# 61 | EigenLayer: My Value Analysis of Economic Security

Merits, Return Profile, and Blatant Ironies of the Hottest Protocol Out There

I remember the study of principal components and factors in econometrics as one of those rare personal enlightenment moments where the elegance of mathematical structures could be appreciated in the context of drastic pragmatic benefits. In PCA, the covariance matrix of a dataset (containing most information about the interconnections among variables) is squashed into abstract and recombined components that are ranked by amount of information they carry circa the dataset itself. It turns out that few recombined components carry a very significant portion of the information contained in most datasets. Those components are eigenvectors of the covariance matrix, and its corresponding eigenvalues a sort of measure of the amount of dataset variability that can be extracted through that component. Such linear transformation works so beautifully that what we spend most time not on calculating but on giving human names to the principal components identified.

Eigenvalues and eigenvectors are everywhere in dimensionality reduction, and more in general everywhere in fields that employ linear transformation techniques and reiterated mapping. They are, more specifically, nothing short of fundamental in the quintessentially good-enough-is-great field of machine learning. Making enough sense of our continuum to fool a human is an exercise of pragmatism, brute force, and indeed dimensionality reduction. Making security good and cheap enough to be used is a somewhat similar exercise. The name EigenLayer is so beautiful and fitting, for a security abstraction and application layer, that I kind of feel guilty to point out that the value assigned to it by the market doesn’t make much sense to me.

Re-Staking in the Meme Only

As we often do here on DR, we aim to separate the signal from the noise. Usually one is contained in the other. But what constitutes noise for EigenLayer? How does EigenLayer define itself? According to its whitepaper, EigenLayer is a restaking collective—it is indeed a pretty simple and powerful market characterisation in crypto. But what exactly does a restaking collective entail? In striving for simplification, I ask the technical experts to pardon my inaccuracies.

In a nutshell, EigenLayer enables Ethereum validators to direct their beacon chain withdrawal credentials to the EigenLayer smart contracts, thereby opting into new modules that are built on EigenLayer. Essentially, modules built on EigenLayer can utilise staked capital currently providing security collateral on Mainnet, introducing additional ad hoc slashing conditions. Consequently, Ethereum validators can earn additional revenue streams by lending out (in some form) staked capital for other use cases while, on the other hand, security modules built on EigenLayer can leverage the existing Ethereum validator pool. Naturally, these additional modules must offer suitable incentives to Ethereum validators for this added security provision. This is the process referred to as restaking.

Publicly, the team places significant emphasis on the ability to productively unlock the staked $ETH pool, highlighting clear advantages—we are rephrasing the whitepaper’s points below and taking them at face value for now:

No need for an additional security layer for those modules built on Ethereum, that won’t require another digital asset (token) functioning as a security collateral

Reduced fee spillage for users who wouldn’t interact any longer with dedicated modules (but only indirectly with Ethereum)

Reduced capital (opportunity) costs for stakers—costs associated with the need to lock capital in order to (purchase and) lock specific security tokens

Decreased (security) start-up costs for DApps—given that the initial capital at risk in staked tokens could be significantly lowered

Three out of the four primary advantages highlighted in the whitepaper are financial, rather than technical. These advantages primarily concern the structural costs associated with ensuring a minimum viable security for users of decentralised applications. Given the financial undertone of those statements, I believe it would be beneficial to look at them from a corporate (or actually protocol) finance perspective.

Security Under a Corporate Protocol Finance Perspective

Blockchains have dramatically reduced the cost to build, launch, and maintain/ develop an application by providing an available common computation layer. If we ignore those costs and simplistically consider the computation layer a common good, we can conceptualise that projects require financial resources to create and control an asset generically called Security. Typically, Security in DApps has been achieved by asking external parties to invest financial resources in protocol-specific tokens that would have had to be put at risk to guarantee incentive alignment. In order to incentivise financially those parties, tokens accrue some level of yield (typically in kind) and, in the best case scenarios, some residual claim on protocol economics.

In protocol finance jargon, it would be fair to say that protocols fund their Security through the use of proxy-equity instruments, either of the pure or of the preferred type, depending on what type of financial mechanics are attached to them. From a protocol finance perspective, and under the semi-strong assumption of market efficiency, equity is indeed the highest cost source of financing a company can have; if a venture investor provides non-recourse funding to your start-up company, you can rest assured that in the valuation of such a company a good investor has embedded a 30-50% internal rate of return (or IRR) that he or she is expected to make in equity cash flows of some kind. This is an extremely dilutive form of funding for teams, even if probability of success is relatively high.

In token-land, dilution occurs not only through the surrender of company ownership in exchange for cash funding but also via frequently highly dilutive incentives designed to attract the capital that Security providers (and often users) contribute. When looked through the hyper-simplistic flowchart above, token incentives further reduce the ownership of a best case future valuation, and therefore depress today’s expected valuation further. In all frankness—and in my personal opinion, if we look at private valuations today, we can infer that those are more a bet on public market mis-pricing than anything else.

Reducing opportunity costs → EigenLayer’s point, that equity-like instruments are a very expensive form of funding and that some form of re-hypothecation of other types of instruments is a more efficient way to fund atomic security for individual protocols, is absolutely not wrong from a financial perspective.

Elegantly, if we consider Ethereum as a kind of sovereign economic system with its own rules and enforcement mechanisms, where investors (or citizens) evaluate risk directly in terms of $ETH rather than dollars, the process of allowing these investors to pledge $ETH for security is akin to enabling lenders to finance the assets of a company through a lower-volatility hybrid form of debt. This type of debt, even as subordinated as physically possible, is less costly than project-specific equity. The effect would be that of reducing a project’s cost of capital, and lowering the bar for innovation.

EigenLayer’s description of trust enforcement (read Security) is elegant. The research team identifies three sources of trust available to developers:

Economic: inferred from the (relative) amount of capital put at risk

Decentralisation-based: inferred from having a sufficiently-decentralised network of independent and isolated operators

Inclusion-related: somehow emanated by Ethereum validators’ privileged position in proposing blocks and running consensus software

Here on DR, considering the nature of the research I do (as well as my limited abilities) and the profound significance of the phenomenon, we concentrate on economic-based trust. Collateralised incentive alignment is not novel in the transactional realm, offering transparent and observable alignment, alongside prompt remediation for misconduct. However, this approach is inherently capital inefficient, as it requires locking significant resources in a non-productive manner to ensure trust, a topic we've explored above and that EigenLayer wants to mitigate.

Economic Security and Market Inefficiencies

EigenLayer puts a lot of emphasis on its ability to dramatically reduce cost of economic security through the re-hypothecation of $ETH in substitution of native equity-like instruments. Do I agree with this statement, at least from a protocol finance perspective? My answer is, well, that it depends on who asks.

While from an $ETH-denominating investor’s perspective it does indeed make a lot of sense that using $ETH rather than equity-like instruments drastically reduces cost of capital, it is not so relevant from a USD-denominated one. For investors that think, evaluate, and price in dollars, substituting the volatility of a native staking token for $ETH has only marginal benefits when it comes to lower volatility and inherent yield. Fortunately or not, 99.99% of investors and builders in this space think, evaluate, and price in dollars.

Wen token? Let’s be real, whether they are de facto securities or not, project-specific tokens that have some form of governance functionality, utility, economic, or scarcity claim have been considered by investors a proxy of a project’s success or fame. The same market sentiment has existed even without any residual financial or control claim. In a sector as small as crypto, tokens have been often more connected to narratives or expected liquidity shifts, rather than cash flows. No matter how we see it, it is clear and documentable how the market for equity proxies is far from being efficient in crypto, and how higher-than-rationally-justifiable token prices translate in a lower-than-rationally-expectable cost of capital for projects. Often lower cost of capital happens in the form of lower dilution for venture-funded rounds, or higher valuations compared to other sectors. It might well be argued that native tokens actually carry lower cost of capital than $ETH for builders due to the market inefficiencies across the capital markets stack.

Dual staking allowance → EigenLayer’s team, breathing crypto and definitely not living in a vacuum, seems to have anticipated the market inefficiency issue right from the whitepaper, or actually at the very end of it, when talking about Multi-Token Quorums. In what was later called Dual Staking, AVSs could specify more than one quorum, one based on staked $ETH and the other on native tokens. While EigenLayer states the ability for projects to define better-targeted consensus systems as the key objective of Dual Staking, we cannot ignore the skepticism that such mechanisms have been indeed introduced to make peace with the desire to launch native tokens in order to provide appropriate exit liquidity windows for investors and teams. Ironically, embracing this approach may inadvertently lead to even greater disruption for native tokens, resulting in significant adverse selection and in an increase in the inherent cost of capital for builders—who again finance themselves in significant part by (pre)selling tokens.

In their whitepaper, the EigenLayer team goes further, by describing a marketplace for efficient $ETH resource allocation, with the effect of further reducing cost of funding, and improving pooled security—although how this benefit is achieved is still unclear to me. The whitepaper describes how the protocol tries to maximise restaking flexibility by providing appropriate avenues to interact with EigenLayer’s smart contracts as a solo staker, a LST holder, or a LP token holder—so called superfluid staker. Although these are various methods to package Ethereum's native yield and enhance its interoperability, each carrying its own financial and technological risks, we can set aside these differences for the moment since they do not directly pertain to the analysis of the EigenLayer protocol itself.

Is Anyone Supplying Staked $ETH Then?

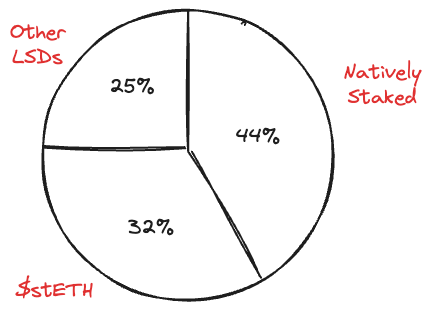

Short answer: many. Based on the latest figures (March 11th) there are c. $12b worth of staked $ETH (or c. 3.1m $ETH) deposited in EigenLayer contracts, c. 1.3m $ETH of which natively staked and the rest in the form of LSTs—with Lido’s taking the lion share. TVL has grown massively since the launch of the protocol, positioning EigenLayer as the second-largest DeFi protocol on Ethereum by TVL based on DefiLlama—just behind Lido. The irony of double-counting between Lido $stETH and Lido's re-hypothecated $stETH has not escaped me.

The process to restake on the platform differs depending on the type of restaking. LSDs can be easily restaked by interacting with the front-end—LSDs depositing has currently been maxed out. Native restaking is slightly more complex, and it involves broadly the creation of an EigenPod contract, and the definition of a set of validator withdrawal credentials. DR does not intend (nor is able) to provide a technical overview of EigenLayer, and intends to focus solely on the financial and incentive implications of the set-up.

Based on this amazing Dune dashboard, of the total $ETH supply of c. 120m, c. 26% is currently staked, and 2.5% restaked on EingeLayer across c. 116k depositing wallets. This is a lot. The demand side (AVSs and rollups benefiting from the restaking pool) is growing but it’s definitely just a beginning.

The Answer Is Points

So why would $ETH stakers participate into the pooled restaking community? Back in the glory days of the 2020-2022 bull cycle the answer would have been tokens. Today, it is points. Big difference.

What are points? Points are loyalty measures stored and verified off-chain, that theoretically provide future rights to participate in airdrops or digital token distributions. In other words, they are a loose derivative of digital assets, that provide some level of comfort to holders they will receive digital assets, most probably in the form of an airdrop, that are expected to have some financial value in a further distant future. If tokens were a (often worse) proxy of the equity interest in a project, points are a proxy of such proxy, with significantly less certainty and rights.

EigenLayer’s users receive points in proportion to their restaking time and amount—restaked units of $ETH per hour. For example, 1 $stETH staked for 10 days produces 240 Restaked Points. Around 2b Restaked Points have been emitted so far.

While there is no guarantee that points will be converted into tokens through a future airdrop, users are expecting EigenLayer’s token generation event (or TGE) to happen at some point in Q2-Q3 2024.

It didn’t take long for other protocols to start creating aggregation structures on top of EigenLayer’s point exposure. On Etherfi, for example, users could obtain $eETH, a natively restaked liquid staking token. Yeah, you are reading this correctly, a derivative of a derivative of a re-hypothecated digital asset. Users will be able to compound staking rewards with restaking rewards, as well as loyalty points to restaked points. Swell, Kelp, and StakeWise provide something similar. The cat is out.

I want to recap, because there are many moving pieces—oh God I was missing the bull market: we have protocols emitting points that promise to give exposure to future (hypothetical) token airdrops, in order to amass liquidity to be provided to another protocol (EigenLayer) in exchange for another type of points that promise to give exposure to future (hypothetical) token airdrops, in order to activate a restaking pool that intend to avoid the creation of project tokens in the first place. If you have reminiscence of Curve wars, you are not alone.

Where is the money coming from? DR is not a research venue that focuses on technical or trading topics, but rather on value analysis with the intent of deepening our understanding of economic designs—hopefully helping us to improve those same designs. Any value analyst should start by asking where value streams are coming from, and what is the connection between the expected economic returns and the flows. Ignoring dual staking, in a pure system that entirely uses $ETH as an economic security tool for AVSs, economic value accrues in terms of (i) $ETH emission (staking yield) and (ii) asset appreciation—achieved through lower supply and/ or higher demand. As a reference, currently (h/t ultrasound folks) Ethereum provides c. $1b of profits or c. 500 P/E at current prices, which is an incredible value if we exclude any implied monetary premium. We don’t have, however, to estimate implied returns on $ETH to assess whether depositing value in EigenLayer is fairly priced—thanks to re-hypothecation $ETH stakers are not renouncing to those returns.

So what is the market valuing depositing EigenLayer at, and why? KelpDAO is helping us (analysts) by tokenising 1-for-1 through $KEP EigenLayer points. At the time of writing those tokens were trading at c. $0.133 each, meaning that restaking one unit of $ETH for a year provides 1x24x365 = 8,760 points or $1,165 or 30% additional return at current (high) $ETH prices. What can justify the 30%?

Additional expected burning due to increased staking on Ethereum

Additional demand for Ethereum as a consensus layer

Better user experience for DApps and AVSs and therefore (1) and (2)

Some sort of economic capture of restaking for EigenLayer’s future tokens

Market dynamics (that I intend to ignore)

Interesting, even if we assume (1), (2), and (3) as realistic, EigenLayer would be more a public good with positive externalities than anything else. (4) hardly justifies a 30% return premium on $ETH at current prices. (5) is most probably the responsible one—betting on the heuristic “TVL up and token will pump”. Whilst EigenLayer may indeed represent a significant innovation by standardising the designs and execution practices of protocol security for projects to utilise—and I sincerely believe it has this potential, the figures don't quite add up from a value perspective. a16z has recently announced an $100m investments in the company, I would love to see your investment memo guys—please. Interestingly, the announcement refers to public good contributions; it is not economically irrational for a16z to invest in improving the Ethereum ecosystem given how invested they are more broadly. The EigenLayer investment should therefore be seen holistically and not in isolation.

Risks and Ironies

The analysis of nominal returns performed above is obviously superficial and not risk-adjusted, and excludes potential negative return implications for restakers driven by additional smart contract risk, slashing risk at the AVS level, and turbulence at the $ETH consensus layer caused by consolidated restaking. Re-hypothecation is indeed a dangerous beast, and increases opacity and systemic risks. I’d suggest anyone with sleeping issues to go through a 2017 paper by the Financial Stability Board on the topic.

Why doesn't EigenLayer take its own medicine then? Why not simply develop useful, standardised staking frameworks without resorting to the financialisation of its adoption via the same tokens it aims to partially render obsolete? Because it's crypto, mates, and people have bills to pay. May the bull market forgive us all.

fantastic read as always

STANDING APPLAUSE FOR YOU SIR. I enjoyed this immensely. Thank you.