# 19 | Klima, a Family Story

Tackling the Ultimate Coordination Failure Through Unsatisfiable Greed

This is another issue of Dirt Roads. Those are not recaps of the most recent news, nor investment advice, just deep reflections on the important stuff happening at the back end of banking. The time we are sharing through DR is precious to me, I won’t make abuse of it.

In my latest article on OlympusDAO I had promised to leave John Von Neumann and Oskar Morgenstern, the two semi-gods of applied mathematics, alone. But I changed my mind. So after bashing $OHM for their pseudo-theoretical (3, 3) we can look at some real, although very simple, game theory: the so-called prisoner’s dilemma - or PD.

In the PD, two bandits are caught by the police and have the opportunity to avoid jail time by talking - although at the expense of the other. The optimal strategy would be for both to stay silent and get one year each. However, since the incentive to betray is so strong for both, they end up with two years of jail each by both playing the betray strategy and cap their maximum loss.

A lot is condensed into the matrix above. First of all, it is a game, i.e. a set of interactions among actors governed by well established, widely known, and immutable rules. Second, it is a rational and non-cooperative game, meaning that every actors is supposed to maximise his/ her expected monetary payoff function, and only his/ her own. Third, it is symmetrical, since these payoff functions are all similar. Fourth, it is simultaneous, as there is only one game and one game only to play. Fifth, it has perfect information, with all actors knowing exactly what is going on. Last, it is zero-sum, with one actor winning at the expenses of another.

How many situations, in real life, do sit at the crossroad of all those characteristics? None. Still, the PD is the most used (and abused) example of game theoretical thinking of the last fifty years, and for a good reason: it is simple to understand and yet fully provable mathematically. If you want to embed into a quantitative framework the fact that actors can jointly take stupid decisions, use the PD. If you want to show how we can screw everything up even when we know exactly what we are doing, use the PD. If you want to try to change this twisted cooperative dynamic, go back to the whiteboard and start from the PD.

Nash-Stuckness and Sequential Games

The climate crisis is the emblematic PD.

We know that by ignoring the problem we are digging our children’s grave and still we do nothing about it. The assumptions at the basis of the climate crisis game theory are easy to demonstrate: we kind of all know we are poisoning ourselves, we are supposed to care about our legacy, we are lazy and discount future pain vs. present pleasure the same way.

Fortunately there is a silver lining: the climate crisis is a very extreme version PD.

Things look so bad that the game has actually two Nash equilibria: we could all keep doing nothing, or we might actually start doing something. Said less technically, we are stuck. The silver lining is that it is enough to tweak the payoffs slightly to tilt the game towards one equilibrium or another.

We have two options:

We can wait for time to change the payoffs, e.g. making the worst case immediately life threatening

We can try to create ourselves an incentive system that pushes early movers to do something and get an early mover benefit

Somebody out there understood that blockchain tech, often nominated the ultimate coordination problem solver, might have been used to implement (2) by transforming the game into a sequential one and by leveraging the insatiable financial greed of us humans. Let’s dive.

Family Businesses

If OlympusDAO and Greta Thunberg fell in love while on a date together, at Burning Man, their daughter would have been called Klima. Driven and passionate like her mother, visionary and thirsty for money like the dad.

Klima was born in privilege, thanks to dad’s businesses, and learned from him that you can construct a mechanism to suck cash in based on an attractive manifesto and the incentive for adopters to remain involved. The secret for success is that: (i) the manifesto needs to be very attractive - like that of creating a decentralised reserve currency that remains unbound by a peg, and (ii) the incentives to get and remain engaged need to be, at least at the beginning, insanely high - 100,000% APY type of insanely high.

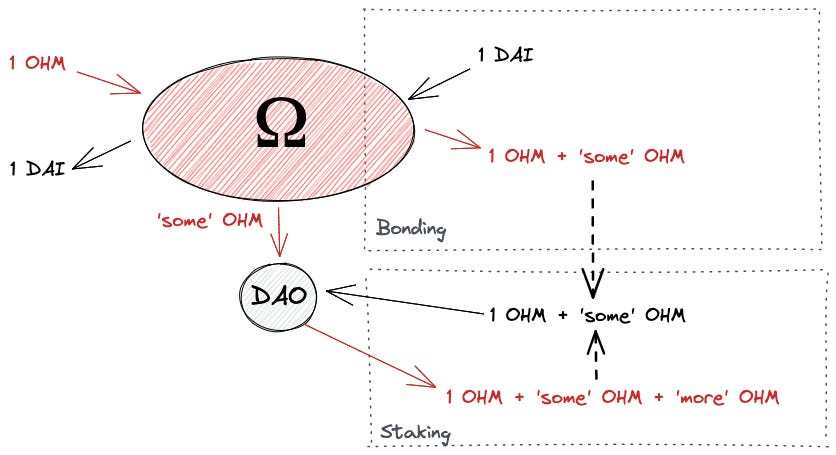

We already spoke about OlympusDAO extensively. In its simplest form, OlympusDAO is a bank that issues currency, $OHM, in exchange for two types of collateral: (i) other currencies, (ii) a promise to provide liquidity to their native $OHM.

This has, allegedly, several advantages for adopters:

It diversifies the pool at the basis of the meta-currency $OHM across the various currencies that are accepted as collaterals

It provides a source of revenues (the liquidity attraction tech that can be rented out to other protocols - i.e. Olympus Pro) that could justify a currency premium in the market (market cap minus market value of treasury assets)

It recreates through market dynamics a powerful money multiplier (market cap over market value of treasury assets) that other centralised stablecoins aren’t able to replicate, expanding footprint

It guarantees available liquidity with limited slippage for the users of the native currency $OHM - while also internalising the fees for providing such liquidity

Olympus’ model had, however, one weak spot: in order to justify the continuous attraction of new liquidity, the assets already attracted should have generated value at a rate that was faster than that of the attraction of inflows. The larger the asset base, the more difficult this would have been. With inflows slowing down nobody could have anticipated how everybody would have reacted to more normal, or even negative, returns on their money. Dad’s business was still up and running, but with the constant threat of imploding.

It was the profound distrust for the self-referencing capitalist system that Klima inherited from her mother that gave her an idea that could have solved, potentially, Olympus’ flaw. So, fast-forward one generation, KlimaDAO was created on Olympus’ footsteps as a bank that issues currency, $KLIMA, in exchange for two types of collateral: (i) carbon, (ii) a promise to provide liquidity to their native $KLIMA.

The substitution of an asset with negative carry - idle cash that burns in your pocket, with one with positive carry - unused credits to pollute, could have just done the trick. Klima might have found a type of asset that, by being scarce in the real world and damaging when used, could have appreciated in value by simply remaining idle in the treasury of the DAO. Coordinate a group to keep doing nothing is easier than do it to find a (progressively more difficult) productive use of time.

How You Tokenise Carbon Emissions

Today, by investing in projects that prevent and reduce emissions being released, businesses can receive carbon offsets credits. Those credits are tradable in the open markets, and provide a crucial source of funding for those offsetting projects to be financially sustainable. The creation of such markets is an indirect way to price and discourage the production of greenhouse gas. A carbon offset represents a measurable and verifiable removal, reduction, or avoidance of GHG emissions and is denominated in tCO2e - i.e. tonne of CO2 equivalent. Standards exist to verify that those projects meet the required quality criteria. The Verra Standard and the Gold Standard are the two major verifiers.

Through the Toucan Carbon Bridge, those tCO2e can now be brought on-chain: physical carbon offset credits are retired (i.e. cancelled from the registries) and recreated on-chain on the Polygon network as TCO2 tokens. The bridge is one-way, meaning that if the tokens are burned, there’s no central party that needs to register the cancellation - this improves the scarcity narrative and avoids single points of failure. Those tokens represent individual projects, with individual characteristics, and are non-fungible in nature.

Because of this, TCO2 tokens are not very liquid. That is why Toucan created carbon pools, vaults where TCO2 projects with specific attributes (type, vintage, country, etc.) can be set as deposit criteria. Toucan worked with KlimaDAO to create their first pool, the Base Carbon Tonne - or BCT. In this pool tokens must be Verra-verified, and have a vintage of 2008 or greater. The BCT token is still somehow specific but, representing a larger aggregate of underlying projects, carries higher liquidity.

There are quite a few steps here, making the transfer fragile - as it happens for most real-world → blockchain bridges, and delaying price discovery.

Arguably, the price reaction of BCT tokens, traded in DeFi liquidity vaults, will be faster than that of NFTs of individual projects, and much much faster than paper-based carbon credits.

Klima, Queen of the Desert

The mechanics of bonding and staking are similar to OlympusDAO’s - again, you can read more here, but the nature of the treasury assets is a very significant difference:

Carbon credits are a real-world resource with demonstrated industrial use and market value (ask Tesla)

Those credits are supposed to be a scarce and diminishing asset, something that is supportive of their market value - differently from what happens for money, credits have a positive time value

Reducing their availability in the open market (by trapping them in Klima’s treasury) is another supportive force for their market value

There is a premium for treasury, both financial and environmental, in remaining idle and doing nothing with those credits

I decided to do some simple calculations and see what would be the rational behaviour of an early adopter. I spare you the math, but there are a few forces interplaying here.

Ignore bonding. The one-off benefit coming from the bonding discount can be ignored when designing an optimal strategy - staking returns will always be higher than bonding discount to discourage the bond→cash→swap→bond loop. Bond vesting, also, is a way to reduce arbitraging and stabilise the inflows. Bonds are a way for more sophisticated investors to optimise their returns, while doing something very useful for the protocol.

Staking favours early adopters. Staking returns come in the form of a growing share of the pie, and because of the law of compounding, benefit early entrants that have longer compounding periods.

Inflows are key. The benefit in terms of accruing share of the pot materialises because there are new inflows coming in all the time; those new inflows, as well, are rational because there is an expectation that those inflows will keep coming in. The benefit of inflows is disproportionally allocated to early adopters. Without new inflows, it wouldn’t make sense for the late adopter to stay engaged because his/ her share will continue to get diluted against that of early adopters. Late adopters cashing out might ignite the death spiral.

Treasury returns are key for sustainability. The force needed to keep adopters within the system grows exponentially, and hence only treasury assets with convex return can ensure that centripetal forces continue outpacing centrifugal ones. Nevertheless, inflows will stabilise at some point. Carbon credits have the potential to do this, and that’s where Klima differs from Olympus. The scarcity of tokenised carbon assets in the market - compared to stablecoins, acts also as a limitation to the speed of growth of the Klima protocol. And in this type of liquidity aggregation mechanisms, speed is key.

It Wasn’t All Flowers

KlimaDAO officially launched this week printing some impressive numbers - at the time of writing: c. 40m USD attracted in treasury that were used to purchase 4,013,538 carbon tonnes - a lot of them sitting in liquidity pools, c. 1.5m USD of LP fees earned by the protocol, a c. 530m USD market cap - i.e. 12x multiple on NAV, c. 13,200 klimates (🌳, 🌳), and still the highlight APYs in the 50,000% that investors love to see. You can find a great Dune dashboard here.

The launch, however, wasn’t uneventful. Everything was delayed by c. 2 hours, infuriating the Discord community. Klima issued an official statement describing what happened. An unofficial BCT pool was set up at a price of USD 100, with the pricing surging up to USD 1,600 - well outside the parameters that the DAO had in mind. BCT currently trades at c. USD 5.5 on Sushiswap. The DAO had to intervene by selling BCT and drive the price down, although somebody might have clipped significant profits in the process. Around the same time the community crashed the Discord server, leaving many in the dark. Debate is still heated on Discord about what happened, and it will be most probably the medium term outcome of the project that will be ultimate judge - huge profits tend to make everyone happy.

The issue of price opacity, however, will remain. It is very difficult to assess what is the underlying price of real-world carbon credits for those that participate in the on-chain ecosystem, and we can’t deny to suspect there is somebody making some serious money by collecting off-chain credits at very low prices - given that they most probably have very low liquidity, tokenise them, putting them in the BCT pool, and throwing those tokens into the KLIMA black hole. But that’s also how it is supposed to work in DeFi, with arbitrageurs doing the lifting and making an outsized portion of the profits. In order for Klima to become as big as Olympus, my beginner’s math says that roughly 10% of the outstanding carbon credits should be swallowed by the protocol. This might be possible and would be enough to impact carbon pricing also in the real world, which is ultimately what Klima was set up for.

Last Words

Ultimately, the Klima experiment resembles a 101 class on how to build a drug cartel: gather significant amounts of cash with the promise of insane wealth in order to remove big chunk of product and keep prices high. Heroin, like carbon, is highly addictive and does better to the world when kept idle and off-market. It is one of those rare occasions where the hunger for profits is conducive for a better communal outcome. Like in drug dealing, the taxman might soon notice and come knock at the door.

Disclaimer → I purchased and staked some KLIMA tokens and I am now waiting impatiently to reduce pollution and become insanely rich to then be able to buy back my right to pollute just a little bit. Purchase was minimal in accordance to Dirt Roads Rule #1: don’t get high on your own supply.

Innovating is a communal effort. If you have great ideas you want to explore together, great companies that should be on Dirt Roads radar, or topics you would like to co-author on DR, please feel free to reply to this email or contact me on Twitter.

What kind of assumptions/constraints led you to believe ~10% of carbon offsets being swallowed by the protocol? And how would the DAO guarantee bad actors (say, a big polluting country/gov't or company) won't interfere with the protocol?

Solid post bro. Love the Greta reference. 😂