# 12 | BlackPool: Initiate Coverage

Early Chapters, Valuation, and the Ingenious Term "Axies Under Management"

This is another issue of Dirt Roads. Those are not recaps of the most recent news, nor investment advice, just deep reflections on the important stuff happening at the back end of banking. The time we are sharing through DR is precious to me, I won’t make abuse of it.

The DAO of Morgan

From Narrative Economics: How Stories Go Viral and Drive Major Economic Events, by Robert J Shiller

We need to incorporate the contagion of narratives into economic theory. Otherwise, we remain blind to a very real, very palpable, very important mechanism for economic change, as well as a crucial element for economic forecasting. If we do not understand the epidemics of popular narratives, we do not fully understand changes in the economy and in economic behavior.

The history of modern investment banking is the history of the United States of America. At the very beginning of any story however, before anything had yet to happen, there was only a confluence of competing narratives trying to breach the heart and mind of the masses.

In hindsight every successful narrative has had its own series of prophets. In the case of modern investment banking one of those prophets, perhaps the very first, has been Jay Cooke. In the middle of the Civil War years, when the American government was in desperate need for fresh cash, Cooke successfully placed USD 830m of government bonds to a widespread group of retail investors, captaining a patriotic sentiment and the hunger for future financial gains. It was one of many successful stories of mass intermediation deployed to achieve a greater, more centralised, goal. In the meanwhile Cooke had pioneered price stabilisation mechanisms that are still at the core of the services currently offered by Wall Street, making himself rich in the process.

History moved on. Following the end of the Civil War the growing appetite for capital of an accelerating American economy, unsatisfiable through the existing local banks, led to the emergence of new institutions able to intermediate domestic borrowers and large, often international, pools of capital. Cooke’s era was fading. It was ultimately J.P. Morgan (the man) who broke Cooke’s government privileges by raising significant sums from Europe to finance, and actively steer, the development of the American railroad system. American investment banking had a new prophet. Through railroads, steel, treasuries, gold, J.P. Morgan exercised his immense influence on the American economy until death reached him in his sleep while he was visiting Rome, Italy, in 1913.

During the following century the American economy, and its investment banking, went through several more cycles of capital accumulation and dispersion, paced by exogenous (wars) and endogenous (technology) factors. Each cycle gave birth to new players and made illustrious victims. The House of Morgan itself, following the provisions of the Glass-Steagall Act of 1933, split into J.P. Morgan & Co. (operating the commercial operations) and Morgan Stanley (dealing with investment banking). Both institutions, although with a radically different shareholding backing them, still exist today.

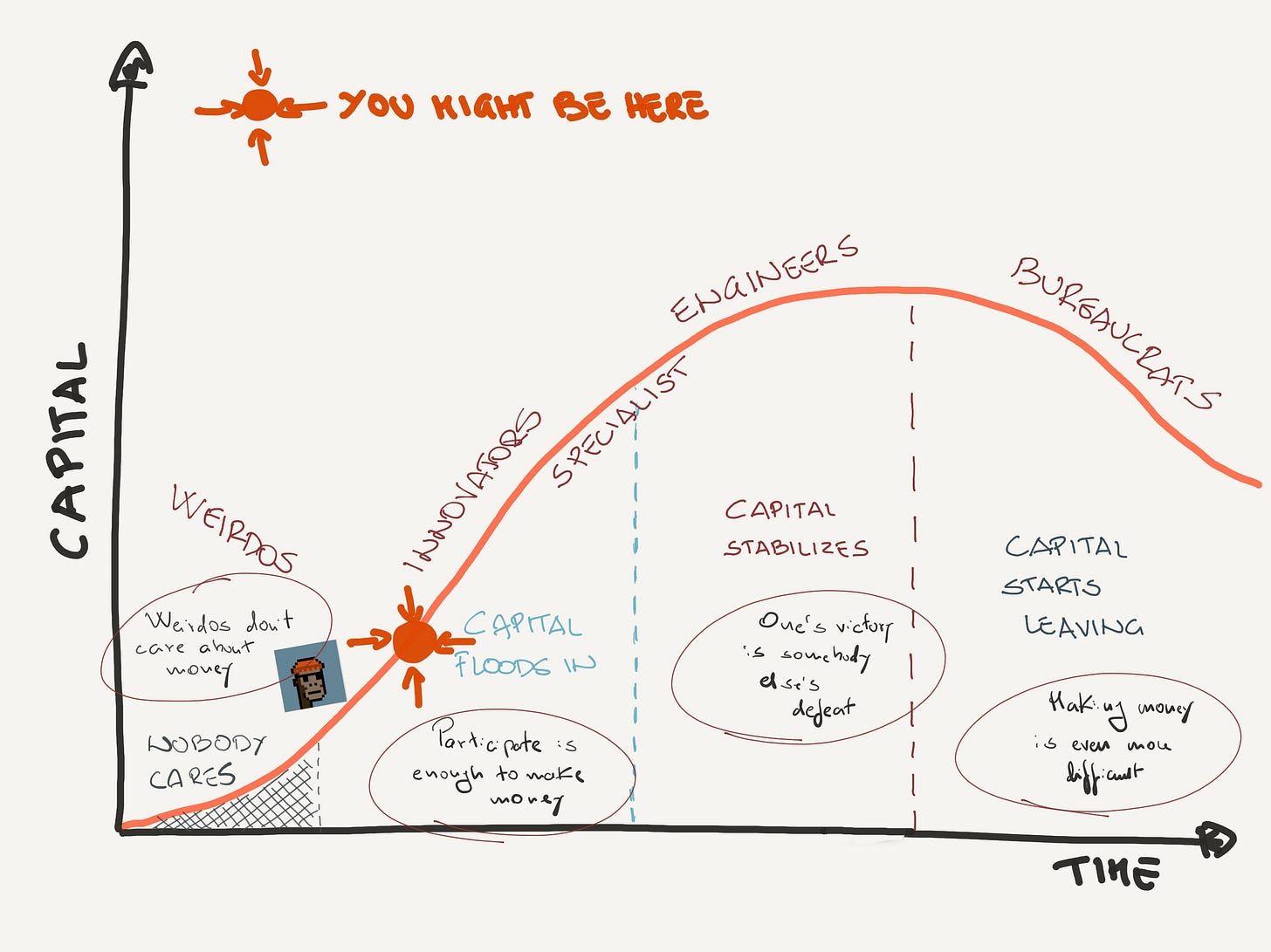

I firmly believe we are at the beginning of yet another capital accumulation cycle, and one that could obfuscate the tech-led capital starvation of the first decades of the 21st century. As it happened for the US at the end of the 19th, endogenous capital formation won’t be in any way sufficient to satisfy existing and future investment needs. As it happened for the US, a new generation of specialised institutions, able to intermediate external pools of capital with internal demands, will emerge. We just don’t know whether the early prophets of today will be the dominant forces of tomorrow.

This post of DR is dedicated to BlackPool, and divided as follows:

Black____: can insert pool or stone

Implications of the scholarship model

Challenges for a sustainable growth

My take on valuation

BlackPool: the Early Chapters of a Long Story

BlackPool was launched in December 2020 as a “new fund operating within the non-fungible tokens (NFT) space” with the ambition of providing access to some of the scarcest non-fungible assets, currently trading at prices that are prohibitive for most non-institutional investors. Fabric Venture and Stake Capital backed the DAO in their seed round.

Providing affordable access to expensive and scarce digital assets, however, could have been achieved through a much more hands-off approach, like the one used by Fractional, which unlocks liquidity and usability for highly-valued assets by fractioning ownership into standard, fungible, ERC20 tokens. BlackPool’s true ambitions are higher: the DAO intends to become the first quantitatively-driven asset manager fully specialised in the digital, non-fungible, assets space, whose (actively managed) returns could be accessible by anyone through ownership and staking of its governance BPT token.

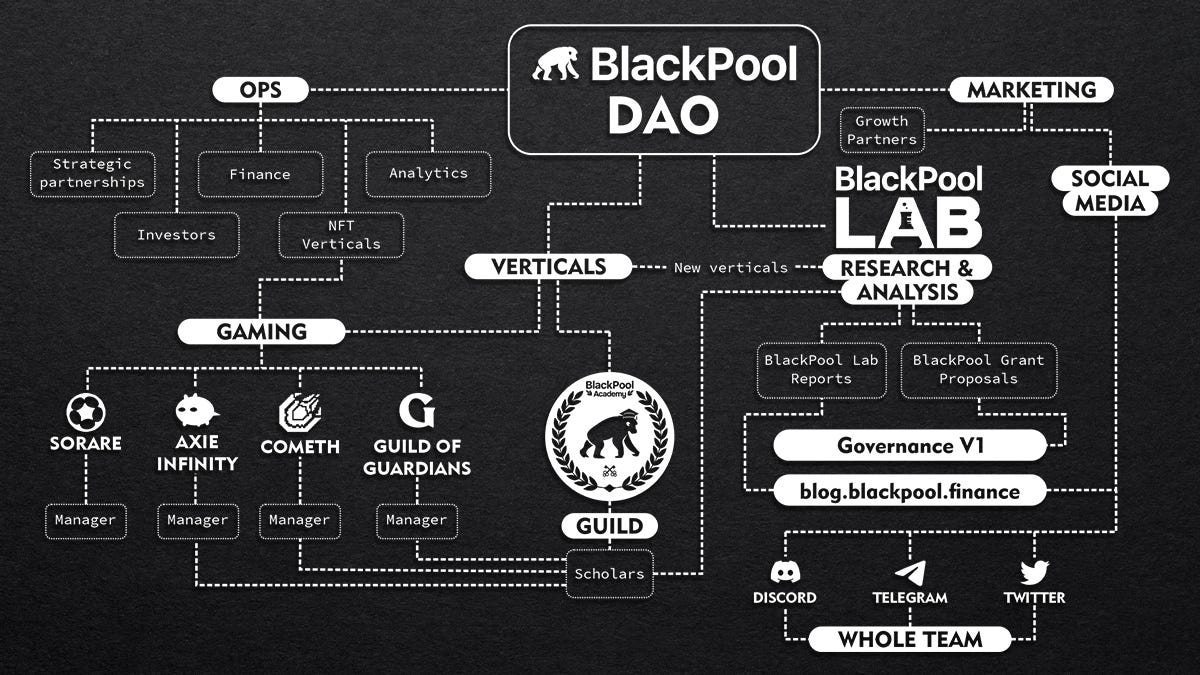

BlackPool’s organisational chart fascinatingly reminds that of an old school investment institution, just parachuted into 2021.

We can see back-office operations supporting the core business, marketing, research, and front office business units. As in most other DAO constructs, the company will at some point leave organisation and decision making in the hands of the governance token holders. We will have to see how this plays out in a complex, highly specialised, high-growth space such as the active management of digital scarce assets. Until then we must sustain the innate conflicts of interests of an organisation calling the shots, originating most of the business, and bearing and charging back development and management costs to token holders.

But what is BlackPool’s core business exactly?

Black____: Can Insert Pool or Stone

The DAO has a balance sheet constituted by NFTs belonging to specific business units, for total AuM of c. USD 15m. Those currently are:

Sorare - global fantasy football

Axie - battling and breeding Axies in a digital nation

Cometh - space exploration

Guild of Guardians - mobile blockchain RPG

OVR - spatial web platform for live events

Hashmasks - living digital art gallery

Collectibles - uncategorised collectible digital assets

Those units are expected to grow as BlackPool expands its expertise, footprint, and funding.

Assets are purchased and actively managed with the ambition of generating active returns from scouting and trading mispriced opportunities, and of using those same assets to generate passive return streams through NFT lending - this time not programmatically but for specific use cases. The DAO states that gaming and trading are the DNA of the company, but anybody can see how wider the applicability of its business model and expertise can be.

At Dirt Roads we have already written about Axie Infinity, so let’s look at the Axie business unit in a bit more detail.

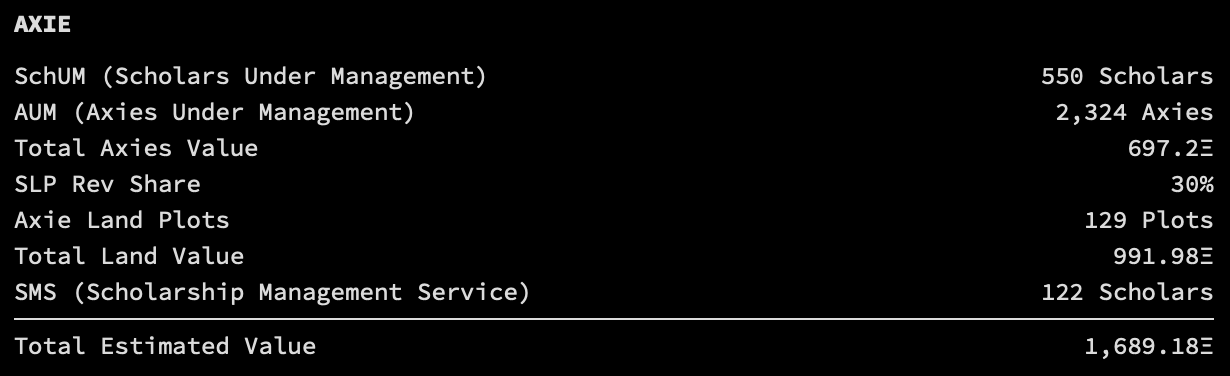

At the core BlackPool is a prop book. BlackPool’s treasury currently owns Axies worth an estimated ETH 697.2, and Land Plots for an estimated ETH 991.98. It is not clear how estimates are done, also considering that many of them would have been minted as a consequence of playing the game rather than purchased on the marketplace. It is true that those NFTs have enjoyed significant liquidity recently, but we ignore what type of accounting principles would apply to such investments. Are those asset considered as held for trading, or available for sale? Would those be accounted for at costs or at fair market value, and in this case how would the fair market value be estimated? Are changes in the estimated value affecting the governance token holders, and if they do, how? I have tried to find answers to those question but without luck - if someone from BlackPool wants to help the community navigate the balance sheet, DM me on Twitter or reply to this email.

On top of the prop book, there is a scholarship model. In order to maximise the yield of the assets owned (think of renting out owned real estate assets) BlackPool runs what they call The Academy, which could be somehow compared to a servicing arm of a TradFi asset management company. Actually, it runs two different types of academy. In the first one, the DAO selects and trains scholars and in exchange for a fee lends them DAO-owned assets able to generate in-game income denominated in SLP - Axie’s currency; there were 550 scholars at the time of writing. In the second, called BlackPool Academy Scholars Management Service (BPA SMS), the DAO onboards and actively manages assets owned by external owners, retaining 15% of the generated income and leaving the rest to the asset owner (15%) and the scholar (70%). Think of it as an old school property management service.

Implications of the Scholarship Model

By surfing the BlackPool’s blog it is clear that most scholars (aka players) are active in order to provide for themselves and their families. The lines between the metaverse and reality are blurring: merchants across the Philippines, Axie’s most represented nation, start accepting SLPs as a mode of payment for their products and services. Rather than being the fruit of a top-down political decision, the entry of cryptocurrencies in the real world of payments was the result of a bottom-up need, i.e. the fact that a significant fraction of the population started earning directly in SLPs.

The social, fiscal, and monetary policy implications are not negligible. With a significant portion of the population earning and spending in a foreign currency, how could the government control monetary base, inflation rate, job market, and tax coffers? With those transactions happening on separate rails, in an export-led economy still significantly informal, those issues are real. Programs like BlackPool’s Academy are acting as social buffers in a moment where developing governments are already stretching their limits, and they are doing it by channeling liquidity out of developed countries via the intermediation of a new type of export: digital gaming collectibles. BlackPool and YGG are sensitive to the topic, and position themselves as forces of positive change. The reality is that they are operating in a space with very little regulation, through a narrative that closely resembles that of the early days of the gig economy. We all hope they will learn from our past mistakes.

Challenges for a Sustainable Growth

As it happened for the first generations of investment institutions, the long term viability of projects like BlackPool’s will ultimately be dictated by (1) access, (2) accurate risk management, a (3) functioning organisation, and a (4) good dose of luck.

(1) Access -> Since the beginning of the industrial era, the control of the workforce translates into economic and political influence, often with vicious results - see Jimmy Hoffa. BlackPool and its main competitors are aware of this: a better access to the community that underpins each gaming world means a more stable workforce, better yields, and more liquidity for the governance tokens. New joiners are fought for and celebrated, upcoming events are heavily advertised in the community.

(2) Risk -> Financial intermediaries are regulated, heavily if they are granted the ultimate backstop of governmental deposit insurance or if they deal with the hard-earned savings of unsophisticated investors. Other institutional players that have power of attorney in managing institutional money (i.e. the hedge funds) enjoy significantly more freedom. BlackPool is definitely more similar to the latter. Currently, BlackPool’s balance sheet is fully backed by equity and doesn’t use explicit financial leverage; that won’t necessarily be the case in the future. DeFi protocols are starting to be deployed on NFTs ownership and trading - see NFTX, and again Fractional: sharding, staking, farming, could all increase market liquidity but at the cost of amplifying systemic leverage. It might become difficult, for outside investors, to appreciate the full risk spectrum of BlackPool’s balance sheet. Something similar happened to investment banking ahead of the Great Financial Crisis, when balance sheets became more illiquid, levered, and opaque, up to the point that not even insiders had a clear view of what was going on. The underlying exposures of metaverse asset managers are already increasing in complexity - see YGG’s latest token and treasury report. We welcome a future when data will be provided to the community in a standardised way to be analysed by specialised tools and providers.

(3) Functioning organisation -> There are currently c. 3m BPT circulating tokens, for a market cap of c. USD 22.5m. Total token supply is capped at 100m: 50% to insiders (with a 5-year vesting schedule) and the rest for the community - see below. In the long run, BPT holders will be able to participate to the economics via staking, and directly to the governance of the protocol. It is very difficult to assess from the outside how this would work through the governance forum.

(4) Good dose of luck -> I won’t comment on this one , but the trajectory of ARK’s Innovation ETF is a good proxy.

My Take on Valuation

I rarely end Dirt Roads with valuation consideration, it is a stupidly risky move when the spectrum of possible futures is still so wide. I can, at least, try to provide a very simplistic framework to potential investors.

There is a connection between assets under management (AuM) and market price for a captive asset management company - i.e. a company that fully enjoys the investment returns generated and doesn’t live on fees. Simplistically: when the company trades at premium over its AuM, it is expected that the growth of those AuM (i.e. their returns, if we assume again for simplicity total reinvestment) will exceed the internal rate of return (IRR) demanded by the investors while valuing the company. The opposite happens when the company trades at discount.

By using the standard formula to calculate the present value of a growing perpetuity, and mapping the implied growth rates demanded by the investor, we can have a good guide on how to think of a fair pricing. In the case of full dilution, i.e. an implied market cap for BPT of USD 413.4m1 , in order to justify the current 2.5x multiple of AuM vs. market cap an investor with, let’s say, a 50% IRR would expect a similar (48%) underlying investment returns with full reinvestment.

Growth in perpetuity is a harsh concept, especially in crypto where the ageing process runs several orders of magnitude faster, so let’s try to narrow our time horizon to 10 years. In order to justify the current fully-diluted valuation, a 50% IRR investor would require fully reinvested compounding returns of 92%. Limiting to a 5-year timespan, that number would be 166%. A lower expected growth rate would mean that the current price is not attractive2.

Insane, excessive, fully justifiable, a bargain? I will leave these considerations to yourselves.

Innovating is a communal effort. If you have great ideas you want to explore together, great companies that should be on Dirt Roads radar, or topics you would like to co-author on DR, please feel free to reply to this email or contact me on Twitter.

We do not consider those tokens allocated outside of the DAO as they could well be accretive to the business.

Slight catch here: we assume (1) full reinvestment of returns - a dividend payout would dramatically increase the asset growth required to justify current pricing, making the breakeven growth rate parabolic; and consequently also that (2) investors are indifferent between holding cash and token with a similar market valuation.