We live in a strange loop. Something looks weird, as it always does when the snake eats its own tail. Many have tried the illusion of closing the loop, and there is always something that hits our gut feelings. Escher played with closed-loop perspectives that warp around themselves: stairs that go up and down at the same time, rivers that flow downstream to ultimately become waterfalls falling into the same rivers, men that look at themselves into infinite mirrors. Bach played with similar illusionary fractal harmonies, as well as Zimmer. Staircases that keep going up for ever until suddenly something breaks them before that the listener can go insane. It is no coincidence that Nolan, obsesses by the flow of time, has collaborated with Zimmer for so many movies. If you want to blow your brains up, I have you served.

There is a reason those tricks drive us mad. For as much as they look and sound convincing, they are impossible. Mathematically impossible. And our brains know it. Research on self referencing has been at the centre of mathematics for ever, until Gödel dropped the mic. If you sometimes wake up thinking to be smart, just know that a man managed to mathematically prove at the age of 25 that no consistent system of axioms, whose theorems can be algorithmically listed, is able to prove all truths about the arithmetics of natural numbers. In layman’s language, the kid demonstrated that the rigorous research for knowledge that starts by setting the axioms (unprovable truths) and then lists provable theorems one by one, will never end. No matter the simplicity of the system, no matter the number of theorems, and no matter the number of axioms either. The symbolic space of the mind, in other words, is infinite.

The strange loop cannot ever close. If your senses are telling you something is wrong, it might be that someone is trying to let you believe the opposite. A musician, a director, a painter, a politician, an entrepreneur. Sometimes they call it the flywheel, the magic machine, the new paradigm, the incentive-complete system. Watch out. At some point, the music stops.

Nouns: the Value of the Seat

The Nouns Project is beauty in simplicity. And, as often happens for frontier experimentation, it has become way more than that. And, yes, I know I am late to the party. Beginning on the 8th of August 2021, the Nouns protocol has generated and auctioned one Noun every 24 hours, starting from Noun 1 — Noun 0 was for the founders. Or Nounders. It is supposed to continue to do so for ever. As of today, the protocol is auctioning Noun 397.

WTF Are Nouns → In a nutshell, Nouns are simple examples of generative art in the form of non-fungible ERC-721 tokens representing stylised 32x32 pixels pictures of people, places, and things. They look like this.

How Are Nouns Generated → Nouns are generated by shuffling predefined characteristics belonging to 5 traits: backgrounds — 2 characteristics, bodies — 30, accessories — 137, heads — 234, glasses — 21. Assuming no further characteristic or trait is added (they can and I am sure they will) that’s 1,923,480 available combinations, or c. 5,270 years of runway, all with equal probability of happening. The generation algorithm is kicked off by using a Nouns Seed that is based upon the block in which the prior auction was settled. It is a nuance, but an important one. After the auction is completed the community must trigger settlement, and although the winning bidder has obviously the incentive to do it, settlement could theoretically be triggered by anyone. This provides power to the community to influence what characteristics the next Noun would have, with implications we will dig in later. You can experiment with the generating mechanism on the Nouns Playground.

The auction process → Every Noun, apart from one each tenth that goes to the Nounders free-of-charge, is auctioned to the highest bidder. Simply put, the highest bidder will receive the Noun permissionlessly at settlement, with 100% of the $ETH clearing price deposited in treasury. The average winning bid has been $ETH 67.12 per Noun — Dune, or $110k at current prices. This means that a totality of c. $ETH 26,513 (or c. $43.4m) has been transferred to treasury. Being ERC-721 tokens, those Nouns can be sold on the secondary market, and looking at Opensea, 81 of the c. 400 nouns generated have changed hands, for an average price of $ETH 82, or $ETH 15 average profit.

(Basic) Governance Implications → Nouns DAO is tasked with managing the current balance of the Nouns treasury — Etherscan, through a governance infrastructure that is as simple as powerful:

One mandate and ultimate guardian: financial resources should be used to strengthen and expand Nouns’ footprint, and Nounders retain ultimate veto power to enforce it against non-compliant successful proposals

One-Noun-one-vote: each Noun gives the owner one vote in governance

Simple majority: for each proposal, the vote with the highest number of supporting Nouns wins — subject to quorum

Dual quorum: a minimum threshold (currently 1 Noun) must be reached to submit a proposal to governance, and another (currently 5% of outstanding Nouns) to execute a successful proposal

So far, 125 proposals have been submitted to the DAO for voting, showing a mix of operational improvements, governance parameterisations, grants for expansionary projects, and allocations of available financial resources.

Sure, the Nouns Project is a spectacular success story for a hedge fund bootstrapped via a capital raising strategy anchored around the release of distinctive art within a niche yet deep-pocketed community. That would be the take of the slick-haired private banker. But we are better than that and know that great things are not originally about the money, ever. The reason why here, at DR, we care about Nouns, is for what Nouns is pioneering and experimenting on: dilutive ossified open-source governance. Let’s unpack the definition.

Dilutive | Governance → Recently, we have spent significant time in detailing and analysing the most powerful limitations of today’s dominant DAO governance structures — ref. #43. The approach taken was post-academic: we tried to get involved — at Maker, then stepped back, analysed what happened, and now are starting to propose alternative approaches. One of the takeaways from getting my hands dirty was understanding the effects of power concentration: the existence of highly concentrated and unquestionable centres of power incentivises corruption. It is now evident that most crypto projects started with a governance token distribution that is impractical to be meaningfully reshuffled, making it impossible to explore universal maxima and providing incentives for insiders and outsiders to turn into bad actors. A dilutive governance mitigates this phenomenon.

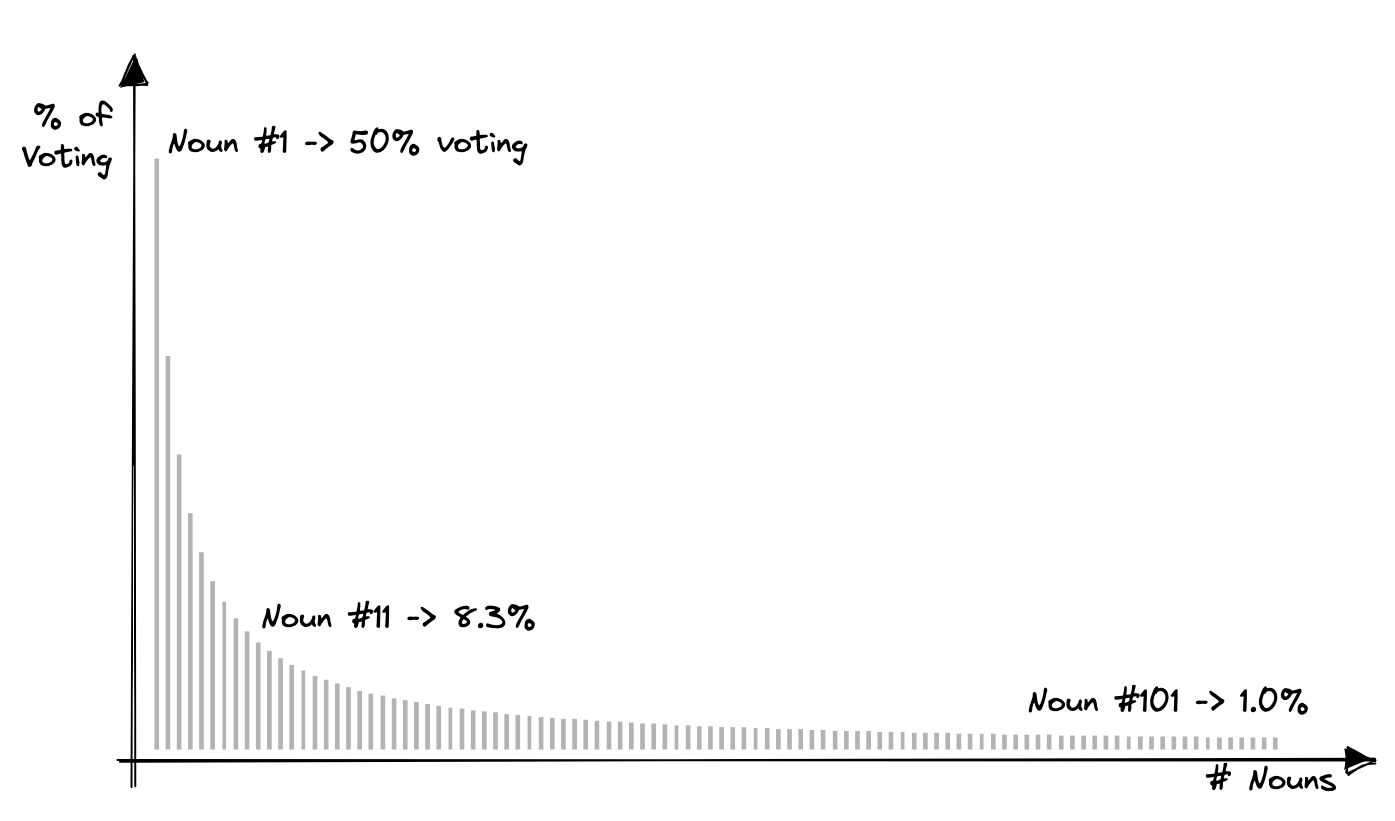

It is not difficult to see how a one-Noun-one-vote system is dilutive. Buying the first auctioned Noun (the very first Noun wasn't auctioned and went straight to the Nounders) would have come with 50% of voting power. Buying the 11th 8.3%, and the 101st 1.0%. Said differently, in order to control the majority of voting we would have needed to own 7 Nouns when the 11th was auctioned (after #0 and #10 went to Nounders) or c. $770k at current prices, and 52 Nouns when the 101st went to market or c. $5.7m. Securing a majority of votes gets exponentially more expensive.

Another way of looking at this is to calculate how difficult/ costly it would be to challenge Nounders’ voting power — ignoring their ability to veto. We would need to own 3 Nouns when the 11th is auctioned or c. $330k, and 12 Nouns when the 101st goes to market or c. $1.4m. Still a reasonable amount.

The cost of control (and colluding) gets exponentially higher with time. To me, this is a great thing. Sure, it isn’t perfect with the founding team retaining veto power over the effective implementation of proposals, but it is way better compared to what else is out there. The increasing difficulty applies also to the ability to execute on a successful proposal. Although every wallet with at least 1 Noun (today) can create a proposal, there is a 5% quorum required for any proposal that has been successfully voted in order to be executed. This avoids voters’ apathy to gain overwhelming importance. Following quorum clearance and positive voting, a proposal is executed within 48 hours.

We would expect the auction price of Nouns to progressively decrease in time given the dilutive effect of new issuances. This, however, hasn’t been the case. Settlement prices have been hovering around $ETH 100 for some time (Dune again) and have actually been in positive trend for the last 200 days. It appears that the positive forces that are accretive to Nouns are currently outpacing the dilutive ones. Given that the marginal dilutive cost is mathematically decreasing with time, valuations might at some point actually reach an equilibrium and a stable rate of return — what that stable return will be is difficult to tell but my guess is that it will be somehow correlated (and slightly superior) to $ETH staking yield. Subject to the absence of value destructive events happening within the treasury of course.

Ossified | Governance → Simple, measurable, and stable objectives simplify a lot governance. Nouns DAO has maintained a very clear mandate for the use of its treasury — below from Nouns DAO’s website.

Ossified governance has produced a surprisingly homogeneous set of outcomes. Of the 125 proposals submitted, a vast majority (96) was executed, with only 1 proposal vetoed — and as a test, for a total amount of allocated funds worth c. $ETH 13.2k. Most proposals have had a remarkable one-sided voting (h/t @Mega_Fund for this and other hints) that might suggest a few things:

Very cohesive community around a simple mission

Great soft (forum) and hard (quorum) filtering mechanisms for avoiding unpromising proposals

Still small and immature community — there are c. 200 nouners + Nounders

Positive bias to spend due to the growing treasury — it’s easy to be proactive during times of abundance

What is happening is probably a combination of all of the above, and the virtuosity might have been indeed facilitated by the dilutive and personal (or Noun-al) angle of voting. If it is difficult to control relative majority at Nouns DAO, it is almost impossible to preserve anonymity: Nouns can’t be as easily reshuffled as fungible tokens, they aren’t as often used for staking or commingled in CEX contracts, and take with time an identity that is affiliated with the owner. Those characteristics go a long way in increasing the (personal) cost of deviating. It will be interesting to see how those dynamics evolve with the number of nouners growing, and (potentially) the governance mission becoming wider. Personally, I am hoping for the ossified governance to stay, and for its development to happen organically and away from the mother DAO. But more on this below.

Open-Source | Governance → The project opted for copyright protection under CC0, in other words opting out of any copyright and database protection whatsoever. Everyone can build upon what Nouns DAO has done, out of the belief that on average those contributions will be accretive to the value of Nouns and of the DAO treasury. As we have said before, the DAO is ready to put funds to work to stimulate this, and it is not surprising that most teams willing to build on the Nouns platform start by asking for a budgetary contribution.

In other words, Nouns DAO governance is morphing into some sort of (community-gated) optimistic granting program where the DAO distributes significant amounts of $ETH ex ante, with the hope that the money will be well spent and that the outcome will be accretive for Nouns in general. This concept is adjacent to that of community soft forking that Packy, David, and myself had fun in exploring recently for Not Boring: the community agrees on allocating a specific amount of resources to a project that, although governed by its own members, is believed to ultimately accrue value to the parent project.

FOMO Nouns is one of the earliest and most interesting applications of this concept — again h/t @Mega_Fund. We have discussed previously how the generation process of each Noun is triggered based on the settlement block of the previous one, giving the community some sort of influence on the characteristics the next Noun will have. Being the process block-specific, incredible coordination (plus speed and luck) is required to predict a Noun’s looks at the beginning of the block, vote, and trigger on time. In order to systematise this process, the creation of FOMO Nouns was brought forward with Proposal #8. Participants can vote 👍 or 👎 for a predicted Noun to be minted. If the (like/ dislike adjusted) vote goes above a certain threshold, the contract will try to trigger settlement. $ETH 50 were originally asked to fund the development of the project, including a donated budget for the contract to try and get block inclusion. Although there are no immediate monetary positive impact from the project, the belief of the proponents was that the implementation would have helped creating more appealing Nouns, increasing bidding value, and enabling further participations.

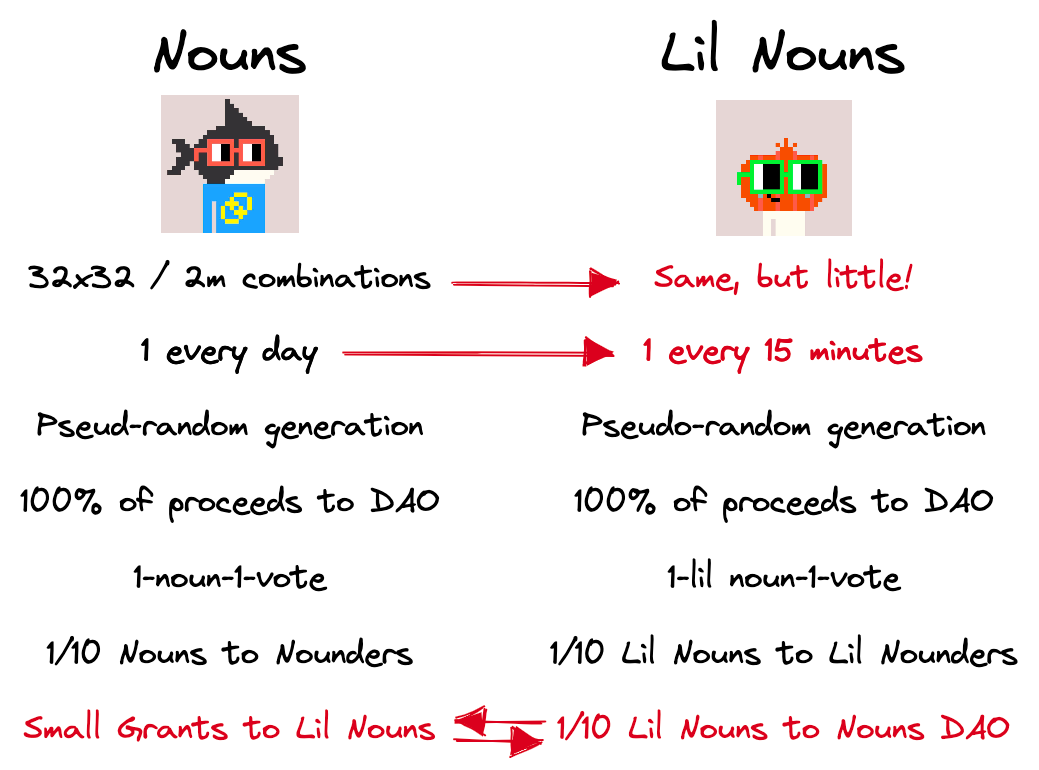

There is no limit to forks. Lil Nouns spun out of the Nouns example as the most classic of hard forks, generating an output that is religiously connected to Nouns but operationally and (partially) financially independent. A quick look to the website shows how the Lil team opted for keeping differences between the two projects to the bare minimum.

The project is building an independent treasury, composed of $ETH and Nouns, and is part of Nouns’ Small Grant program voted by Nouns DAO governance. It is also a playing ground for the mother ship. A (I believe) comprehensive list of the Nouns-inspired projects can be found Nouns Center. This, too, is a projected funded by Nouns. The loop starts closing, the mind starts bending.

We don’t have (yet) a framework to measure the impact of the grants provided by the DAO treasury on the value of the project. Some kind of Return to Nouns should be developed. But we can observe through the best proxy, i.e. the price of the next Noun minted, that the strategy is so far working. The constructive forces are outpacing the dilutive ones. For how long this will last, however, it is very hard to tell. At some point, the balance of forces will shift, and that is when governance will be tested. The open-source nature of the project will make this even more complicated to handle.

In #43 we identified few characteristics that incentivised actors to deviate and turn bad in a (simplified) organisation: (i) expropriability or size of private benefits, (ii) mutualisation or size of the community, (iii) uncertainty or perceived risk of encountering bad proposals, (iv) urgency or probability of suffering pain from bad actors, (v) risk aversion. Nouns DAO improved governance on many dimensions vs. its predecessors: the community is small and cohesive — less mutualisation and uncertainty, with grants being relatively small compared to the value of votes/ Nouns — less expropriability, control diluting over time — even less expropriability, and a clear growth mindset — less risk aversion.

The growth of the community, and the wider ecosystem inspired by Nouns, will ultimately threaten the balance of powers and reduce the margin of safety. Nouns DAO will need to implement governance changes before it’s too late. What those could be, in an open-source world, is material for another piece. In the meanwhile, watch out, it might seem we are living in a strange loop, but we don’t.