# 17 | Permission to Lend

Last Week SocGen Asked a Decentralised Community for a Loan, This Is Everything You Need to Know

This is another issue of Dirt Roads. Those are not recaps of the most recent news, nor investment advice, just deep reflections on the important stuff happening at the back end of banking. The time we are sharing through DR is precious to me, I won’t make abuse of it.

On the 30th of September, few hours after I published on Dirt Roads a piece called Full-Stack Central Banking, SocGen dropped a bomb in MakerDAO’s forum.

For the first time in history a blue-blooded invested bank, Société Générale, approached a DeFi DAO, MakerDAO, to (re)finance a security that was originated and held out there in the real world, the one made of real homes - those investors never visit before deciding whether to buy a security written against them, of real mortgages - those you only talk about with a bank teller, and of real dollars - those you can touch and feel in paper but that you forgot you never actually touch and feel.

The approach came in the form of a MIP6 application, a standardised process where any interested party can post and advocate the introduction of a new type of asset as eligible collateral to be pledged in exchange for DAI, Maker’s USD-pegged native stablecoin. The collaterals at stake, typically crypto-native tokens such as ETH or wBTC, were in this case OFH tokens - Obligations de Financement de l’Habitat, characterised as cover bonds and backed by home loans, rated by Moody’s (Aaa) and Fitch (AAA), and yielding a 0% rate.

Let’s stop here for a second and recap:

SocGen, an intermediary who’s currently the holder of a certain amount of super-safe bonds yielding no interest and issued by a subsidiary via DLT tech…

… is asking a Decentralised Autonomous Organisation, MakerDAO, to recognise those bonds as eligible collateral…

… in order to (re)finance those via their sovereignly-minted stablecoin called DAI…

… by pledging the bonds as eligible collateral in a vault

I looked again at one of the charts in Full-Stack Central Banking (the one below) and banged my head against the wall I didn’t wait at least a day to release it. For the first time in history we had a real-world non-qualified intermediary (SocGen), who had amassed a set of assets (off-chain mortgages) in covered bonds (liabilities), asking to be approved (become a qualified intermediary) and finance some of those bonds (eligible collateral) via a sovereign system (MakerDAO).

Then I decided not to bang my head against a wall, and instead take this as a segue to write the second chapter of the story. The approach by SocGen has already shaken the DeFi degens, who see it as a proof of concept. I wonder when their TradFi counterparts will start noticing too. For all of us spending time and investing in the space, the later the better.

How Does This All Work?

So how does this all work? What type of instrument does SocGen want to refinance? How safe is it? How would the structure work between the two worlds? And what does this all mean for the financial community? I have tried to put it all together. Let’s start from the beginning.

The Underlying Debt Issuance: Covered Bonds

In May 2020 Société Générale SFH (or Forge) issued a EUR 40m debt instrument with 5-year maturity backed by a pool of mortgages originated by SocGen and others. Those debt instruments, named covered bonds, help originating banks use their mortgage book to optimise funding costs while providing a super-safe source of yield to investors. The fact that those instruments are not meant to transfer risk away from the bank’s balance sheet but actually aim at using those assets to raise liquidity at advantageous rates, is important. There are several reasons behind the extra safety of covered bonds, but the two main ones are the following:

The underlying mortgages remain on the balance sheet of the borrowing banks, acting as an extra layer of security but not as the only source of yield for the ultimate investors - as it happens in a securitisation

Bonds are typically over-collateralised, with underlying mortgages representing in this specific case a value 15.7% higher than the par value of the instruments

It shouldn’t surprise that those notes are extremely highly rated. In the case of this specific issuance, both Moody’s and Fitch assigned the highest possible credit rating - Aaa / aaa respectively. Unsurprisingly, in Modern Monetary Theory times, the interest rate paid by those bonds is extremely low - a nice 0% in this specific case. This shouldn’t surprise us, as AAA-rated corporate bonds with 3.5-year residual maturity currently yield a negative 0.7% in Euro-land.

The Collateral and Structuring Under MIP6

There is one (big) thing however that makes this specific issuance different from most siblings. Through the application of a new open-source market framework called CAST, Forge issued those covered notes in a tokenised manner on the Ethereum blockchain. The OFH tokens, a one-for-one representation of the notes, are currently held by SocGen - Forge’s mothership.

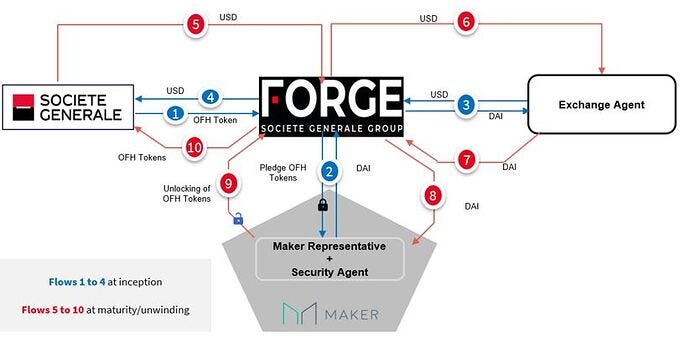

CAST is trying to patch off-chain traditional issuances, that depend on a series of centralised authorities and regulatory frameworks, with on-chain and quasi permission-less sources of liquidity within DeFi. The challenge lies in letting those two worlds speak more than in accommodating DLT as a new tech to manage storages of value. Maker, to start, is not a legal entity. The structure envisaged in the MIP6 to pledge OFH as collateral with Maker is cumbersome - below, but there’s no way it could be otherwise.

We can simplify a bit the intra-company flows to highlight a few things worth mentioning.

(1) MakerDAO needs to elect a legal representative → With MakerDAO not being a legal entity a Maker Representative needs to be identified in order to execute all the legal docs that are necessary on the TradFi side. Forge has done the scouting and is bringing forward the candidacy of DIIS Group in the role. Such candidacy and its mandate will have to be ratified by the community.

(2) Forge indirectly borrows DAI from Maker → SocGen’s ultimate goal is to refinance a USD-denominated loan. To do so the group borrows DAI through Forge signing an agreement with the Maker Representative who will, in some way, receive the DAI minted by Maker.

(3) Forge will pledge (but not transfer) OFH tokens as collateral → Forge will pledge an agreed amount of OFH tokens to protect the DAI loan, to a Security Agent; coincidentally, DIIS Group could act both as a Maker Representative and Security Agent.

(4) DAI will be exchanged in USD by an Exchange Agent → Forge will exchange DAI into USD through an agent - not yet identified; the USD will then be used to refinance the loan by SocGen.

(5) All parameters are to be set by Maker → All parameters, including the applicable Stability Fee, Debt Ceiling, and Collateralisation Ratio, will have to be established as part of the onboarding process within MakerDAO’s governance framework.

As it happens for all collateral types, the DAI loan issued vs. the OFH tokens will terminate in one of two possible scenarios: (6) repayment, or (7) liquidation.

(6) Redemption by SocGen would trigger unwinding of the structure → Following the maturity of the underlying notes - or another refinancing, SocGen would trigger the unwinding of the structure: (i) SocGen redeems USD loan vs. Forge, (ii) Forge exchanges those USD for DAI with the Exchange Agent, (iii) DAI obtained by Forge are used to redeem the DAI loan with the Maker Representative, (iv) the pledge of OFH tokens is released, (v) OFH tokens are transferred back from Forge to SocGen.

(7) Insufficient collateralisation would trigger termination and liquidation → Each business day a Collateral Agent values the OFH pledged vs. a pre-agreed threshold, and informs both the Security Agent and SocGen. If the collateral pool isn’t replenished within a certain period a liquidation process kicks in. The loan is terminated and the OFH are transferred to the Security Agent who will proceed in liquidating them. SocGen will retain any remaining excess value.

Why SocGen’s MIP6 Matters, and Why It Doesn’t

SocGen’s intention to finance a very small portion (up to DAI 20m) of a super senior and extremely liquid instrument for a very short time (6 to 9 months) is irrelevant in the grand scheme of things, but it matters much more than what it seems at face value.

It Matters for SocGen

SocGen is paying a price to do this transaction, and not only in the form of salaries and advisory fees. Namely, it is asking for a loan at a 0% interest rate when it could place it in the market at negative levels. I know, it is difficult to wrap our mind around this, but currently super safe borrowers can get money and give back less than what they got. How can it be? It’s all about opportunity costs: if you are a bank, today, and have liquidity in your balance sheet - which by your own nature you do, the central bank would charge you to park it there. Zero (nominal) is suddenly a good result.

Great advertising. So why is SocGen doing this, and for such a small ticket? First of all it is great advertising: in being the first institution to interact with DeFi, SocGen is trying to position itself as the reference intermediary when users and providers of capital will intend to access the DeFi ecosystem to satisfy their needs. Most traditional institutions have pushed themselves to offer crypto-linked investing solutions, or maybe custody services, to their clients, but SocGen is the first to try and connect the pool of capital sitting in DeFi with traditional use cases of institutional size. That could have also positive externalities in how innovative potential clients would perceive SocGen to be.

Reaching new hungry investors. There’s really not the need to reach out to the DeFi ecosystem to refinance a super-senior and mega-liquid covered bond, but let’s judge this as a way to test the waters. Once the link has been established, the channel could be used to finance many different assets. The appetite for risk is there, what we miss today is the infrastructure. SocGen had the merit to understand MakerDAO’s positioning in the DeFi ecosystem: a very conservative lender with the ability to mint currency at an almost-zero cost of capital, and a focus on footprint expansion more than extra-high returns. Once the proof of concept has been established, riskier loans can be pledged to other pools in the ecosystem. With the DeFi economy growing from within, the bank had the intuition this might be the right place to start. I tend to agree.

It Matters for MakerDAO

MakerDAO won’t be able to ask for a lot more than 0% in Stability Fees to refinance those loans, and that’s not a lot. Still, the transaction represents a landmark for Maker’s future development and for the DeFi ecosystem as a whole.

A step towards making MakerDAO a core pillar of DeFi. In Full-Stack Central Banking I had argued MakerDAO was best positioned to be the senior lender of last resort of ultra-safe loans within the DeFi ecosystem. SocGen’s application is a dramatic step in that direction. With a strong focus towards protecting the DAI as the main crypto-native stablecoin, Maker shouldn’t be excessively focused on returns. More DAI mean a more widespread adoption, and this has a virtuous effect for Maker.

Outsourcing and decentralising most of the work. SocGen has been doing most of the heavy lifting for this transaction: originating loans, packaging them into bonds, negotiating with the regulators, designing the transaction, and ultimately reaching out with a MIP6. Maker has had no cost whatsoever, and might be able to offer financing with minimum involvement. If the community will approve the transaction, the signalling power to other similar borrowers will be immense. This goes in the direction of decentralising most of the work by dictating, under consensus, the key rules of engagement of the community, rather than doing the work in house. A similar signalling power could be used to enforce the high ambitions of environmental sustainability that Rune Christensen (Maker’s founder) has been advocating in the forum.

A more diversified collateral pool. Today, one of DAI’s main issues is the over-reliance on ETH or highly correlated alt-coins as a source of collateral. As we have argued several times here on DR, a lack of diversification limits the ability to grow for Maker’s sovereign coin. Expanding the collateral pool to assets that have a negligible, or even negative, correlation vs. ETH has huge benefits for the stability of the DAI. Said with different words, by financing the covered bonds currently owned by SocGen Maker is incorporating another use case (or industry) into its sovereign community - residential real estate. A larger, more diversified, economy translates into a more stable sovereign currency. In the hypothetical distant future where the collaterals backing the DAI extend to hundreds of use cases, billions of ultimate borrowers, and deserve the unconditional trust reserved to mature and safe sovereign economies, the DAI might not even need a hard peg vs. the USD any longer.

But There's Still a Lot Missing

For as much as SocGen’s move is unprecedented and powerful, there is a lot missing.

Not much decentralisation. There is quite a lot of centralisation in this transaction, and that isn’t really in line with DeFi’s trust-less ambitions. One firm will act as Maker Representative and Security Agent intermediating flows and securing collateral, collaterals are periodically valued by a Collateral Agent, no automatic rules are written in the code of smart contracts for pledge enforceability, a centralised and not well-specified Exchange Agent will swap DAI and USD, and all agreements are dependent on external legal and regulatory frameworks. We can imagine a world where every contract is natively tokenised, where collaterals sit in a smart contract that doesn’t depend on anybody’s will or ability to do their work, but this is not the world SocGen (nor the rest of the financial world) is living in.

Not the best use of capital. Yes, it is true that Maker’s cost of minting new DAI is negligible, but isn’t there a better way to use freshly minted DAI without parking it in a 0% yielding instrument? Especially considering the APYs achievable out there within the DeFi ecosystem? We have argued that there are probably more pros than cons in providing financing to this type of instruments but, at the margin, couldn’t have Maker found a slightly higher yielding collateral? Probably.

Not the most transparent liquidation mechanism. Usually, when things turn south in the crypto-market Maker’s DAI position is secured by over-collateralisation and a well-oiled auction system that incentivises liquidators to buy out the collateral and make a good profit by immediately re-selling it. Things should stay extremely volatile for a long time to hit Maker’s position - assuming the smart contracts work well. Visibility on the auction mechanism and on the market liquidity is ensured by the nature of smart contracts coding. That’s not the case here. The Security Agent has the mandate of liquidating the OFH token in the (remote) scenario that’s needed, but Maker needs to rely on its best effort. On top of that, OFH is not a liquid instrument, it’s traded over-the-counter and has currently a limited natural market - i.e. institutional regulated investors interested in a zero-yielding security issued on the blockchain. Good luck. Sure, soon those types of tokens will float in DEXs and CEXs and have a market themselves, but that’s not the case today. SocGen might have offered an extra guarantee to stop-loss the doomsday scenario.

MakerDAO’s community reaction is uncertain. MakerDAO has showed itself to be an incredible cohesive community, with the immense ambition of remaining the core pillar at the centre of the DeFi ecosystem. But it is not sure how the community will react to this collateral request - although initial signs are positive. Crypto-native members do not necessarily respect traditional banks - sometimes for good reasons, and might not grasp the monetary implications of being a 0% lender to the traditional financial system. The next weeks will be important.

This transaction might be a benchmark moment for other borrowers and use cases, and its importance couldn’t be overstated. At the same time we shouldn’t get carried away. There is still a lot to do on each front: DeFi lending pools need to educate and structure themselves to welcome the bridge, and centralised counterparts must understand that there are lines of decentralisation and control that cannot be overstepped when dealing with this side of the universe. We have had a first contact.

Innovating is a communal effort. If you have great ideas you want to explore together, great companies that should be on Dirt Roads radar, or topics you would like to co-author on DR, please feel free to reply to this email or contact me on Twitter.

How to buying on this program