probably not by accident, NounsDAO was brought forward by Packy, David, and myself as one of the best examples of governance experimentation. The same Nouns, almost a year later, became the first project to propose, implement, and suffer from a native governance forking mechanism that roughly resembles what we had envisaged. The snake ate its own tail.

» NounsDAO: Recap

But what is NounsDAO? More than a year ago, right in the middle of our governance summer of ‘22, #44 described NounsDAO as one of the most interesting distributed governance experiments in crypto. Readers can go back to that entry for a more detailed analysis of what Nouns actually are, but here below is my TL;DR:

Nouns are generative art pieces in the form of non-fungible ERC-721 tokens

Realised by shuffling predefined characteristics in a semi-controllable manner

Sold through a permissionless $ETH-based auction process

With $ETH amassed in the project’s treasury, and used for accretive purposes

Under the control of governors, themselves voting through the Nouns they own

The project stimulated the interest of several (crypto) governance nerds for several reasons, starting from the fact that the cumulative proceeds realised from auctioning the NFTs reached > 50k $ETH / $100m at bear market prices. True, the bull market helped, but by all metrics the Nouns project has been an example of successful decentralised governance implementation.

Nouns, however, wasn’t the only example of successful decentralised governance implementation coming from the 2019-2021 bull market. If there’s something that the crypto movement has done right, it has been harnessing liquidity through narrative building and algorithmic mechanisms, with an apparently never-ending effect on digital asset prices. Yet, good times don’t last for ever, and high-beta frameworks were often not the most resilient ones in managing the downturn.

With the NFT market crushed by excessive supply, nonexistent demand, unjustifiable speculation, how is NounsDAO doing? The short answer is not great, with protocol treasury at c. $17m. How did they get there, however, is what interests us here.

» NounsDAO: Forking

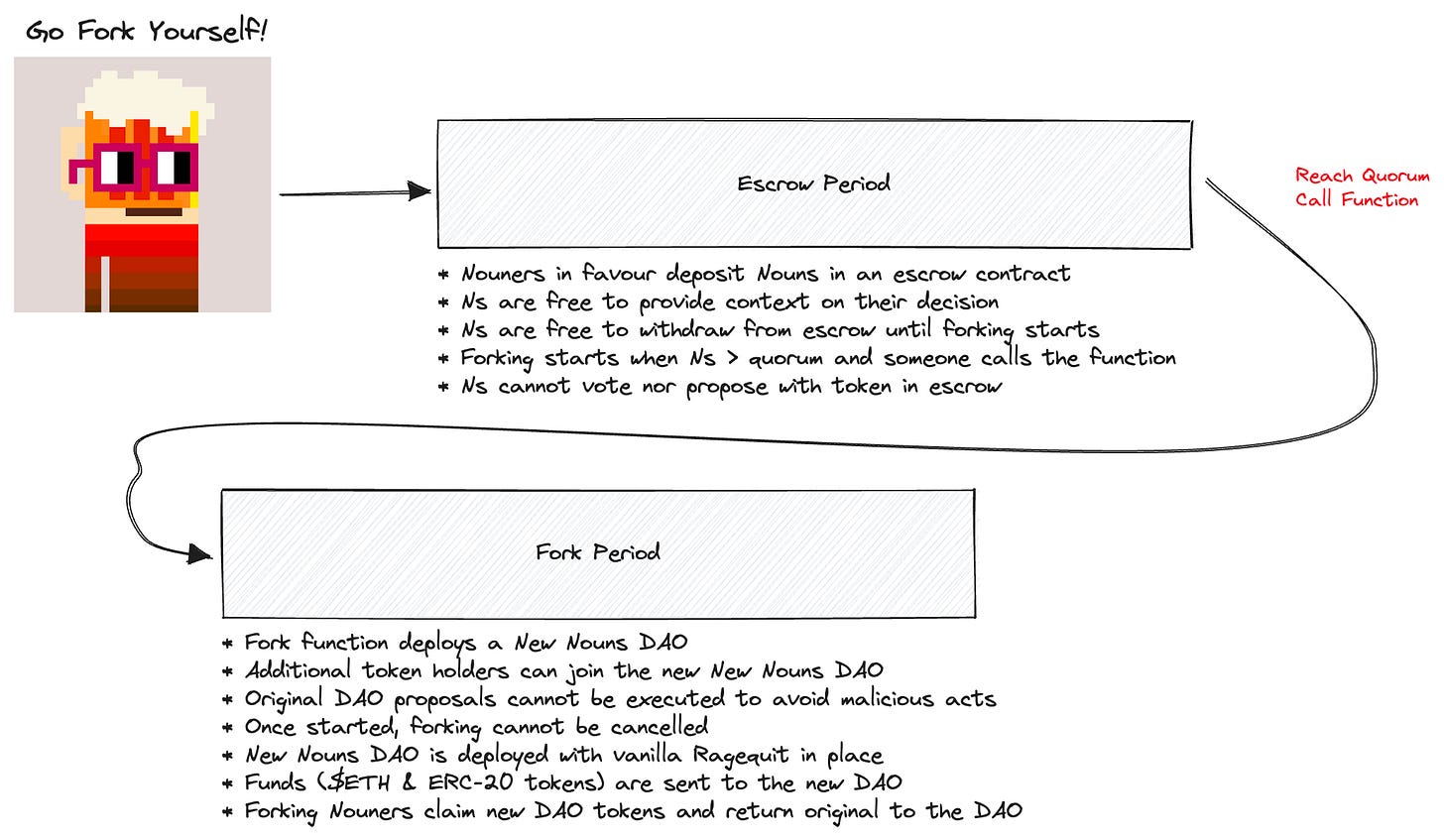

Following a series of debatable (and debated) proposals on how to productively use the protocol’s funds, in May 2023 some members of the DAO brought forward the idea of creating a native (on-chain) mechanism allowing members of the DAO to part ways, carrying a proportional part of the treasury with them. Although other mechanisms, like Ragequit, had been used in the past to allow individuals to put their hands on a pro rata share of project treasuries, Nouns Fork would give instead the ability to a group of participants to provide collective signal and move on, bringing with them not only financial resources but also tools to restart fresh their (sub)community. Nouns, yet again, was trying to pioneer governance incentive design, by giving minorities additional levers to protect themselves against the tyranny of the majority—within on-chain communities of course.

Proposal #356, introducing Nouns DAO v3 upgrade as well as Nouns Fork, was voted in August, passing with 201 Nouns in favour and 54 against, and included a required quorum for forking of 20%—soon lowered to 10%. The DAO had a new tool.

Fork 0 → Things didn’t stay idle for long. On September 8th, 2023, the first fork was executed, with 472 Nouns joining, and an initial treasury balance of 5,123.28 $ETH, representing at the time more than half the DAO. Bear market vibes caught up with the good ones within the community, with heated debates on fiscal policy reaching record levels. Growth is a history of decreasing marginal returns, and it became harder and harder to justify (often outlandish) spending in the middle of the coldest NFT market ever. Behind all words of accusation and defence, however, a more fundamental question loomed: had NounsDAO exhausted its original purpose (that of bootstrapping, growing, and monetising an art project) or not? Or more pragmatically, should NounsDAO have stopped spending money to just redistribute to the community what was left in the treasury? Ultimately all projects, like companies, states, stars, and ourselves, have a lifecycle—even if their lifespan is so much longer than ours we tend to ignore the existence of it.

Ragequit → Money talks. Over the following days, more than 60% of forked Nouns opted for the exit door, bringing with them c. $14m worth of treasury assets, or c. 35.5 $ETH / $50k per token. With floor prices at the time ranging below 30 $ETH, the arbitrage opportunity was clear. Even for a believer in the merits of the original DAO, it would have made more sense to get out through the window of the Fork→Ragequit mechanism and re-enter through the front door of the daily auctions. Public markets, or better price discovery, can be a bastard at times. Nota bene, current bid prices continue to range around 20-30 $ETH, with significant variance.

» NounsDAO: the Burn

In absolute harmony with the must always go up mentality pervading most of crypto’s class of 2020, rather than internalising the message what was left of the original community ran for the hills of incentive design, pregnant with the illusion that it exists a mechanism out there able to overcompensate market dynamics. On September 23rd, 2023, the Burn was proposed.

The Burn would have codified an incentive for the DAO to spend money, with the illusion of virtuously affecting auction prices through the credible threat of burning any $ETH in excess compared to the fair market value of Nouns. The formula worked as below.

More on the Burn’s insanity → With the prevailing auction price being the best available proxy for the most recent fair market value of a Noun, the formula compares the value of the treasury (which is backward looking) with that of the current outstanding Nouns. In corporate finance lingo, the formula tries first of all to calculate the equity of NounsDAO by comparing its available financial resources (or its assets) to the outstanding Nouns supply—or its liabilities. It goes, however, one big step further, by codifying a mechanism forcing the project to keep a net zero equity with the credible threat of burning any positive equity available at any time.

In the mind of the proponent, the credible threat would have forced the project to:

Spend $ETH in excess of the equilibrium—didn’t matter on what proposal

Artificially manipulate the price of new Nouns, de facto incentivising the injection of more resources into the project in order to avoid the project itself to defecate the existing ones

Keep the daily auction flowing, or in other words keep the project alive

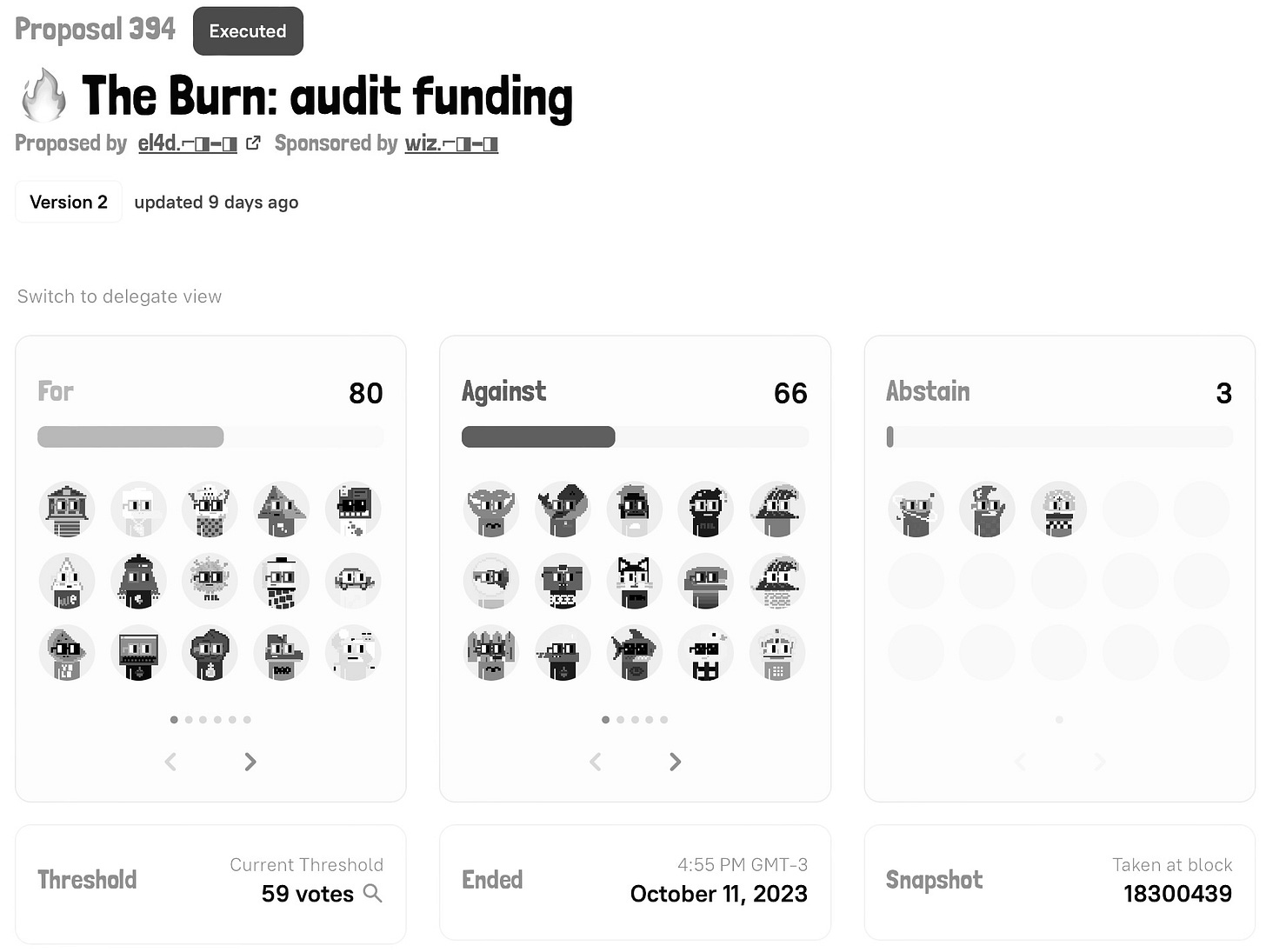

In its hubris and aloofness, the proposal goes completely against any sound principle of corporate finance. The fact that the proponent decided to quote the legendary Charlie Munger (“Show me the incentive, I’ll show you the outcome”) makes it even more ridiculous; imagine the old Charlie—who hates crypto more than the plague btw, or Warren, suggesting one of their portfolio companies, struggling to find accretive initiatives to spend money on, to forcibly sell their product to its own investors at jacked-up prices through the credible threat of financial suicide. My guess is that they would have simply opted to receive money back instead. Interestingly enough Apple, Berkshire’s largest holding, is also the one with the largest share buyback program in the world. Yet, DAO governance never stops marvelling us, and the community voted in favour of the burn—below.

Fork 1 → Certainly enough, with the road to the exit door made available by the native forking mechanism, the DAO forked again, with 69 now Nouns joining. It is still early (forking period ended 4 days ago) to see how many will opt for redeeming their Noun and get a share of the forked treasury through Ragequit; the arb, with redemption value c. 2 $ETH above floor prices, still exists.

Living Will

So, was forking good or bad, for the community? Did it contribute to the progressive demise of the Nouns project, or was it simply a tool used by a community to dictate its death by natural causes? In my opinion this is not a smart question to ask. Everything dies, and whether therapeutic fury can or cannot be justified, it isn’t something for me to say. I am simply a researcher. Yet, when the time comes, I’d appreciate it if those who will remain after me will do me the grace of letting me go. The stream flows, the wind blows, the cloud fleets, the heart beats.

Great read. Ragequits are "consensus cop-outs"