# 35 | Morpho, Gentleman Vampire

Describing What Might Happen but Hasn't Yet Is as Way of Living

Pardon me Steve, but from the first first time I heard it, I have found the saying that you can only connect the dots looking backwards rather insulting.

In hindsight, we can justify pretty much anything. Every stupid decision, every nonsensical move, every bit of supreme luck, becomes testament to our superior intelligence, epic stamina, or to the ineluctable existence of the Supreme. While starring at the papers full of stains and random patters that are our lives, backward-looking assessments resemble nothing more than idiotic Rorschach tests. Look, a goat. Hey, blood. Incredible, the rolling Italian hills of my childhood. In my opinion there is only one way of living honestly, and it’s by looking forward, battling the strength of the winds, the adrenaline pumped by unavoidable uncertainty, the shakiness of our convictions, and the rigour of our thinking process. Opting not to live cuddled by the warm magic of self-inflicted ignorance is a difficult decision, and a decision not for everyone. But it’s up to us and no-one else. The signs are all out there, telling us what the future might bring with a fair and measurable degree of certainty and risk. It means choosing the scientific method rather than magic, hard work rather than comfort, patience rather than wishful thinking.

Everything we need to live lays in front our eyes. We only have to try to decipher it. Together. We know most among us won’t, and that’s a great head start to transform the future we want into reality.

Vampire Bankers: Evolution of Crypto Lending

Emmett Lathrop "Doc" Brown’s influential invention, the time machine, was built upon one scientific intuition called the flux capacitor, consisting of a rectangular-shaped compartment with three flashing tubes arranged in a Y configuration - source Wiki. Mounted on a 1981 DMC DeLorean, the flux capacitor allowed vehicle and passengers to travel back and forth through time bypassing obvious philosophical and mathematical conundra. In the land of DeFi, the constant product function powering the first generations of automated market makers is probably the closest comp to the flux capacitor. The mathematical equation connecting lenders and borrowers on pool lending protocols, however, is a close second. And in all its mathematical inelegance when compared to AMM’s constant product engine, the formula governing rates remains second to none when it comes to pervasiveness in the everyday lives of DeFi users - as it sets the liquidity opportunity cost for the whole industry.

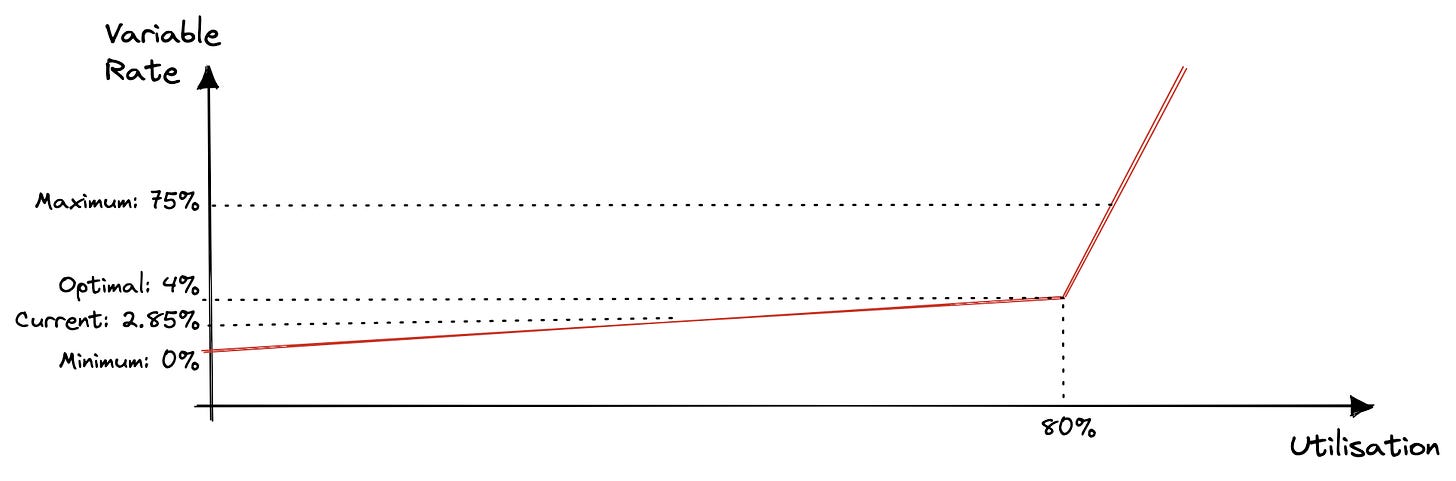

There are a few things we can deduct by looking at the formula governing rates / spread - the above is an abstraction of Compound’s:

The formula is heavily parametrical, with slope, intercept, and reserve factor (i.e. protocol fee rate) being set by governance rather than left to market forces

The output rates / spread depend uniquely on the observed utilisation rate for the pool

It is a linear first-degree function, meaning that the elasticity of the rates to changes in utilisation is constant - there isn’t, in other words, a growing disincentive to borrow as we move rightward along the utilisation axis

The last point is particularly important for pool lending protocols. By using a first-degree function alone it would be impractical for the protocol to incentivise an optimum utilisation level - something crucial for a protocol that intends to continuously maintain a healthy level of liquidity in order to allow borrowers and lenders to smoothly enter and exit the money market. The protocols solved this issue brutally by applying two different functions, with different set of intercept / slope parameters, joined at an inflection point that coincides with the maximum utilisation level the protocol is ready to sustain. By tweaking the slope of the second f(utilisation) the protocol can further disincentivise borrowers willing to push into undesired territory.

There is, however, an additional effect deriving from this mathematical approach to rate setting: the bid-ask spread (you can look at the function above) is proportional to the slope of the curve and tends to grow with the utilisation rate. There is no utilisation level, however, where the spread between borrowing and lending is zero - even with deeply liquid pools and very little movement around the optimal utilisation rate. This makes Compound-type systems very capital inefficient, with the spread being indifferent to what borrowers and lenders are theoretically ready to pay and willing to receive. A small portion of that spread is captured by the protocol’s reserves, but a lot is lost in terms of potential volumes.

Criticisms of inefficiency were applicable also to the first generation of AMMs, and the result was an innovation spree that brought us Curve, Sushi, and most recently Uniswap’s v3. The same, for some reason, didn’t happen to lending protocols, with innovation flowing horizontally (less collateralisation, more risk, more leverage, different bundles, more stablecoin integration, etc.) rather than vertically - simply better lending protocols.

In some sense, the width of the bid-ask spread is a measure of the market attractiveness. As usual, we should follow the margins.

Morpho: Peer-to-Peer Overlay and Ode to Composability

The guys at Morpho Labs listened. What is Morpho? Morpho is a protocol intending to vampire-attack Compound and Aave, betting that the width of Compound’s and Aave’s bid-ask spread will make it attractive enough for users to port their liquidity to their meta-protocol. They haven’t yet launched on Mainnet, so we have the benefit of trying to anticipate what could happen. How would that work? See below.

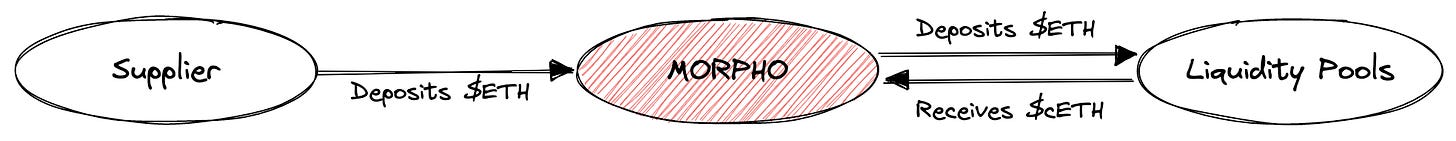

(A) Supply liquidity → A supplier provides token liquidity (e.g. $ETH) to Morpho, that on the back end (assuming for now there are no borrowers) parks such liquidity in a liquidity protocol such as Compound or Aave, receiving in the case of Compound a $cETH token in exchange. At this stage the supplier’s situation on Morpho is exactly similar to that of someone who directly provides liquidity on Compound or Aave.

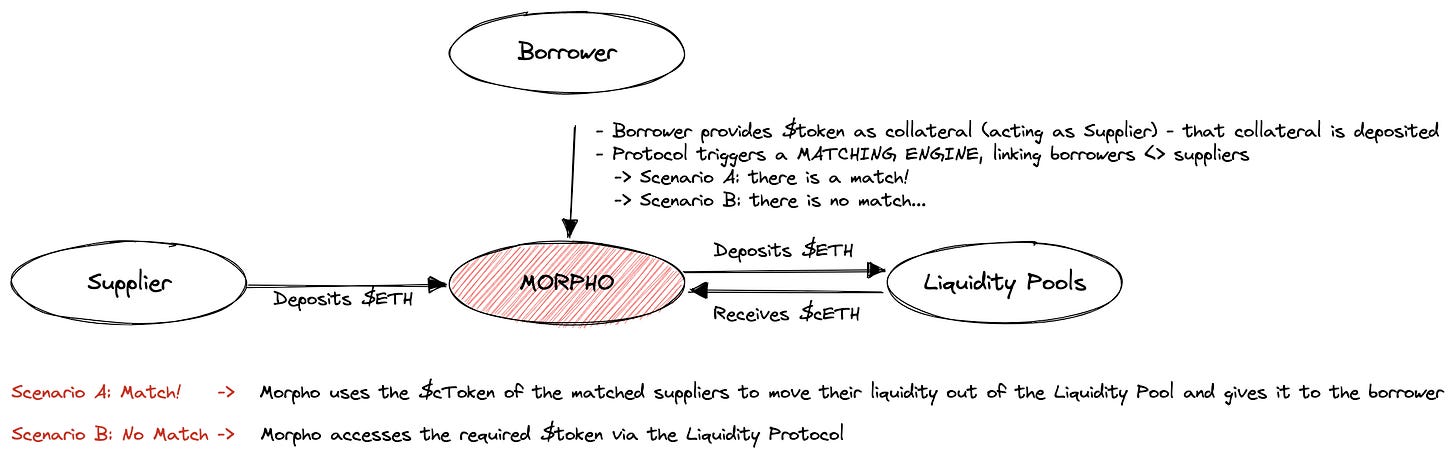

(B) Borrow liquidity → A borrower comes in, provides a certain amount of collateral through Morpho, and signals his intention to borrow a certain amount of tokens. Morpho activates a matching engine to search whether the other leg of the trade exists. If it finds one, the protocol automatically redeems the $cToken (in the case of Compound) and matches supply and demand. The position has now moved from Pool-to-Peer to Peer-to-Peer.

Both supplier and borrower of a matched transaction can, potentially, enjoy a better deal because they do not have from the inefficiency of the lending pool rate setting function. In case the matching is impossible (or incomplete) the borrower would access the liquidity pool at the same terms of a borrower that interacts directly with the underlying protocols, making her indifferent. A supplier could also directly stake a $cToken in Morpho and the value stream wouldn’t change. It goes without saying that Morpho aims at mirroring the same underlying collateralisation and liquidation mechanisms as well.

The value of Compound as an omnipresent back-up option is more evident when we look at a situation with mismatched liquidity. In the example below Morpho has only 1 supplier and 1 borrower, with the supplier providing 1 $ETH and the borrower intending to get exactly that 1 $ETH - and providing a certain amount x of $DAI as collateral, consistent with the collateralisation factors applied by the underlying lending pool protocol - in this example Compound.

We have a match :) → Supplier and borrower are peer-to-peer’ing, and both get some sort of mid rate that benefits both of them for as long as they are matched; for the time being we can ignore any interest rates and incentives provided to the borrower for the x $DAI collateral deposit

I want out! → The supplier wants out, but the borrower doesn’t; Morpho now borrows 1 $ETH (at a higher protocol borrow rate) and pays back the supplier who’s now out of the equation; the borrower is now protocol-to-peer’ing and pays the higher borrow rate - which is still not worse than what she would get directly on Compound

Ready to repay → The borrower is ready to repay her $1 ETH (plus a weighted average) interest to get back the collateral, through Morpho, the circle is closed

By construct, suppliers and lenders would always have an APY that is better than or at least equal to that offered by the underlying pool protocol - including both the base rate and any token rewards. We are saying by construct, because in the worst case scenario a protocol such as Morpho would stick to protocol-to-peer’ing. In normal conditions, with a positive spread existing between bid and ask, that would mean that the peer-to-peer applied rate would sit somewhere between the two. Underlying incentives, however, could de facto invert the spread when they are applied more aggressively to the borrowers - like in the case of Anchor - see here and here1. This would limit the usability of a Morpho-type of peer-to-peer overlay, but it is fair to assess that aggressive liquidity mining programs cannot exist in perpetuity.

Given the structural Pareto-superiority (if we ignore the additional protocol risk layer) of the Morpho construct we would expect a through-the-cycle imbalance between providers and receivers of capital. This is where the matching engine becomes important. The logics and parameters that govern the engine, which is the algorithmic jury deciding who among the wannabe borrowers and lenders can benefit from the superior peer-to-peer yield, are ruled by governance. This includes potential incentives provided by Morpho in the form of their native tokens, a powerful tool to reset the imbalance between the two sides of the capital equation.

If you are feeling the vibes of a Convex-esque play you are not alone. At this stage it doesn’t seem that Morpho intends to offer the ability to recursively play the ve game by providing strong incentives to farm native tokens and influence allocation dynamics. This doesn’t mean this won’t ever happen. From Morpho’s whitepaper:

“Morpho Tokens can be used for different purposes like taking part in Morpho’s decentralized governance or boosting supply and borrow APYs by reducing a potential reserve factor or influencing the matching engine. Finally, if necessary, the Morpho Token can also be used to incentivize certain behaviours that benefit the protocol, for example through liquidity mining programs.”

Morpho Labs, the team behind the project, is already envisaging an evolutionary path based on three main phases: Caterpillar, Chrysalis, and Butterfly. With time, Morpho intends to aggregate demand across underlying protocols and use them efficiently to optimise the conditions at which lenders and borrowers interact among each other. Unsurprisingly, the aggregation will have to go through an off-chain phase before everything can run smoothly on ephemeral crypto layers only.

Standing on the shoulders of giants → Before we start analysing the ultimate phase of Morpho’s intended evolution, Butterfly, we can’t avoid addressing one important pillar and at the same time weak spot in the protocol’s strategy. The success of the project is predicated on the continuous existence and functionality of underlying liquidity protocols such as Compound or Aave. For as much as the interest bonding curves (the term is used improperly here) adopted were and are vastly inefficient, their success was due to liquidity omnipresence. For as much as peer-to-peer appears fascinating, ultimately you need available liquidity at all times to make a maturity-transformation business such as lending (also here the term is used improperly) successful. In the golden days of the DeFi Summer 2020 nobody was too concerned about the width of the bid-ask spread: borrowers were ready to pay whatever to lever up their token investments in a market that was shooting for the moon, and lenders had enough to be happy with given borrowers’ appetite. Things, however, have changed, and the appetite for borrowers and lenders to park liquidity isn’t the same - there are currently c. USD 10.6b sitting as deposits in Compound vs. less than USD 4b lent out and this is not indication of a healthy supply <> demand match. The mere emergence of projects like Morpho is testament that the underlying protocols aren’t reacting fast enough.

What would happen, however, if asymptotically the entirety of their liquidity would move to protocol overlays such as Morpho, using Compound or Aave simply as cheap liquidity parking lots? It is fair to assume that the revenues gathered by those protocols would drastically diminish, impairing incentives for good maintenance and development, and ultimately impacting the very cornerstone upon which the success of Morpho is built upon. Ironically, Morpho’s success could be its own demise. Less ironically and more pragmatically, a good equilibrium could be achieved allowing both protocols to exist one on top of the other.

Butterfly and Rates by the Order Book

The story of Morpho isn’t dissimilar from many other stories in DeFi of protocols iterating on others’ successes and trying to suck liquidity rapidly in order to support their own development. But what would happen to the crypto money market in case Morpho’s vampire attack would be a success? In its Butterfly phase, Morpho Labs anticipate that the effective rates would be set by some sort of competitive dynamics between suppliers and borrowers. Similar to the Uniswap v3 case, those actors could even choose to compete within very specific ranges of the interest rate bonding curve. Pools however, both in the case of DEXs and lending protocols, weren’t born on the Ethereum blockchain solely to guarantee continuous presence of liquidity, but also for more mundane transaction costs problem. It is very inefficient (on Ethereum for example) for atomic borrowers and suppliers to interact continuously among each other to set dynamic peer-to-peer pricing. This could obviously change, but we are far away from worrying about that yet.

But it will. And will that be the endgame of lending constructs? As usual, not at all. In an ode to DeFi composability, we could just observe a reshuffling of the food chain in favour of a more efficient and powerful stack. We are seeing glimpses of this already through MakerDAO’s D3M initiative on AAVE. Through the D3M Maker, as ultimate issuer of its own $DAI stablecoin, acts as an interest rate stabiliser on the Aave platform. There are currently c. $DAI 280m deployed through Aave’s D3M. The initiative was one of the very first examples of a minter of stablecoin acting as a lender of last resort for its own currency through a third-party money market protocol. The D3M alone, however, doesn’t make of Maker the setter of $DAI’s systemic interest rate - e.g. the way it is for $UST through Anchor, but rather the stabiliser of its own money market. Based on the observed market dynamics, it is evident how it is the shape of the interest bonding curve to be the most impactful factor in defining market rate equilibrium. The shape of the bonding curve is parametrical and decided by governance.

In a decentralised world a sovereign issuer can do at best what the rails on which its currency flows allow. From this point of view the emergence of an order book type of interest rate setting engine would be a game changer. Stablecoin issuers (the only ones truly having an inelastic ability to increase or decrease their money supply) could decide exactly at what level to anchor their mid rates, by participating to the marketplace in the same way today’s central banks participate in open market operations for their quantitative easing efforts.

And it doesn’t have to stop here. Stablecoin protocols, who more than anyone value interoperability and liquidity, could potentially incorporate the same market making activities by incentivising liquidity providers through an approach pioneered by Olympus for its own governance-with-reserve $OHM token - see below.

Chasing the Real Risk-Free Sovereign Rate of DeFi

Something is telling me we are not at the end either, but that we are flying closer and closer to the sun. That sun, in crypto-land where value flows on distributed recording layers, is probably the underlying return for maintaining the most fundamental infrastructure. In Ethereum 2.0 jargon, that sun are staking rewards. It is my assumption that staking rewards are the ultimate, true, nominal risk-free rate of any decentralised native financial system. Anything sustainably above that is merely the result of additional risk - being it technological, market-wide, or credit-specific. We are far from reaching some sort of price stability for the native tokens of base layers such as Ethereum, but we will get there at some point. The remaining volatility (e.g. around liquid staking versions) of $ETH could be dribbled out via derivatives similar to $RAI (we wrote about $RAI in the context of treasury management here) and sold to those who are in the volatility business - my guess is they shouldn’t be currency managers.

There are several ways a lending protocol could incorporate the base layer’s staking yield - Terra’s Anchor is the most prominent example today. We have written extensively about Anchor recently, and won’t annoy the audience again here, but there is one thing we can repeat here on DR: the idea of intermediating deposits and loans by incorporating the base layer’s staking yield (i.e. bonding $LUNA) is great. Since the dawn of modern times banks have been engaged in transforming risks and maturities by pooling and structuring, and the composability of blockchain tech can make this even smoother, more transparent, and more efficient. Anchor is engaging exactly in this - whether it is doing it in a sustainable way is a different topic we won’t address here. I have my ideas.

Before concluding, let me adventure into some sort of pompous heuristic-stating effort, caveating this is truly for my own personal amusement. Yet, I believe this could be a useful reminder for many of us. The theorem’s last words are particularly important.

Disclaimer: I am currently advisor to Cherry Venture’s first crypto fund. Cherry is a seed investor in Morpho among others including Nascent, Semantic, AngelDAO, Daedalus, Stake Capital, Faculty Capital, and Atka Capital. The initial investment predates my advisory relationship.

A strong assumption here is that liquidity mining incentives are valued at face value, i.e. using oracle pricing at the time of allocation. This is a strong assumption, as aggressive liquidity mining programs can negatively impact realisation price.